Environmental, Social & Governance Briefs

2019

-

On Governance: President Trump’s Executive Order and Shareholder Engagement on Climate Change

July 03 | Nell Minow, Vice Chair, ValueEdge Advisors | Comments (0)There is a great deal of evidence about the increasing sophistication of the assessments that investors, insurers, and others use in applying ESG indicators to evaluate risk and return. The President’s executive order brings the impact of climate change on retirement investments to the fore.

-

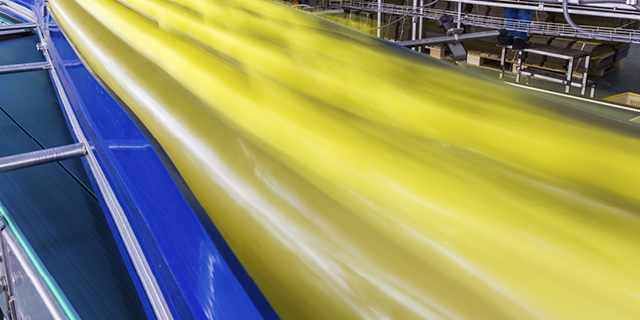

Automation is making a comeback

May 31 | Gad Levanon, PhD, Former Vice President, Labor Markets, The Conference Board | Comments (0)Now, more than in any other time during this decade, we see signs of a comeback in automation activity. The timing could not be better. Labor shortages are becoming a growing problem for the US economy, especially in jobs that do not require a college degree, which in large part are the jobs where automation is likely to have the most impact. From a demographic perspective, this problem is only going to get worse.

-

On Governance: It’s Time Boards Ask Some Tough Questions About Risk Management Effectiveness

May 21 | Tim Leech, Managing Director, Global Services, Risk Oversight Inc. | Comments (0)Good practice risk oversight due diligence guidance clearly says boards should ask about the effectiveness of risk management processes. Evidence suggests many boards have not been. Why not?

-

Balancing Act: Digital Progress and Responsibility

April 23 | Anuj Saush, ESG Center Leader, Europe, The Conference Board | Comments (0)With government regulation lagging, technological outcomes depend on how businesses develop and apply them. It’s important that companies fill that gap by complementing their digital transformation journey with a governance arrangement that drives ethics and builds trust.

-

Breakthroughs with Design Thinking, Diversity, and Inclusion: Part 1

April 18 | Rebekah Steele, Senior Fellow, Human Capital, The Conference Board | Comments (0)The stakes for getting D&I right are high, both for organizations and individuals. Unfortunately, many of our familiar D&I ‘best practices’ are inadequate amid ever-evolving demands and complicated contexts. To advance D&I outcomes, we need next practices.

-

On Governance: Science & Sentiment – A Quantitative Analysis of Warren Buffett's CEO Letters

April 03 | Krista Bennatti-Roberts, Data Scientist, Hansell McLaughlin Advisory | Carol Hansell, Senior Partner, Hansell LLP, ESG Center Fellow | Comments (0)Shareholders and other stakeholders develop a sense for the chief executive's leadership style through the tone and content of the annual CEO letters. In the case of Warren Buffett, the tone and content is unique and effective.

-

On Governance: The Short-Termism Thesis: Dogma vs. Reality

March 28 | Kal Goldberg, Partner, Finsbury | Charles M. Nathan, Consulting Partner, Finsbury Glover Hering, ESG Center Fellow | Comments (0)Whatever the explanations for the short-termism thesis, the conclusion to be drawn from its lack of evidentiary basis is that quarterly capitalism is not the pervasive culprit that the “true believers” would have you believe.

-

Why Are Labor Markets Tight in Central and Eastern Europe — Policy and Business Implications

March 25 | Frank Steemers, Former Senior Economist, The Conference Board | Comments (0)With labor markets tightening and labor costs rapidly rising in Central and Eastern Europe, the advantage of lower labor costs compared to the rest of the continent will further shrink over time and could mean that businesses will shift operations elsewhere.