The performance of the U.S. economy continues to depend heavily on the strength of the consumer. Meanwhile, consumers remain under pressure at the start of 2026. Elevated prices, higher borrowing costs, and uneven income growth are forcing households to make tougher trade-offs, testing the resilience that has carried spending through recent years. While the labor market remains a key support, the margin for error is narrowing as savings buffers thin and credit becomes less available. The outlook for 2026 hinges on how long consumers can sustain demand amid these constraints—and what that means for growth, inflation, and policy. This year may prove to be a pivotal test of consumer endurance and its role as the backbone of the U.S. economy. The Year to Test Consumer Endurance

While The Conference Board maintains expectations of slower growth through late 2025 and early 2026 because of tariffs, there are sizable risks both to the upside and downside.

Fiscal policy will deliver mixed effects next year: growth support from accelerated depreciation and tax cuts will be partially offset by reduced green investment and cuts to Medicaid and Supplemental Nutrition Assistance Program (SNAP).

The monetary policy outlook will depend heavily on the composition of the Fed under a new chairperson. Kevin Warsh, a former Fed governor was nominated to become the next Fed chair after Chair Powell’s term expires in May. Warsh used to be known as someone who strongly focused on fighting inflation – a resolute inflation hawk, but now he seems more open to cutting interest rates even though inflation is not back to 2% yet.

The mid-term elections at the end of the year could prompt some federal government stimulus to address “affordabi

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Charts

The Gray Swans Tool helps C-suite executives better navigate today’s quickly developing economic, political, and technological environments.

LEARN MORECharts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORE

Charts

How Might the World Fall Back into Recession?

LEARN MORECharts

Passing increases downstream, cutting costs, and absorbing price increases into profit margins are the chief ways to manage rising input costs. Few see changing

LEARN MORECharts

US continues to lead global productivity race

LEARN MORECharts

The Global Economic Fallout of the Ukraine Invasion

LEARN MORECharts

The global supply chain disruption associated with the COVID-19 pandemic has resulted in production delays, shortages, and a spike in inflation in world.

LEARN MORECharts

The Conference Board recently released its updated 2022 Global Economic Outlook.

LEARN MORE

PRESS RELEASE

LEI for the Global Economy was unchanged in December

February 26, 2026

PRESS RELEASE

CEO Confidence Rose Significantly in Q1 2026

February 26, 2026

PRESS RELEASE

LEI for China Declined in January

February 25, 2026

PRESS RELEASE

US Consumer Confidence Inched Up in February

February 24, 2026

PRESS RELEASE

LEI for India Ticked Up in January

February 23, 2026

PRESS RELEASE

LEI for Mexico Increased in January

February 18, 2026

All release times displayed are Eastern Time

Note: Due to the US federal government shutdown, all further releases for The Conference Board Employment Trends Index™ (ETI), The Conference Board-Lightcast Help Wanted OnLine® Index (HWOL Index), The Conference Board Leading Economic Index® of the US (US LEI) and The Conference Board Global Leading Economic Index® (Global LEI) data may be delayed.

This report identifies trends to help businesses prepare for an environment with more challenges for labor and capital but improvements in productivity growth.

LEARN MOREConnect and be informed about this topic through webcasts, virtual events and conferences

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026 | Brief

Economy Watch: US View (February 2026)

February 13, 2026 | Article

January CPI Raises More Questions than Provides Answers

February 13, 2026 | Brief

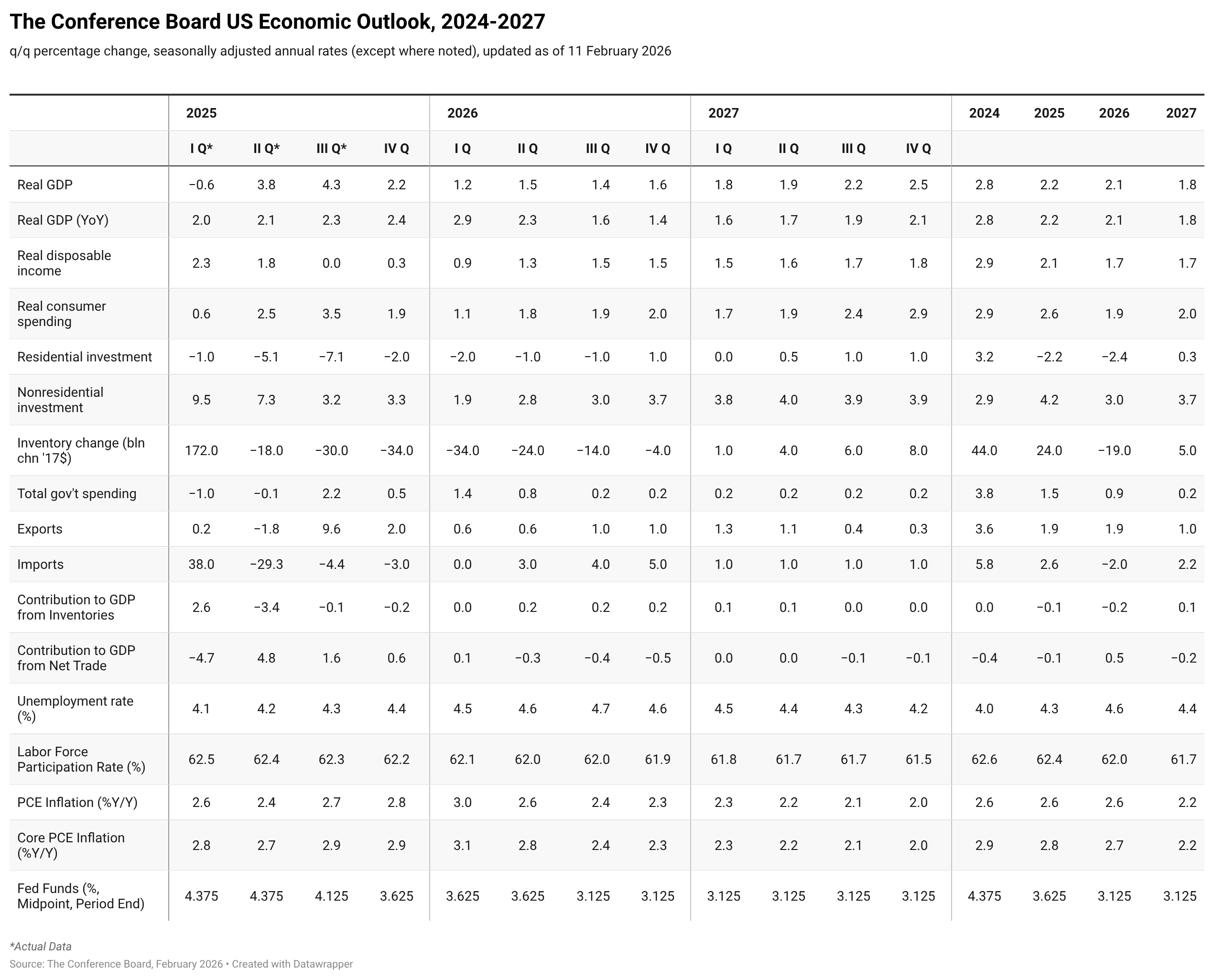

The Conference Board Economic Forecast for the US Economy

February 12, 2026 | Article

Steady as She Goes Labor Market, Risks Remain

February 11, 2026 | Brief

Priced Out: The State of US Housing Affordability

February 11, 2026

The CEO Outlook for 2026—Uncertainty, Risks, Growth & Strategy

January 15, 2026

The Big Picture: What's Ahead for the Global Economy?

December 10, 2025

Economy Watch: Trends in Consumer & CEO Confidence

November 12, 2025

US Tariffs: What’s Changed, What’s Next

October 15, 2025

The Economic Outlook—Storms or Sunshine Ahead?

September 10, 2025