June 02, 2022 | Quick Take

Consumer confidence dipped slightly in May, after rising modestly in April. The decline in the Present Situation Index was driven solely by a perceived softening in labor market conditions. By contrast, views of current business conditions—which tend to move ahead of trends in jobs—improved. Overall, the Present Situation Index remains at strong levels, suggesting growth did not contract further in Q2. That said, with the Expectations Index weakening further, consumers also do not foresee the economy picking up steam in the months ahead. They do expect labor market conditions to remain relatively strong, which should continue to support confidence in the short run.

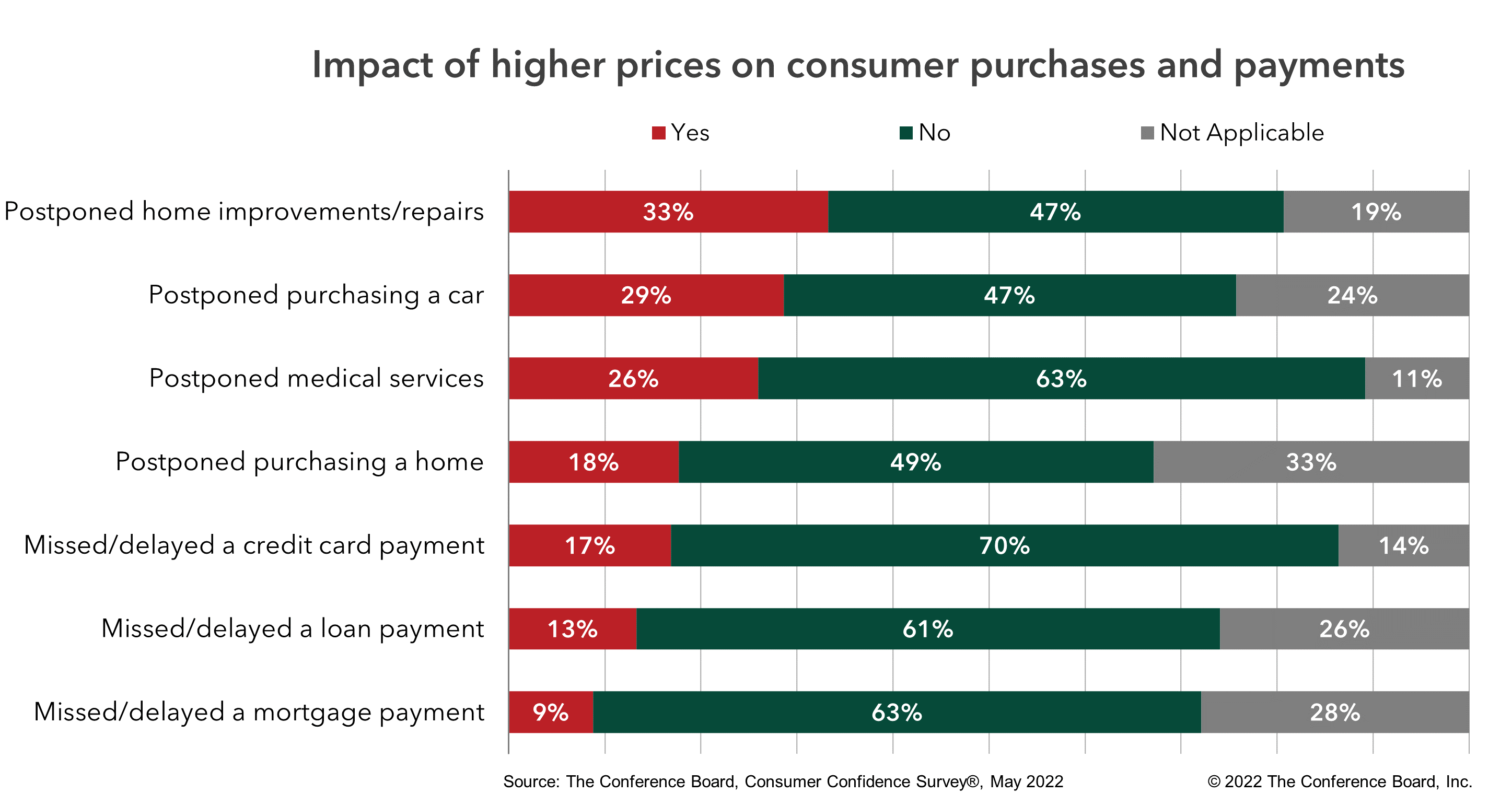

Meanwhile, consumers' purchasing intentions, both for durables and some discretionary in-person services cooled due to rising prices and interest rates hikes. In fact, 33% of consumers have postponed home improvements and almost 30% have postponed purchasing an auto. Looking ahead, we expect surging prices and additional interest rate hikes to pose continued downside risks to consumer spending this year.

For more information about the latest reading of the Consumer Confidence Index®, please visit our website.

To get complimentary access to this publication click "Read more" to sign in or create an account.