July 20, 2022 | Article

The finances of the US government are sailing off the charts. According to the current projections of the Congressional Budget Office (CBO)—which are inherently optimistic because of constraints that the law imposes on the estimating process and will surely worsen with the most recent developments—the federal government’s debt burden (the debt owed to the public, expressed as a percentage of the nation’s gross domestic product, or GDP) will rise to equal its highest level in history within 10 years and then will continue to rise with no end in sight.

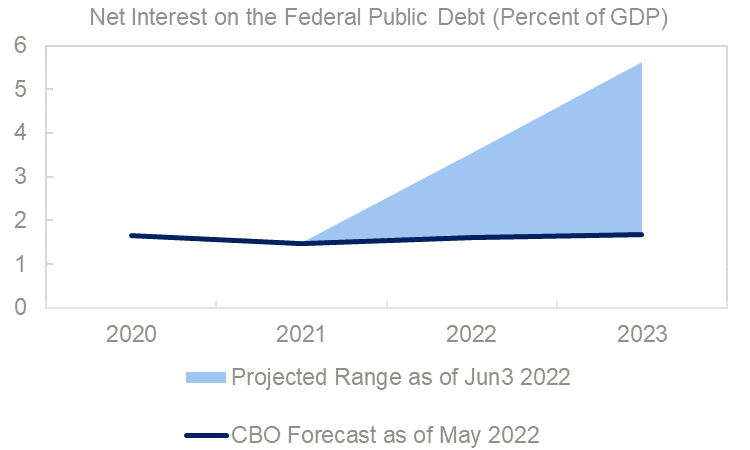

Outsized past annual federal budget deficits due to a combination of fiscal stimulus and tax cuts but no accompanying spending cuts have bloated the deficit to an astounding share of US GDP. Going forward debt will continue to accumulate due to insufficient tax collections and explosive spending on entitlement programs for Social Security, Medicare, and Medicaid. Additionally, debt service (i.e., the interest on the public debt) will grow exponentially. Indeed, the Fed’s interest rate tightening cycle is ramping up the pace of increase in debt service as we speak. This will make an already bad situation worse.

Debt can erode economic growth and sap prosperity and living standards over a period of years, demoralizing the populace and demeaning the nation in the world community. It also reduces the amount of fiscal space for supporting households and businesses during economic downturns. Public debt also diverts investment dollars away from the private sector and toward US Treasury bonds, which are used to finance existing obligations of the government, not new initiatives. Rising debt service costs will prevent the governments from meeting the nation’s most fundamental needs. Importantly, the US faces the risk of sovereign debt ratings downgrades if investors lose confidence that the government can continue to finance the debt. Lower ratings mean higher borrowing costs, and even more debt service – compounding the debt problem.

However, policymakers are not without options to slow, and perhaps even reverse, the trend toward sovereign debt accumulation. Options include major reforms to entitlement programs and increasing tax revenues in a fair and responsible manner. Additionally, congress can commit to abiding by its regular budgetary process rather than resorting to stop-gap measures that may result in increases in discretionary spending.

While policymakers can do nothing to halt interest rate increases, it can help slow the accumulation of debt service by addressing the underlying debt. This can help make a bad situation from becoming worse.

For more insights on the problem of US debt, see Dealing With Fiscal Debt: A Policy Roadmap.