CEOs Chime In on Secondary Sanctions

Four months into the Russian invasion of Ukraine, the potential for escalation on both military and economic fronts remains a concern for business. Secondary sanctions imposed by the US and its allies on third parties to isolate Russia are one such possible escalation in the short term, and despite potential drawbacks for their business, many CEOs support such sanctions.

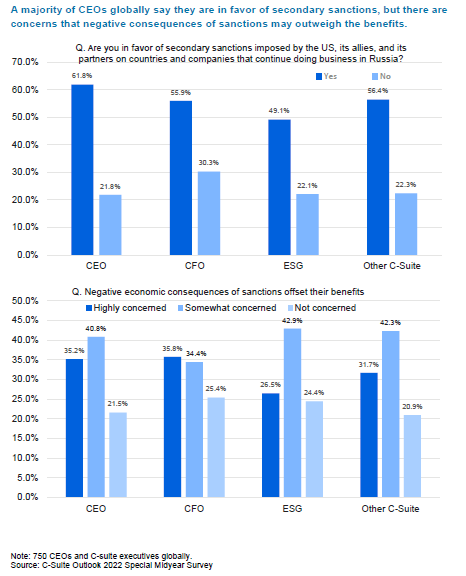

A significant majority (62 percent) of CEOs globally who responded to our special C-Suite Outlook midyear survey say they favor the imposition of secondary sanctions, which are meant to force companies, banks, and individuals to make a tough choice: continue doing business with the sanctioned entity or with the US and its allies, but not both.1 Cutting off access to the US, its allies, and other partners would sharply escalate the economic conflict and set the stage for a fractured global economy and world order.

CEO support for secondary sanctions comes despite their concerns about the negative consequences of sanctions already in place—more than a third of CEOs globally say they are highly concerned about sanctions offsetting their benefits.

One possible explanation for CEOs’ sentiments is that many may view secondary sanctions as an incremental increase since existing sanctions, such as constraints on dollar transactions and US Foreign-Direct Product Rules (for technology exchanges), already cover this ground. Another is that since firms are going through the pain of sanctions, governments need to close gaps, especially for big economies like China and India, for these sanctions to be effective against Russia.

The war’s impact certainly appears to be far reaching. Just 9 percent of companies in our global survey say the war will have no material impact on their business operations in the coming year, though all companies will be dealing with energy and food inflation.

Just 20 percent of CEOs say compliance with sanctions now in place will have an impact on their business operations in the next 12 months, though they will be affected by rising food and energy inflation. However, the issue may require closer attention for many firms.

On May 3, 2022, the US Securities and Exchange Commission’s (SEC) Division of Corporation Finance issued a reminder that public companies, either domestic or international, listed on US exchanges “may have disclosure obligations” arising from Russia’s invasion of Ukraine. These include but are not limited to: reporting on exposure to Russia, Belarus, or Ukraine through operations, employees, investments, securities, sanctions, or legal or regulatory uncertainty; direct or indirect reliance on goods or services sourced in Russia or Ukraine or countries supporting Russia; actual or potential disruptions in the company’s supply chain; or business relationships, connections to, or assets in the affected countries.2

Not surprisingly, the view from Russia is different. For firms with operations in Russia, compliance with sanctions is cited by 57 percent of CEOs as a critical issue affecting their business operations in the next 12 months, and close to half say they are highly concerned about negative economic consequences of sanctions offsetting their benefits.

[1] Daniel Flatley, What Secondary Sanctions Mean, for Russia and World, Bloomberg.com, April 2022.

[2] Robert Lamm, Cutting Ties with Russia (Part 3): A Reminder About Ukraine from the SEC, The Conference Board, May 2022.