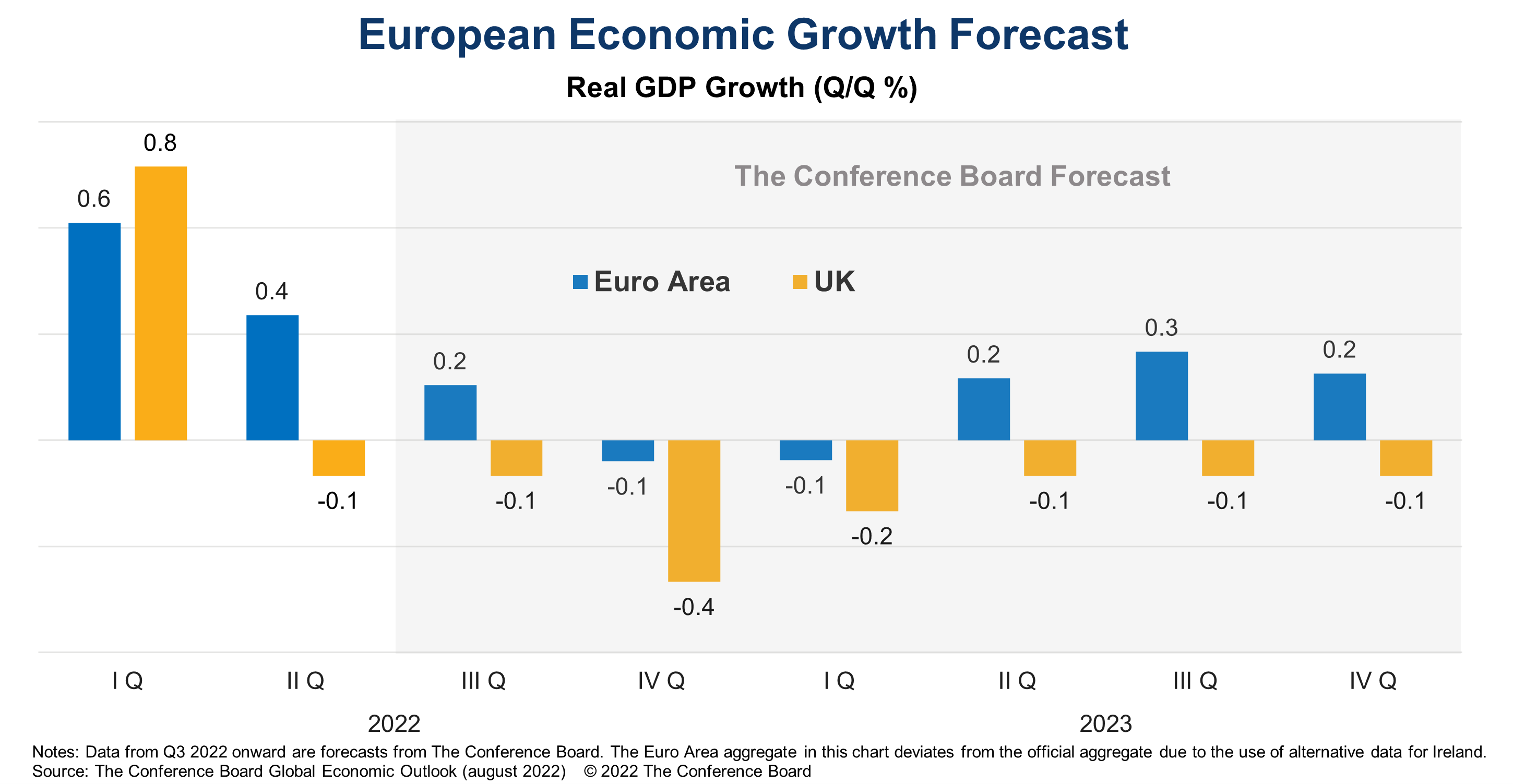

Upward revisions to Q1 and higher-than-expected Q2 figures prompted The Conference Board to raise its 2022 GDP growth forecast for the Eurozone. But with Europe’s headwinds set to intensify over the coming months, 2023 GDP growth estimates were lowered. A technical, mild recession now looks likely in the Euro Area (as well as the UK) later this year, especially if the energy crunch tightens due to significantly reduced natural gas supplies from Russia.

Why It Matters Despite the strong first half of the year, recent indicators suggest the Euro Area entered Q3 on very weak footing. Purchasing manager surveys fell into contractionary territory for the first time in well over a year, inflationary pressures persisted, consumer confidence plummeted to new lows, and geopolitical tensions worsened. More recently, the ECB’s interest rate hike might slow activity further.

Read the analysis »

A cyberattack now occurs in the US every 39 seconds—and the severity and cost of these attacks is only growing. The solution is making the nation more cyber-resilient—a momentous challenge that demands a deeper level of partnership between government and the private sector, as detailed in an op-ed by the Committee for Economic Development, the public policy center of The Conference Board (CED). The article, published in The Hill, is by CED Trustees Reece Kurtenbach, President and CEO of Daktronics, and Peter Altabef, CEO of Unisys.

Why It Matters With the mid-term elections right around the corner and heightened cyberthreats from Russia, the need to fortify the US against cyberattacks comes at a critical time. It is essential that the public and private sector better collaborate to foster greater information-sharing of cyber threats, address access gaps to federal resources for businesses, and improve both cybersecurity standards and how we monitor compliance. The nation must also enhance the size and skillsets of the cybersecurity workforce in the short-term, and lay the groundwork for a second-to-none workforce that makes the nation resilient in the long-term.

Read the op-ed »

For decades, skills have helped to define how work gets done and who can perform the work. But now, as work rapidly changes, defining it in terms of tasks, projects, and needed skills—rather than traditional and static jobs—can provide the agility needed for today’s more dynamic workplace. Skills-based organizations deconstruct roles into critical tasks and outcomes and identify the current and emerging skills required to complete the work.

The complexity of this change to a skills-based organization requires a shift in how we think about work and workers. This is not just a change to processes, technology, and practices, but truly, a shift in mindset in how we identify, measure, and value the skills and capabilities people bring to the organization.

Why It Matters By clarifying key skills necessary today and in the future, skills-based organizations can more effectively deliver personalized, targeted learning and development to employees, redefine qualifications for an ideal hire, gain transparency into their workforce’s skill gaps, and strategically mobilize talent across the organization.

Read the report »

Companies should consider shifting their focus from the latest social and political issues in today’s headlines, toward a longer-term and more sustained effort to strengthen the structures that underlie democratic capitalism. As discussed at a recent Roundtable focusing on the long-term future of corporate political activity, this can take several forms: making bipartisanship a prerequisite for receiving corporate PAC contributions; focusing support on local political leaders who are pragmatic problem solvers; endorsing independent redistricting; working as part of a coalition of companies to strengthen the rule of law; and advocating policies that support economic opportunity and security that cut across political divides.

Why It Matters A future of sustained political polarization, distrust in government institutions, and dramatic policy swings following elections every two years is perilous for both the US economy and democracy. Companies cannot afford to hope that this period of polarization subsides, or to simply try to avoid getting caught in the crosshairs of a partisan fight. They need to take collective action to rebuild bipartisanship and confidence in civic institutions.

Learn more about our Roundtables »

“With ESG funds in particular, what would be very helpful is for them to be clear about their objectives, to provide clear information about their absolute and relative performance, financial performance, and about the impact that they’re actually having.”

— Paul Washington, Executive Director of The Conference Board Governance & Sustainability Center, in a new episode of CEO Perspectives on ESG funds.