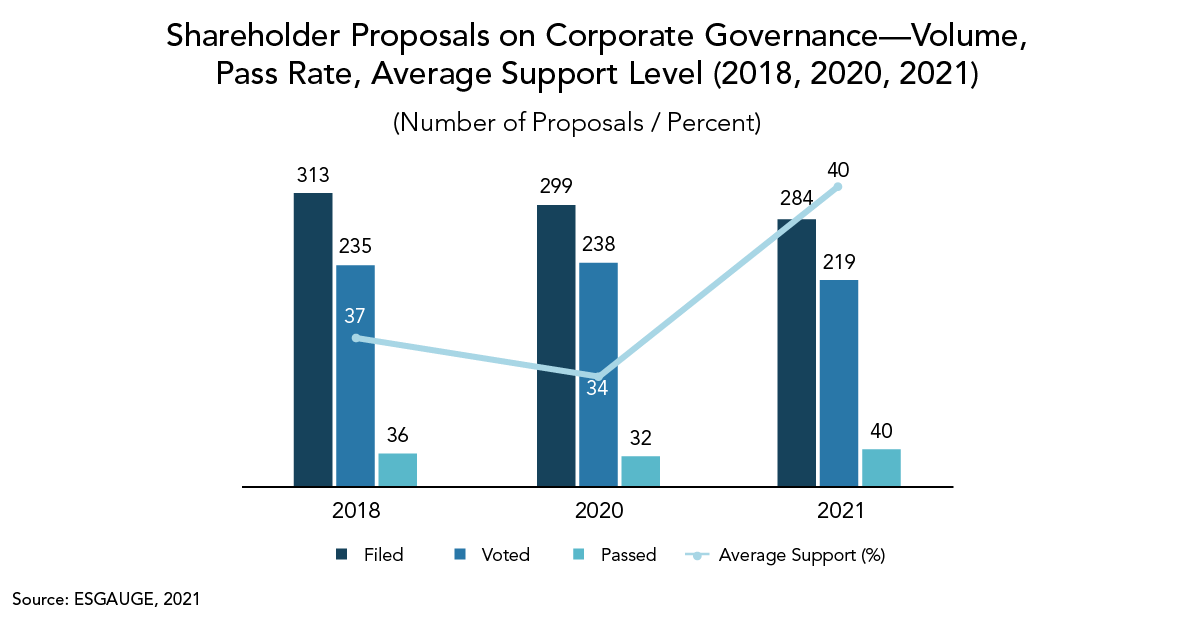

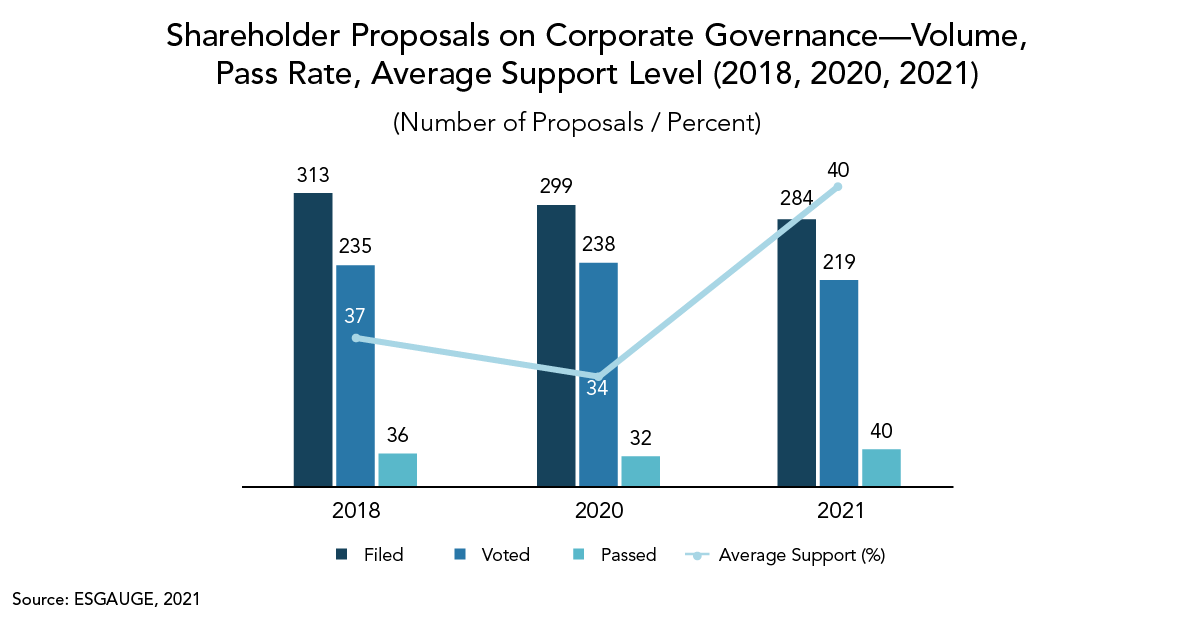

The total number of filed governance proposals declined modestly in 2021, but some topics saw a significant increase in volume. In the Russell 3000, during the first half of 2021, shareholders filed 284 governance proposals, down from 299 in the same period last year and 313 in 2018.1

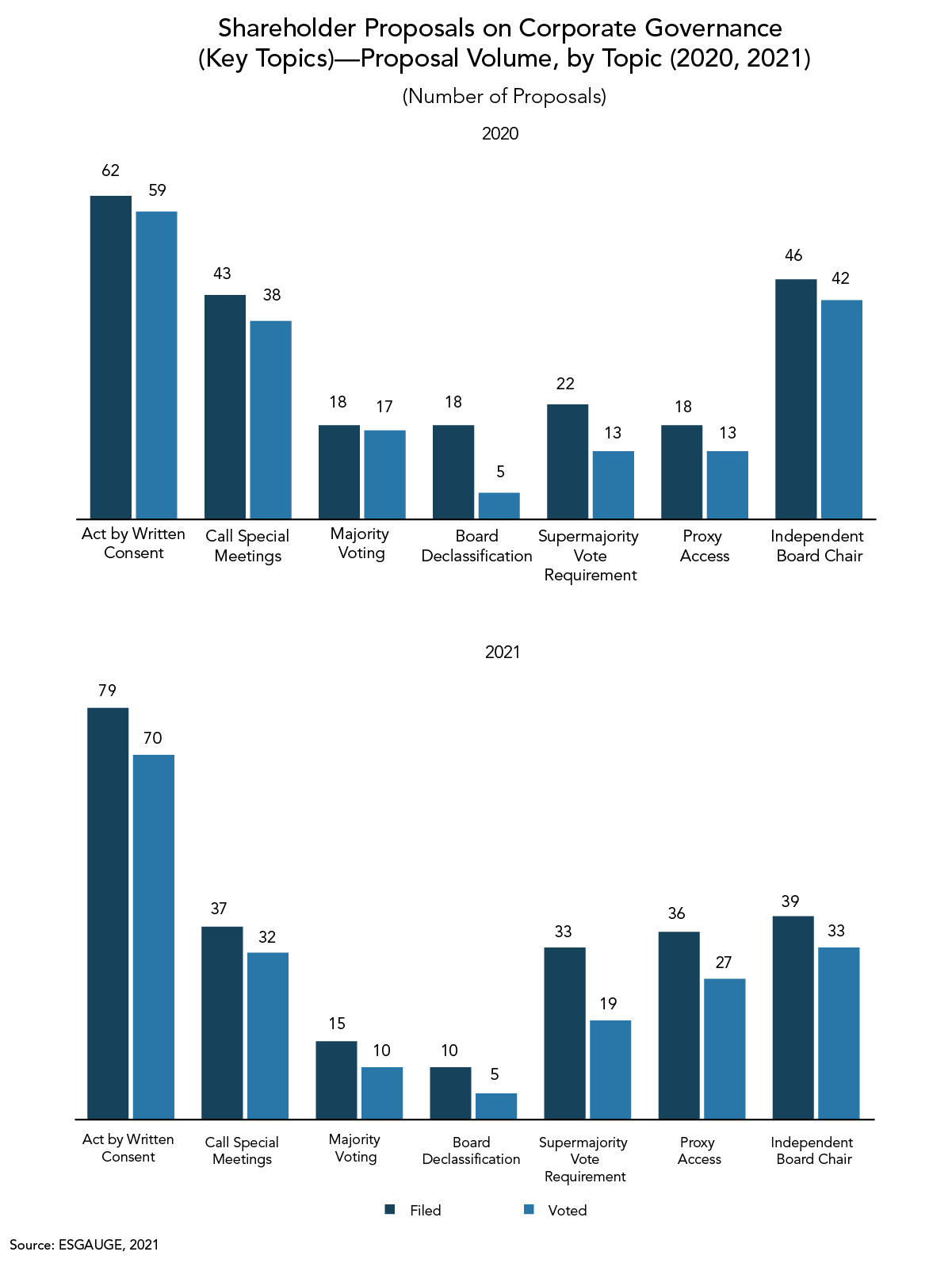

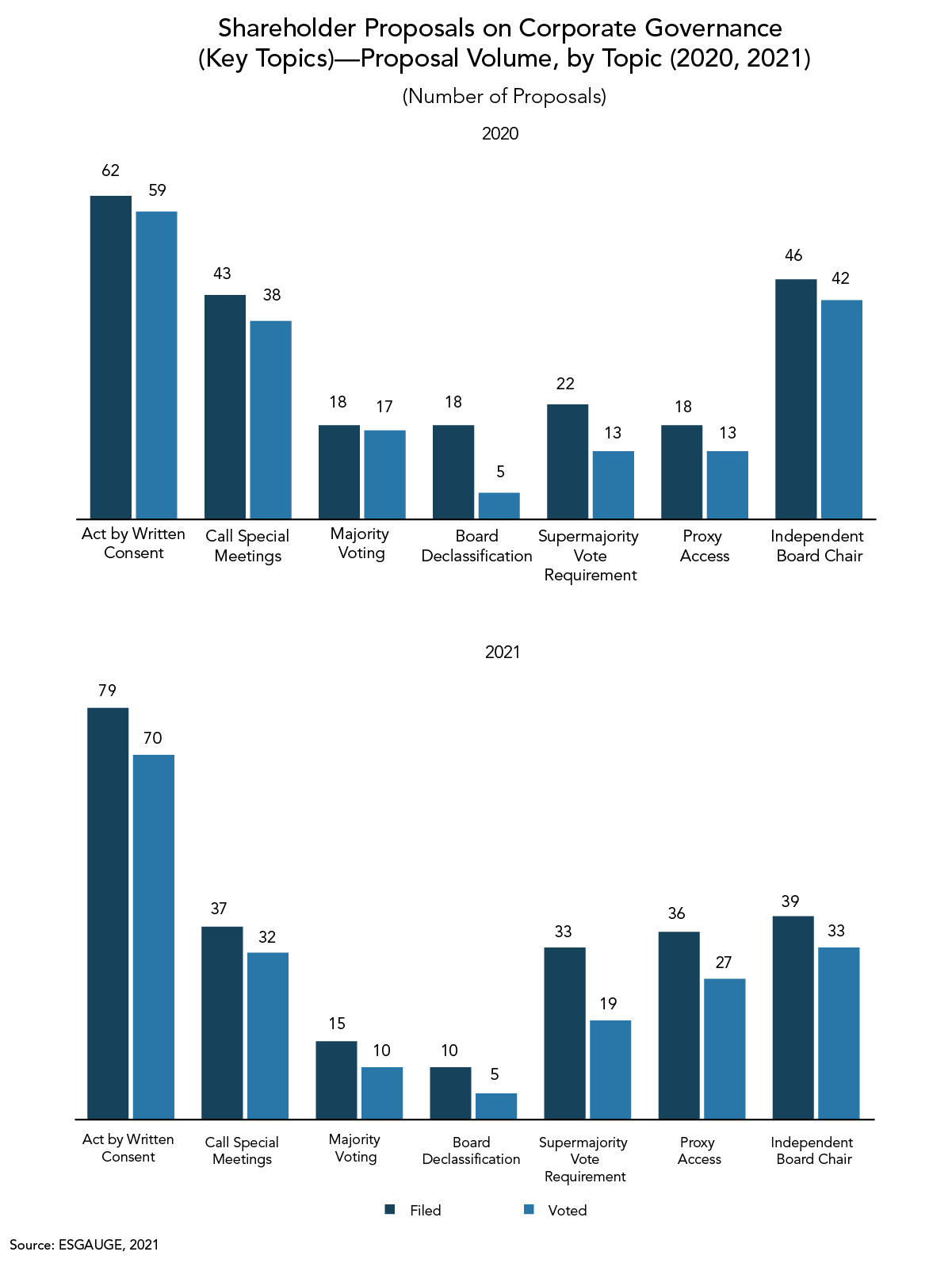

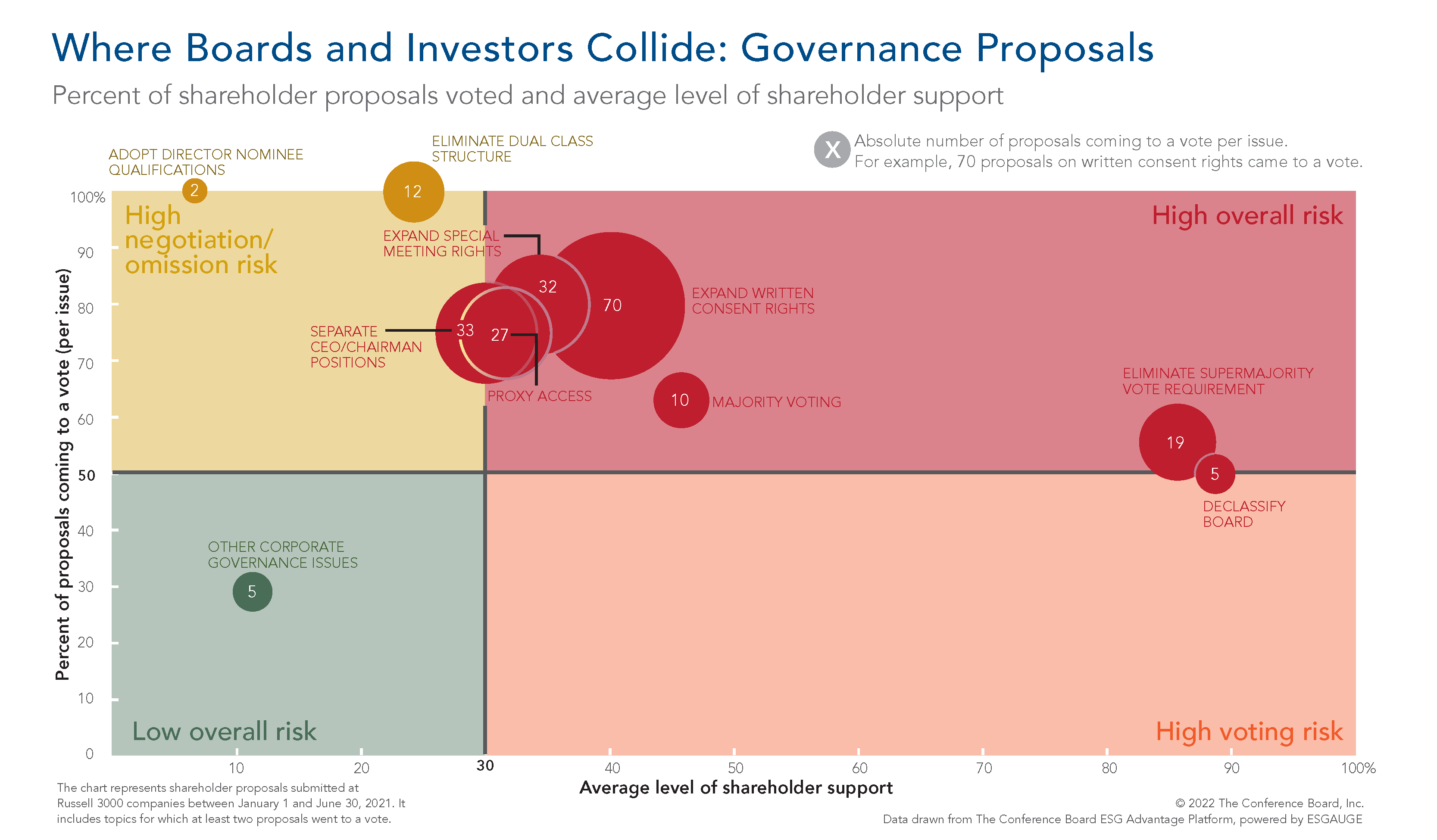

Shareholders submitted fewer proposals on topics such as director nominee qualifications (2 in 2021 versus 9 in 2020), special meeting rights (37 in 2021 versus 43 in 2020), separate CEO/chairman positions (39 in 2021 versus 46 in 2020), and board declassification (10 in 2021 versus 18 in 2020).

But there was a noteworthy rise in proposals on written consent, which represented the largest category of governance proposals for the second year in a row (79 in 2021 versus 62 in 2020), proxy access (36 in 2021 versus 18 in 2020), and supermajority provisions (33 in 2021 versus 22 in 2020).2

(The figures below only show key governance topics.)

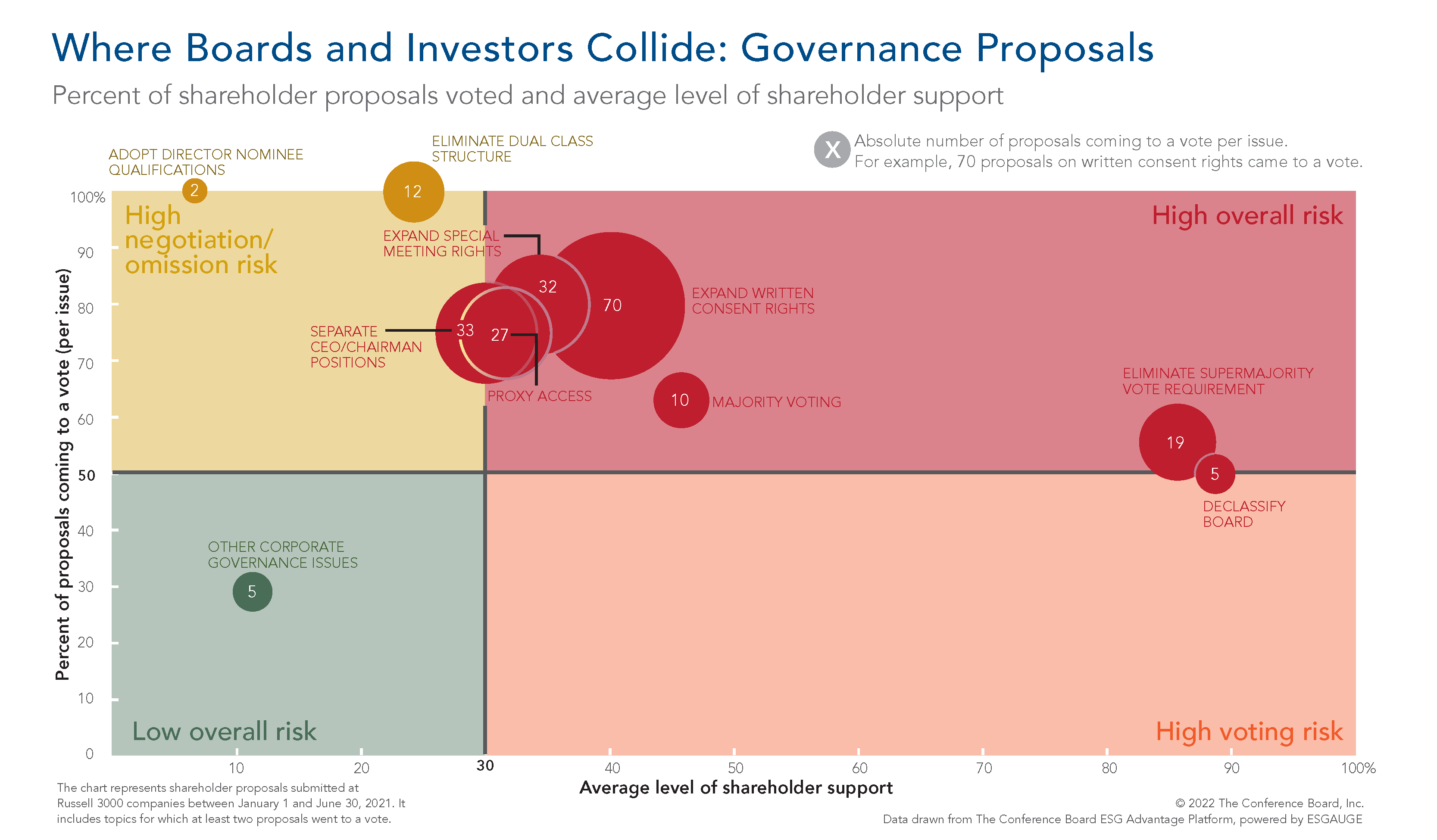

Consistent with previous years, compromise or the omission of governance proposals was difficult to achieve, especially compared to environmental and social (E&S) proposals. In 2021, 219 (or 77 percent) of filed governance proposals came to a vote, compared to 238 (or 80 percent) in 2020. By contrast, 158 out of 348 (or 45 percent) of E&S proposals came to a vote. Moreover, all proposals filed on director nominee qualifications, dual-class structure, and board size came to a vote, as well as 70 out of 87 (or 80 percent) of written consent proposals, 32 out of 40 (or 80 percent) of proposals on the ability to call special meetings, and 27 out of 36 (or 75 percent) of proxy access proposals.

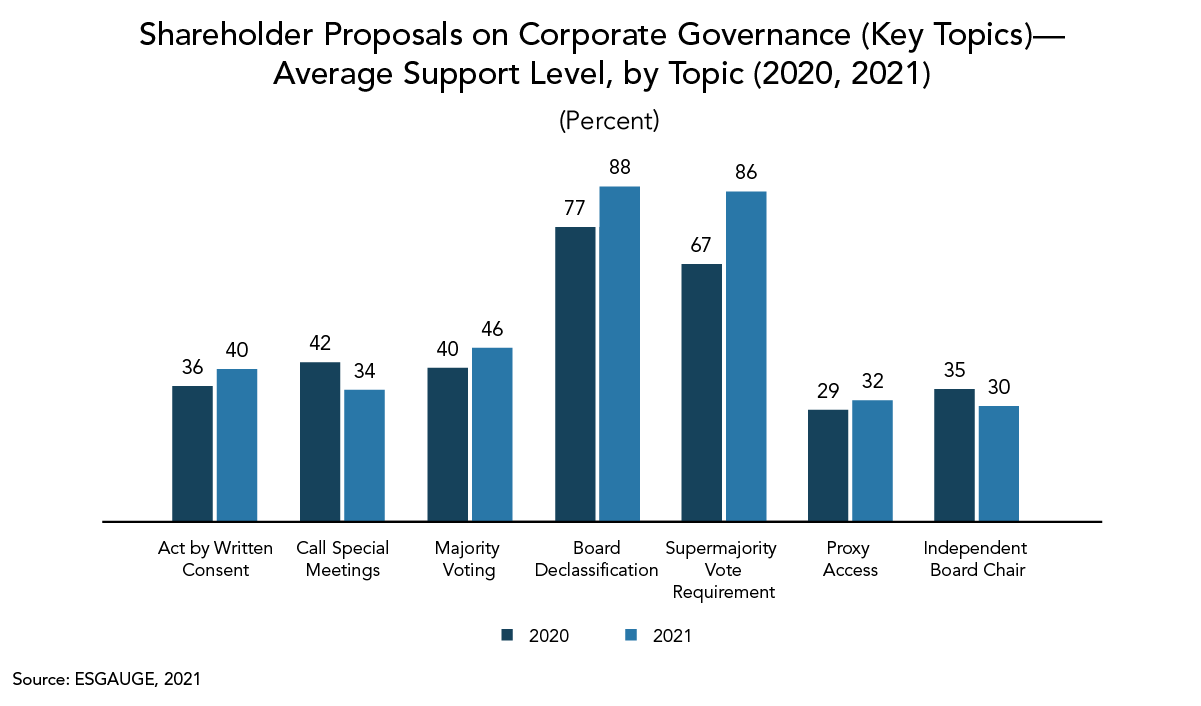

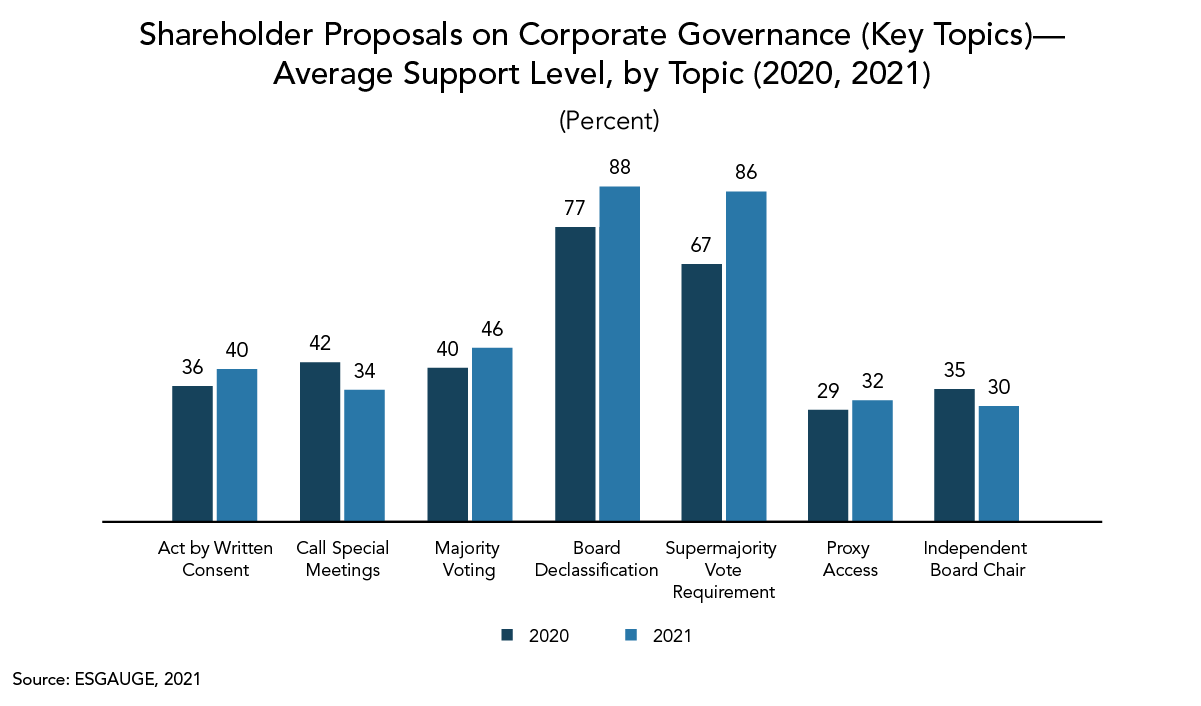

Average support for governance proposals reached record levels in 2021, compared both to previous years and to other types of proposals. In the Russell 3000, in the first half of 2021, support for governance proposals averaged 40 percent, versus 34 percent in 2020 and 37 percent in 2018, and compared to 32 percent average support in 2021 for E&S proposals.

More governance proposals received majority support compared to last year. Of those that came to a vote, 40 (or 18 percent) received majority support, versus 32 (or 13 percent) in 2020. The 18 percent that passed compares to 22 percent for E&S proposals. Average support for certain proposals was notably high in 2021—board declassification (88 percent) and supermajority provisions (86 percent)—with all such proposals that came to a vote passing. And more proposals on eliminating supermajority provisions received majority support than any other topic in the 2021 proxy season (19 out of 19 of such proposals passed). But some proposals were less successful in receiving majority support, including those on proxy access, dual-class structure, splitting the CEO and chairman positions, and director nominee qualifications.

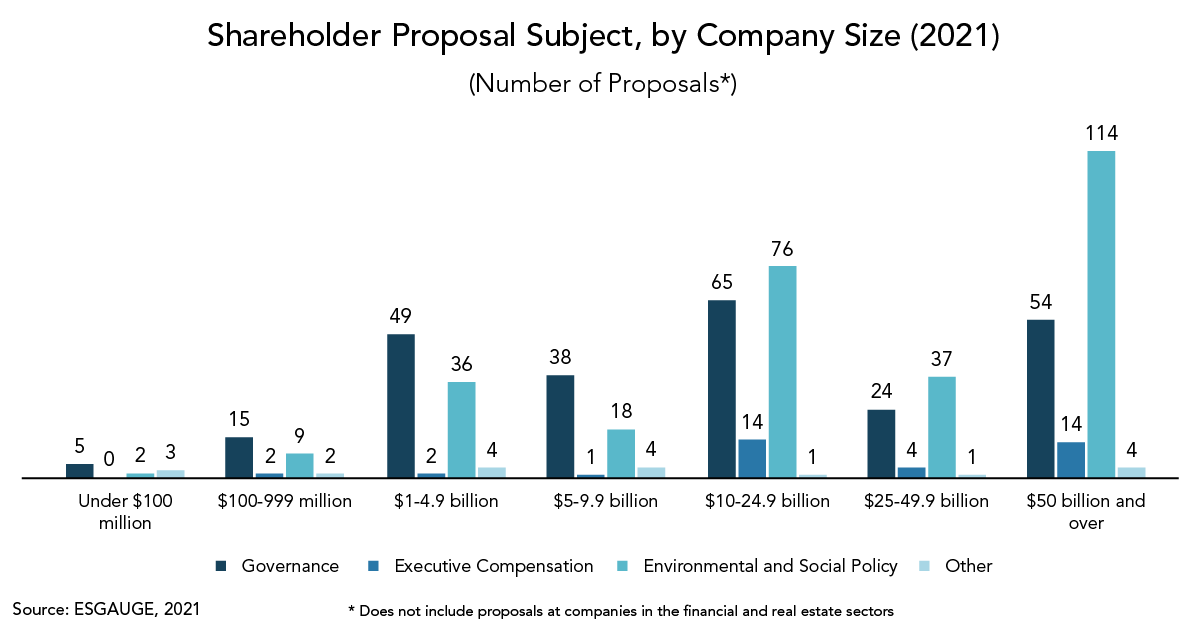

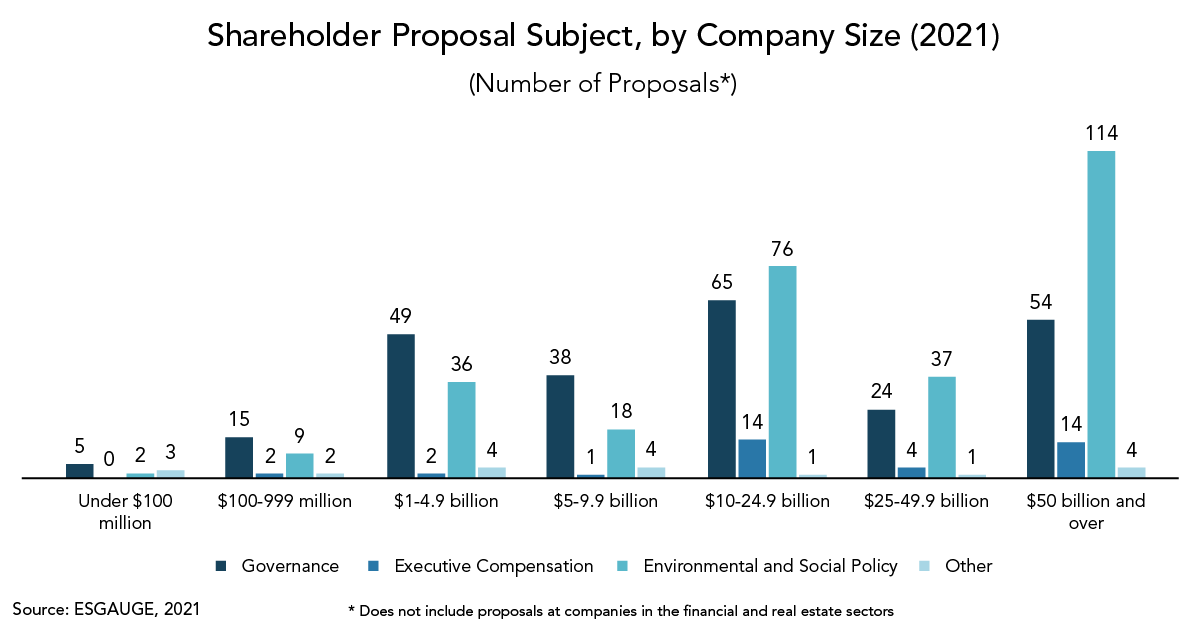

While companies in all business sectors received governance proposals, those in health care and industrials faced the most investor attention. Roughly one-third of all governance proposals were filed and voted with such companies. (This is different from E&S proposals, as roughly one-third of those proposals were filed with companies in the consumer discretionary and financial sectors.) Additionally, midsized and small companies received more governance proposals than other proposal types, indicating such companies aren’t meeting some investor expectations in traditional governance areas. Larger companies, on the other hand, received more shareholder proposals on E&S topics than on governance.

In the first half of 2021, companies with an annual revenue of $25 billion and over were more likely than their smaller counterparts to receive proposals on independent board chair, whereas companies with an annual revenue between $1 billion and $25 billion were more likely to receive proposals on written consent, special meetings, board declassification, supermajority voting requirement, and proxy access. The smallest companies, with an annual revenue under $1 billion, were more likely to receive proposals on majority voting and board declassification than their bigger counterparts. These trends are likely to continue, as demonstrated by a proposal on special meeting rights that passed at Becton, Dickinson and Company (which has an annual revenue of ~$20 billion) at the firm’s annual meeting in January.

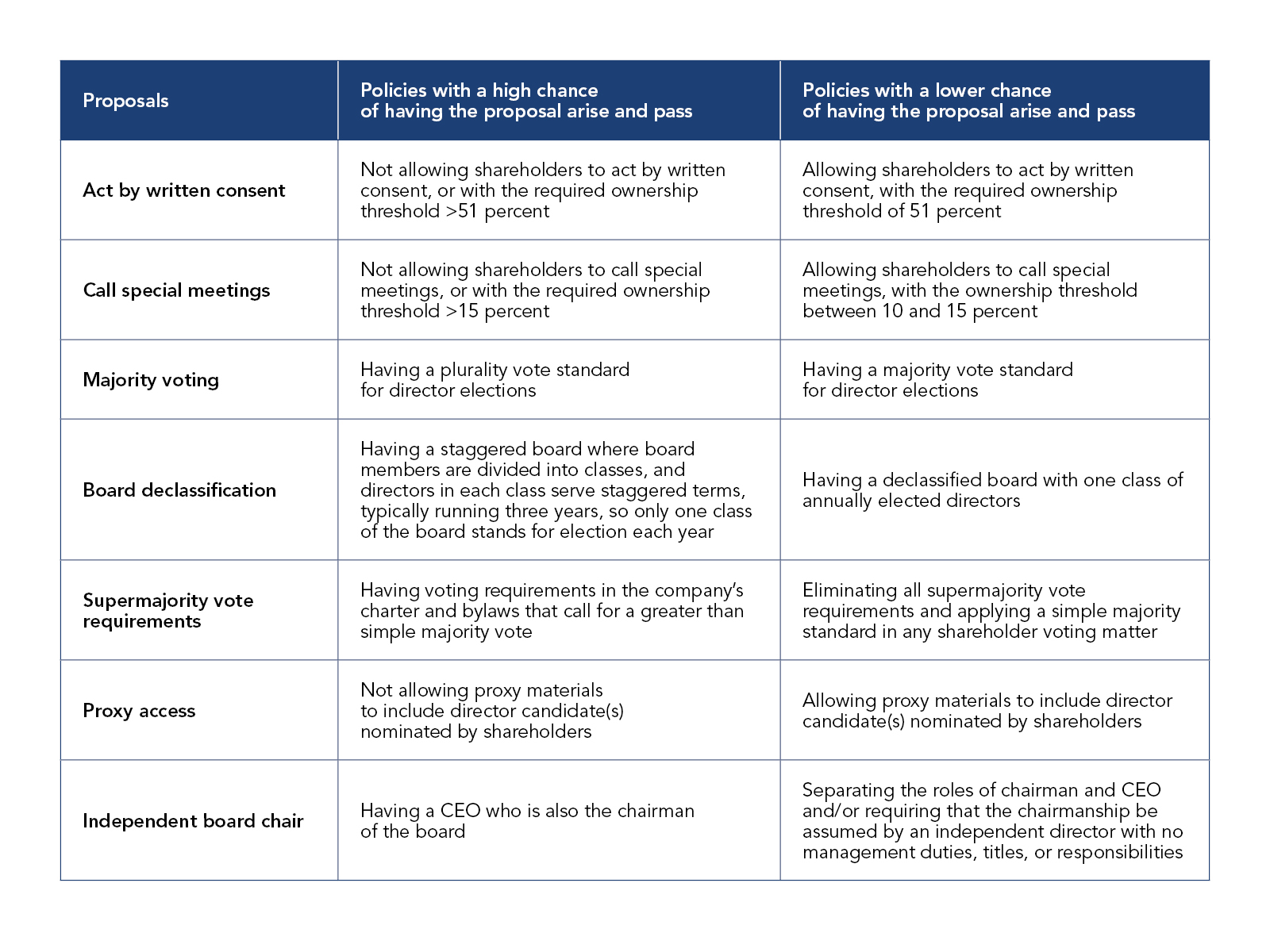

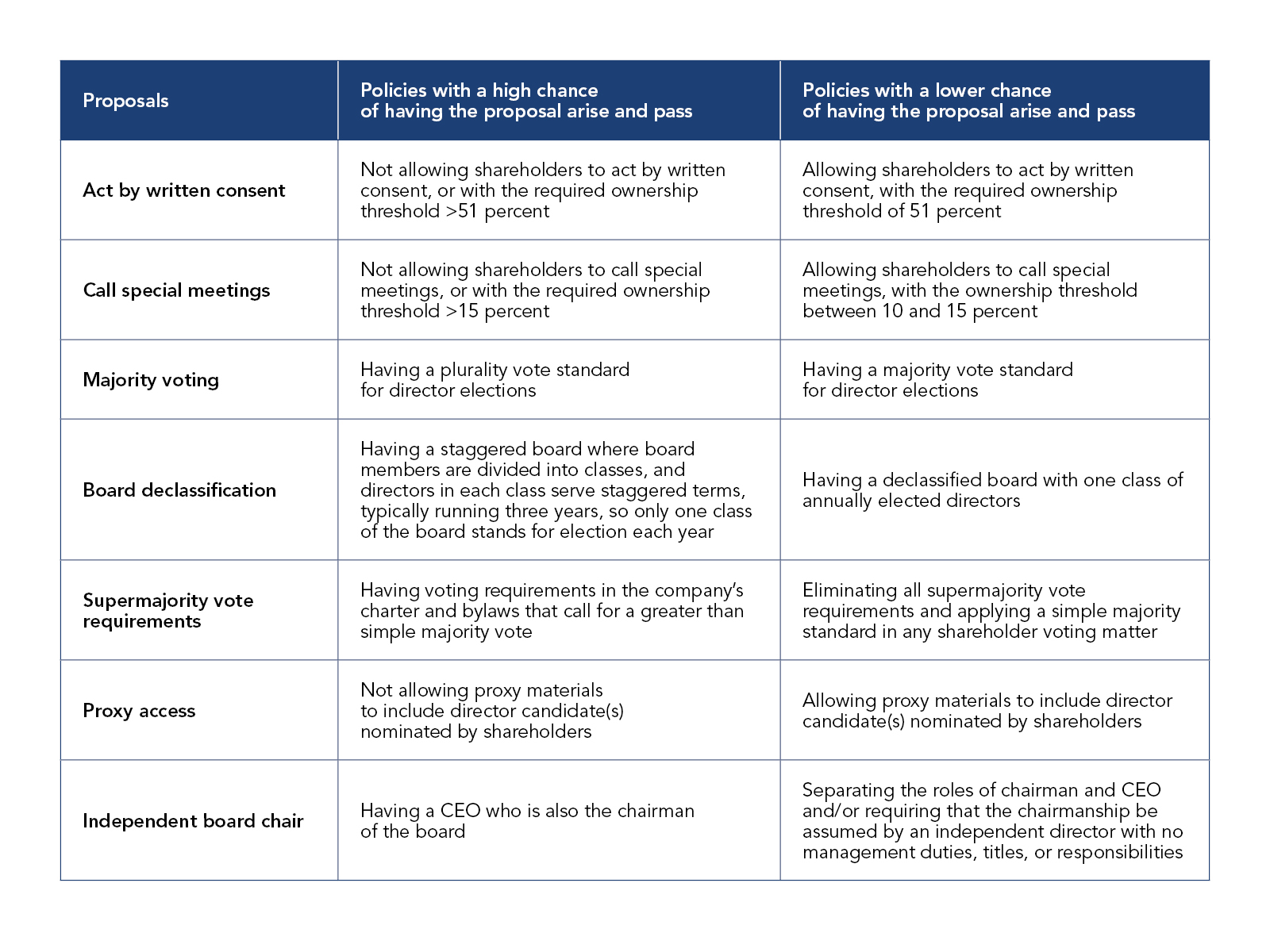

How CEOs and boards can limit their exposure to governance proposals

CEOs and boards, especially at midsized and smaller companies, should consider revising their governance practices to align with investor expectation. By removing wedge issues, they are less likely to be exposed not only to shareholder proposals but also shareholder activism with a big “A,” which is aimed at changing the board and/or the strategic direction of the company.

For all boards to consider: implementing best practices common at large firms

**********

This brief is part of a suite of seven reports: 2022 Proxy Season Preview and Shareholder Voting Trends (2018-2021). Visit conferenceboard.esgauge.org/shareholdervoting to access and manipulate our data online.

[1] The data and figures in this report and all six supplemental briefs represent shareholder proposals submitted at Russell 3000 companies in the first half of 2021, 2020, and 2018. About 90 percent of shareholder meetings at Russell 3000 companies take place in the first half of the year, and this cutoff point also allows easy comparisons with our prior-year shareholder voting benchmarking reports.

[2] For a description of all shareholder proposal topics, visit our Online Dashboard and go to Using This Dashboard > Glossary > Shareholder Proposal Subjects.