Environmental Factors Should Be Considered by the Whole Board

April 25, 2023 | Quick Take

For many years, investors have been pushing companies to address environmental risks and impact. Regulators are now stepping up the pressure, as the SEC prepares to issue its climate disclosure rules and the EU finalizes obligations under the Corporate Sustainability Reporting Directive. Companies, too, are asking their business suppliers and customers to provide more information on their environmental performance. Beyond stakeholder pressure, almost half of CEOs globally see the transition to renewable energy as a positive for their business.

Insight for What’s Ahead: Environmental issues have gone mainstream in terms of business strategy and operations. But there is a risk that companies will silo environment at the board level.

In a comprehensive review of board committee charters at S&P 500 companies, The Conference Board and ESG data analytics firm ESGAUGE found that 212 companies explicitly assign responsibility for overseeing climate in some manner at the board or committee level. The vast majority assign it to the nominating or ESG committee, but only 9 percent assign it to the full board.

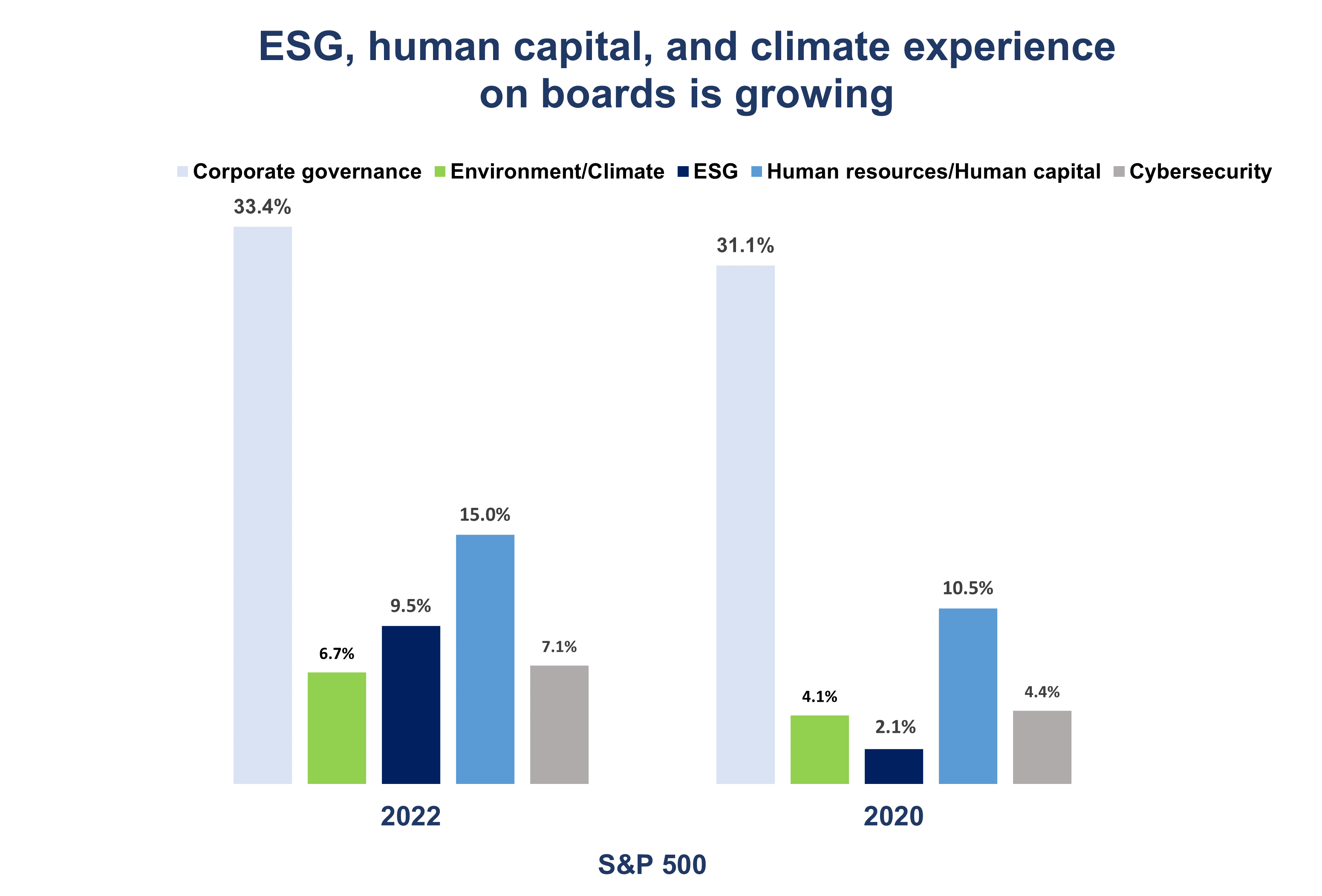

Source: ESGAUGE, 2023

Moreover, as shown above, the percentage of directors with environmental or climate disclosure is increasing, and is likely to continue to do so with new SEC disclosure rules. It is critical, however, that boards not become overly reliant on experts, but cultivate fluency in relevant environmental issues across the board.

For more statistics on environmental and other ESG disclosures, please visit our Live Dashboards on ESG Advantage, Powered by ESGAUGE.