July 20, 2022 | Article

The US Fed’s “full and inclusive” employment mandate helped narrow employment gaps, especially for Black and Hispanic/Latino Americans. However, as the Fed hikes interest rates to tame inflation, some critics say that these same groups may get the short end of the stick.

We counter that lower inflation benefits everyone, and that ethnic minority groups might even be able to capitalize on higher interest rates through lower housing costs.

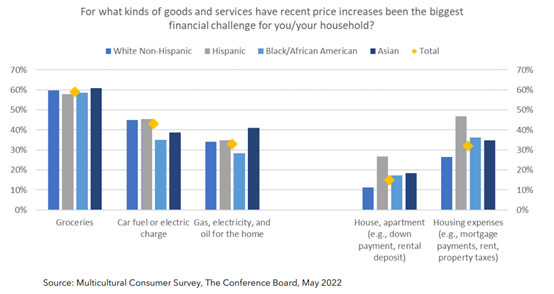

Our most recent Multicultural Consumer Survey reveals that inflation generally knows no color. Complaints about higher prices for goods and services are fairly universal across ethnic groups. However, higher costs for housing—rent and ownership—appear to negatively affect Hispanic consumers far more than other consumers.

By raising interest rates, the Fed’s job is to slow aggregate demand to cool inflation, but it can also help make an overheated housing market more affordable. Learn more by reading Inflation Knows No Color, Except for Housing.