February 02, 2022 | Chart

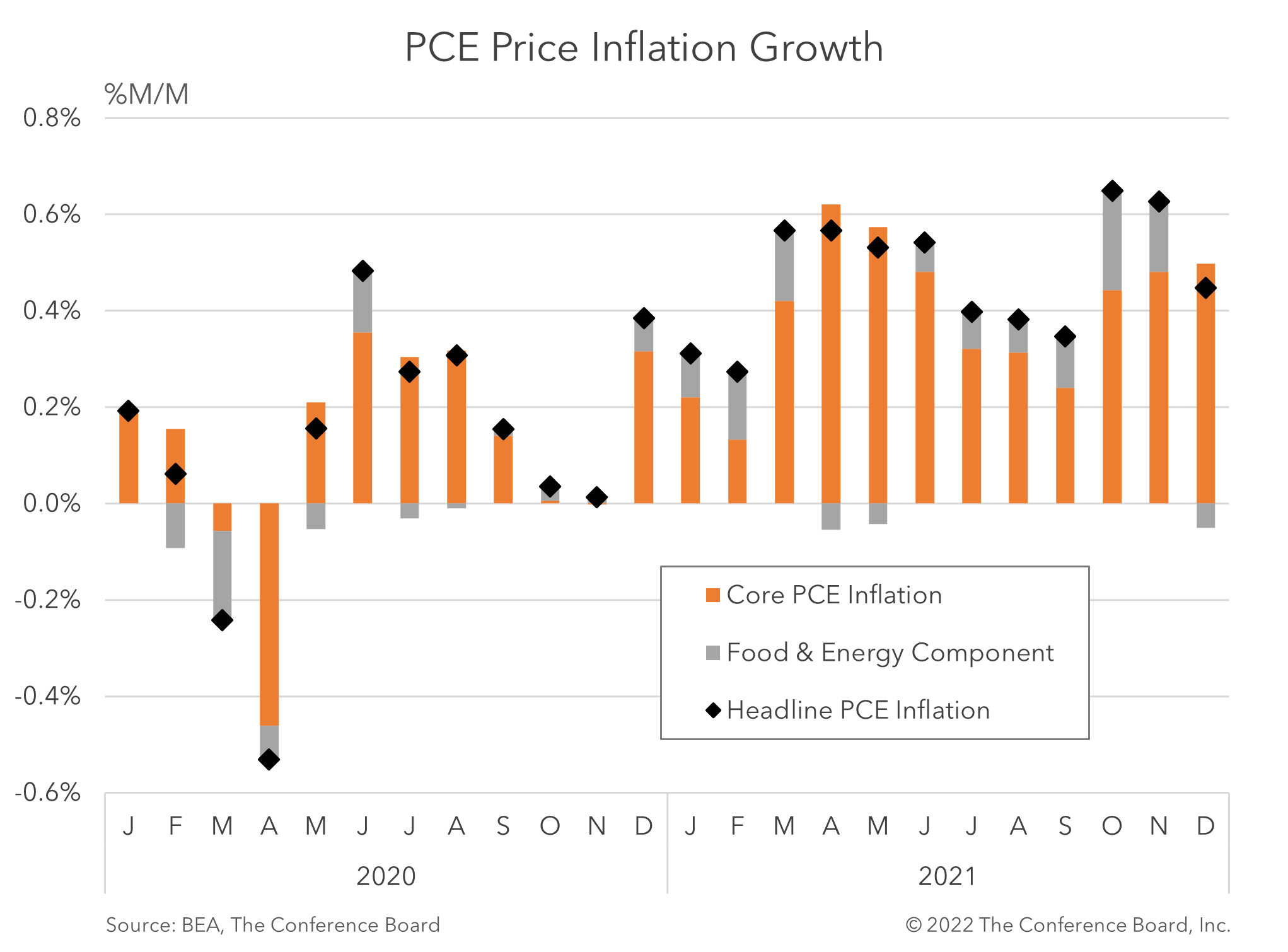

According to Personal Consumption Expenditure (PCE) data from the Bureau of Economic Analysis, US inflation hit a 40 year high of 5.8 percent year-over-year in December. When stripping out volatile food and energy prices, Core inflation (the inflation metric preferred by the Federal Reserve) rose to 4.9 percent year-over-year - also a multi-decade high. Some reports suggest that inflation rates may have peaked and will begin to decline in January, but this is unlikely.

While month-over-month growth in headline PCE prices slowed in December, Core PCE prices rose for a third consecutive month. Falling food and energy prices were responsible for the difference in these two trends in December, which suggests that inflationary momentum has become more deeply rooted in the US economy. As we look to January there two reasons to be concerned about inflation readings. Firstly, new COVID-19 infections skyrocketed – impacting staffing levels, supply chains, and transportation activity. These disruptions create shortages, which in turn drive prices for goods and services higher. Secondly, easing food and energy prices ceased or, in some cases, rebounded in January. Both crude oil and natural gas prices, for instance, rose for the month. These two trends are likely to result in an increase in both the Core PCE inflation and headline PCE inflation in January.

Regardless of the precise peak date, inflation will remain elevated throughout 2022 and into 2023. Coupled with an increasingly hawkish monetary policy, the overall impact on businesses and consumers should result in slower economic growth.

For more information about inflation trends in the United States and around the world, please join us on Wednesday, February 9 at 11 AM ET for our live webcast: Economy Watch: Global Inflation in 2022.

Consumer Confidence Climbs in September as Inflation Expectations Cool

September 28, 2022

Is hydroelectric power’s future ending?

August 01, 2022

US continues to lead global productivity race

April 21, 2022