August 14, 2022 | Chart

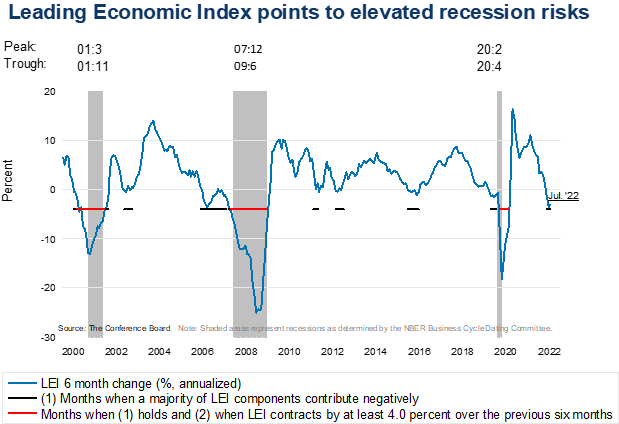

The Conference Board Leading Economic Index® for the US (LEI) declined for a fifth consecutive month in July, suggesting recession risks are elevated in the near term (see the latest press release here). The weakness in the index has been widespread among its drivers and persistent throughout the first half of 2022. Since the index reached its historically highest level in December 2021, consumer pessimism, equity market volatility, housing construction, and manufacturing worsened, and labor markets have moderated. Along with the substantial drop in the LEI, its diffusion index (measuring the proportion of components rising) has remained below 50 percent in the last four months through July -- marking contractionary territory. Based on preliminary data so far, the LEI is essentially signaling that the US economy is on the cusp of a recession.

The LEI is used as a barometer of future economic conditions and a forecasting tool because it is systematic, objective, and reliable. Importantly, it points to changing conditions in the economic cycle. While there are various ways to interpret the LEI in real time, a reliable rule of thumb looks at the duration, depth, and diffusion – the 3D’s -- of a downward movement in the index. This rule now appears to be at or near a recession signal. Duration refers to how long-lasting a decline in the index is, and depth denotes how large the decline is. Duration and depth are measured by the rate of change of the index over the last six months. Diffusion is a measure of how widespread the decline is (i.e., the proportion of index components that are falling below 50 when a majority of the components are deteriorating). The 3 D’s rule provides signals of impending recessions when two criteria are satisfied: (1) The rule requires that a majority of the 10 LEI components are in contraction territory (black dotted line in the chart), and (2) the magnitude of the decline over six months should be below the median, -4.0 percent, annualized (red dotted line). If both criteria are met simultaneously, the LEI signals a recession.

For more information on the most recent Leading Economic Index, please visit our website.

For The Conference Board’s most recent outlook, please see US economic forecast.