July 20, 2022 | Article

Inflation in the Euro Area has soared in recent months. The European Central Bank (ECB), which manages monetary policy for the Euro Area, is preparing to raise rates for the first time in more than a decade. When it comes to raising interest rates, it trails other central banks, most notably the US Federal Reserve and the UK Bank of England, but it is ahead of the Bank of Japan. On its tightening journey, the ECB faces two challenges: it may not be able to rein in inflation, and it may trigger different effects across different Euro Area countries.

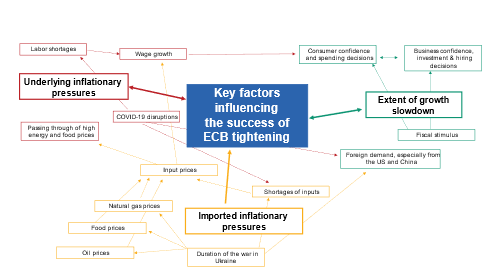

While the Euro Area economies share a currency, fiscal policies diverge and growth potential differs across member states. The chances of success for the ECB depend on several factors, many of which the ECB does not have full control over, including labor market developments, shortage of inputs, domestic and foreign demand, and most importantly of all, the duration of the Russian invasion of Ukraine.

For more, see Monetary Policy Tightening in the Euro Area: What Could Go Wrong?