ESG rating and ranking initiatives - a necessary evil?

20 Apr. 2018 | Comments (0)

An increasing number of studies point towards a strong positive correlation between ESG and financial performance. Whilst this has contributed to an increase in responsible investing, one of the implications of this has been the growth in the ESG rating and rankings initiatives. And, subsequently there has been talk of reporting fatigue as well. The Conference Board recently surveyed more than 70 senior managers responsible for responding to ESG information requests to understand their perception of ESG initiatives.

For the purposes of our survey, we used the term ‘ESG initiatives’ as not all organizations considered are ESG rating agencies – some are ESG assessment tools, whereas some provide ESG rankings. Further, we grouped ESG initiatives in two categories - initiatives which base assessment on publicly available information (e.g. Bloomberg, DJSI, FTSE4Good etc.) and those which base assessment on questionnaire/ survey response (CDP, CHRB, oekom, RobecoSAM etc.). Of course, there are also agencies which adopt a hybrid approach, whereby they prepare a rating based on publicly available information and then ask companies to verify their assessment (e.g. MSCI) but for ease, we considered them with the former.

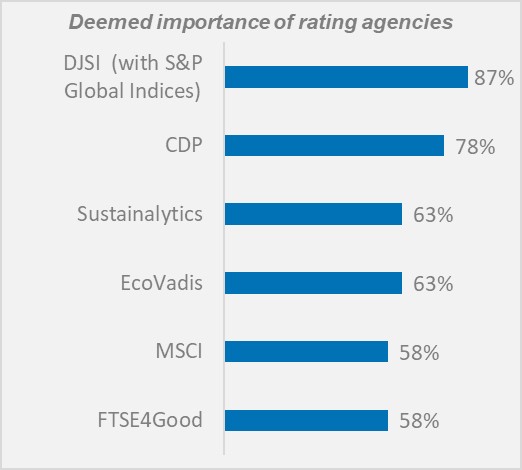

It's very clear from the survey results that there are handful of rating agencies, which companies value and care about. To name a few: DJSI, Sustainalytics and MSCI were considered as the most important ones among rating agencies and CDP and EcoVadis were rated as being the most important ESG assessment tools.

There are often comments made about the time and effort needed to respond to ESG information requests. We found that on average it takes 18 workdays to submit a response to a single request. To put things into context, considering companies on average respond to more than 10 requests each year, one can empathize with the companies feeling survey fatigue.

Having said that, we must appreciate that ESG initiatives play an important role for the investor community and are likely to stay around. For businesses an option might be to be selective, whereby they only respond to one or two ESG initiatives, which they consider to be most important. They could also monitor ESG reporting trends so that they can proactively align reporting to initiatives such as the TCFD (Task Force on Climate-related Financial Disclosures).

A copy of the ESG initiatives survey findings is complimentary to members of The Conference Board and can be requested by writing to anuj.saush@conferenceboard.org.

-

About the Author:Anuj Saush

Anuj Saush is Leader of the Environmental, Social & Governance Center, Europe at The Conference Board, working with Members in Europe, Asia, and North America to embed and enhance sustainable…

0 Comment Comment Policy