October 07, 2022 | Article

A probability model by The Conference Board predicts that the Euro Area will be in recession within the next 12 months. The Conference Board forecasts that a recession in the Euro Area could start before end-2022 as rising interest rates to counter high inflation and the impending energy crisis this winter raise risks. The Conference Board now projects that year-over-year real GDP growth will slow to about 0.2 percent in 2023, down from 3.2 percent in the previous year, with a recession spanning Q4 2022 and Q1 2023.

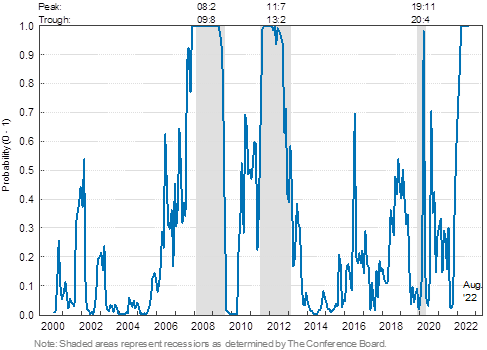

While the recession probability in the Euro Area sometimes fluctuates between 20 and 30 percent due to gyrations in growth among European economies, it persistently rises ahead of significant downturns in the economy. The probability remains high ahead of and during recessions, only to drop as the recessionary period ends.

Note: Probability of the Euro Area economy being in recession within the next 12 months is estimated by a probit model using the following explanatory variables: Yield Spread (10 Year ECB Benchmark Bond minus ECB Minimum Bid Rate), Systemic Stress Composite Indicator, Consumer expectations of general economic situation over next 12 months (balance, percent), Industry: Volume of Order Books (Percent Balance (SA, %)), The Conference Board Leading Economic Index® for the Euro Area (six-month growth rate, annualized). Source: The Conference Board, October 2022.

High inflation since the global pandemic, the economic impact of the war in Ukraine on consumers and production, and the recent hawkish shift in the monetary policy stance of the European Central Bank explain the elevated recession probability in 2022. The probability is estimated using financial leading indicators such as the interest rate spread or yield spread and financial stress, along with three nonfinancial indicators: 1) consumer expectations, 2) order books in manufacturing, and 3) growth rate of the leading economic index.

The variables used in this model are particularly informative about the future state of the economy because they are timely and reflect assessments of future economic conditions by consumers, industry, and financial markets.

While yield spreads have not inverted in Europe as in the United States, their narrowing, especially when measured relative to the long-term average, is an indication of tightening monetary policy and of financial markets expecting future economic conditions to worsen. Both of those factors signal contractionary forces for the economy.

In addition to the yield spread signal, periods of financial stress can be harbingers of economic weakness in the near term, which also causes the recession probability to rise. Recently, the systemic stress variable used in our model has shown rising financial instability, which could translate into a downturn in the real economy.

Meanwhile, the nonfinancial variables consumer expectations, order books in manufacturing, and The Conference Board Leading Economic Index®(LEI) for the Euro Area have deteriorated, also supporting the elevated recession probability.

The estimated probabilities are consistent with other recession signals from the Euro Area LEI. For example, in September 2022, the Euro Area LEI appeared to show a peak in February 2022 and has been on a downtrend since then. Such peaks in the leading index precede recessions on average by six to eight months.

Recession probability models are useful tools in detecting economic downturns on the horizon. The next release of the Euro Area LEI is on October 17, 2022.