CPI Reaction—Prices Reach 41-year High Supporting Fed Hike

10 Jun. 2022 | Comments (0)

The total Consumer Price Index (CPI) rose to a 41-year high in May. Prices increased both month-over-month and relative to a year ago, providing further reason for the Fed to follow through with a 50bp rate hike next week. Core CPI inflation slowed year-over-year for a second consecutive month, but remains extremely elevated. Although prices for select durables are falling, the war in Ukraine continues to stoke nondurables prices, particularly for food and energy (i.e., gasoline and energy utilities). Additionally, services prices are picking up pace, reflecting increasing demand for in-person services now that many consumers have moved beyond the pandemic. Meanwhile, rising home price valuations are placing upward pressure on actual rents and owner’s equivalent rent (OER) within the services category. These shelter costs represent roughly one-third of consumers’ total basket of goods and services consumed.

Insights for What’s Ahead

- Today’s data are consistent with our expectation that overall consumer prices would continue to rise through 2Q 2022. We project that after reaching a peak in 2Q, year-over-year inflation will slow going forward. Core (total less food and energy) inflation did slow year-over-year in May compared to April on smaller increases in select goods prices, but remains extremely elevated.

- Given the current inflation environment, we continue to anticipate that the Fed will hike 50bp both in June and July and raise the federal funds rate to 3 percent by early next year – the top of the estimated 2-3 percent neutral range. Even with this degree of monetary policy tightening, key consumer price indexes, specifically the personal consumption and expenditure deflator, may remain notably above the 2 percent target (2.7 year-on-year) by the end of 2023. If the Fed is willing to accept some degree of inflation, especially supply-side inflation from sources external to the US, then the US can avoid recession.

- However, if the Fed does desire to wrestle inflation to the ground (i.e., back down to 2 percent) by raising the federal funds rate above 3 percent and into restrictive territory, then a brief, shallow US recession is highly likely.

May Inflation Highlights

Total CPI continued to rise in May. The gauge rose by 1.0 percent month-over-month in May, following a 0.3 percent increase in April. On a year-on-year basis, headline inflation hastened to 8.6 percent – the fastest pace since December 1981 – from 8.3 percent. In the month, prices were 1.2 percent higher for food at home (i.e., groceries) and 0.7 percent for food away from home (i.e., restaurants). The cost of food overall was 10.1 percent higher compared to a year ago, the highest since 1981. The year-over-year rate of increase in energy prices was 34.6 percent, also a four-decade high. The price of gasoline increased by 4.1 percent month-over-month confirming what consumers have been seeing in terms of skyrocketing prices at the pump. Indeed, gasoline prices are up an astounding 48.7 percent from a year ago. The price of energy services, which include natural gas and electricity, rose by an outsized 3.0 percent month-over month.

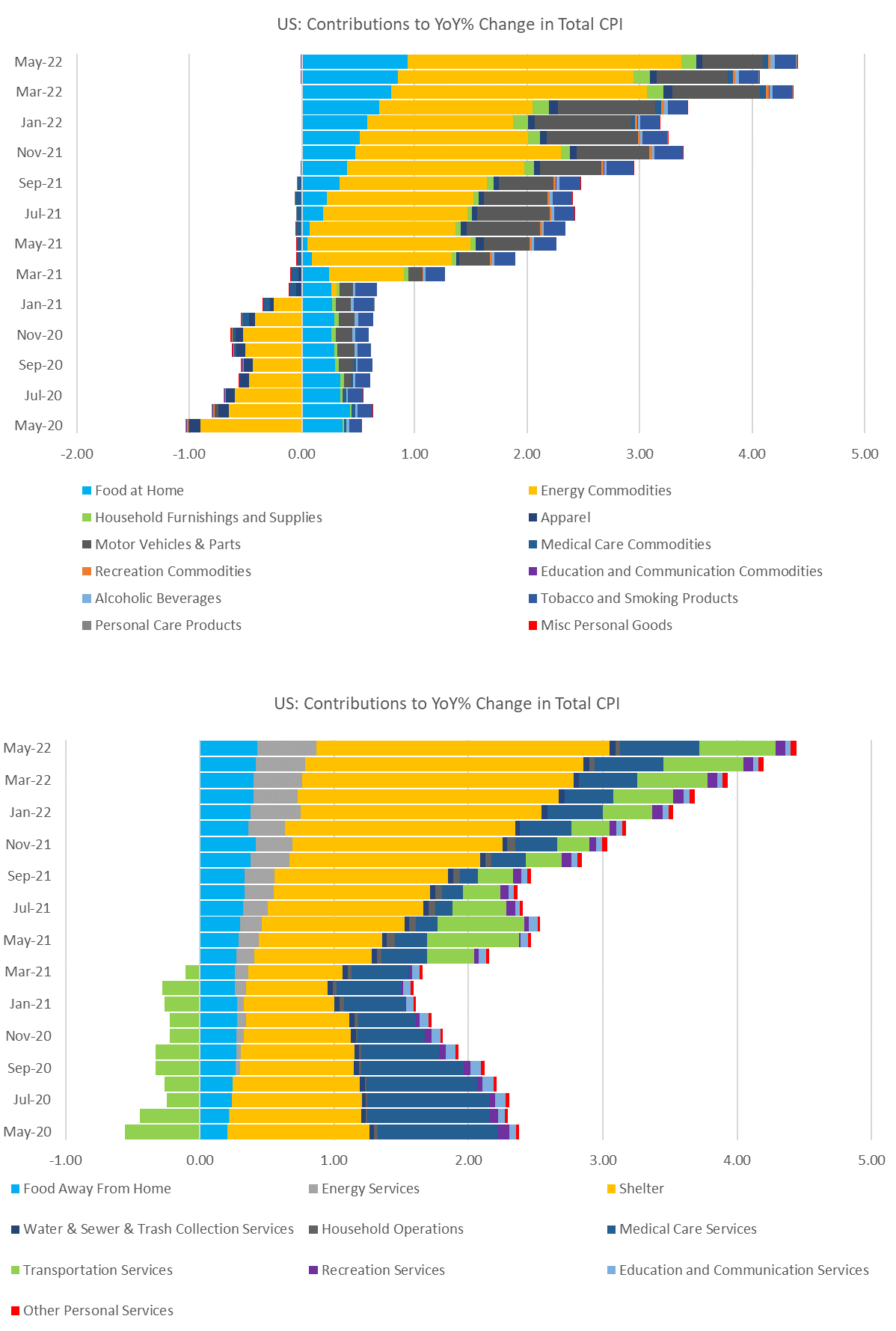

Indeed, prices for food and energy are among the fastest rising costs in the CPI (Figure 1), again reflecting surges in global commodity prices for grain, fertilizer, oil, and natural gas as bad weather events across the globe, and the war in Ukraine and resultant sanctions on Russia are disrupting production and shipments. There could be some relief in gasoline prices ahead as OPEC+ has agreed to increase oil production somewhat. However, the relief could also come from destruction of demand for gasoline heading into the US summer driving season. Indeed, our Consumer Confidence survey reveals that after purchasing cheaper goods, consumers are driving less to manage higher inflation.

Core CPI may be starting to cool, but remains elevated. The core index, which is total CPI less volatile food and energy prices, rose by 0.6 percent month-over-month in May, matching April’s rate of increase. However, the rate of inflation was 6.0 percent higher compared to a year ago in May compared to 6.2 percent in April. This marks the second consecutive month of slower annual inflation gains. The relative improvement reflects smaller increases in good prices compared to a year ago, especially for apparel, furniture, appliances, recreation goods, and new and used vehicles. Slower price increases for many goods is consistent with reports from retailers implementing heavy discounting as consumer preferences are changing with the end of the pandemic emergency.

Nonetheless, services prices even away from energy continue to levitate. This reflects rising home price valuations and increasing demand for services as consumers rebalance their mix of goods and services consumption post-pandemic. Housing costs are rising because the prices of new and existing homes have risen on strong millennial demand and two years of rock-bottom mortgage rates. Rents and OER, which reflects the price a homeowner might receive if she rented her home, mirror home price valuations, but with a lag. As home prices have yet to peak there is still scope for increases in shelter costs going forward. Meanwhile, services costs are also rising quickly – fueled by higher prices for hotels, motor vehicle maintenance and insurance, plane tickets, and out-of-home entertainment. Additionally, costs for healthcare, personal services, and popular streaming services are also rising rapidly.

Figure 1. Food, Energy, and Shelter are Driving Consumer Prices Higher

Sources: Bureau of Labor Statistics and The Conference Board.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global E…

0 Comment Comment Policy