Several factors are driving price inflation in almost every sector. COVID-19 was the catalyst to ignite this rise. There are dynamics that may be more persistent as we move to an endemic stage for the virus, but also some that will be more transitory.

The transitory factors include supply chain bottlenecks, overseas factory closures, labor shortages, monetary policies, stimulus, and changing consumer behaviors. The more persistent factors include deglobalization, labor challenges with demographic aging, declining work in cities, the transition to renewables, and millennial housing demand. You can read more deeply about these factors here.

The net effect of these dynamics is evident in the figures below, and Dana Peterson, Chief Economist at The Conference Board, predicts no easy or early end to these dynamics.

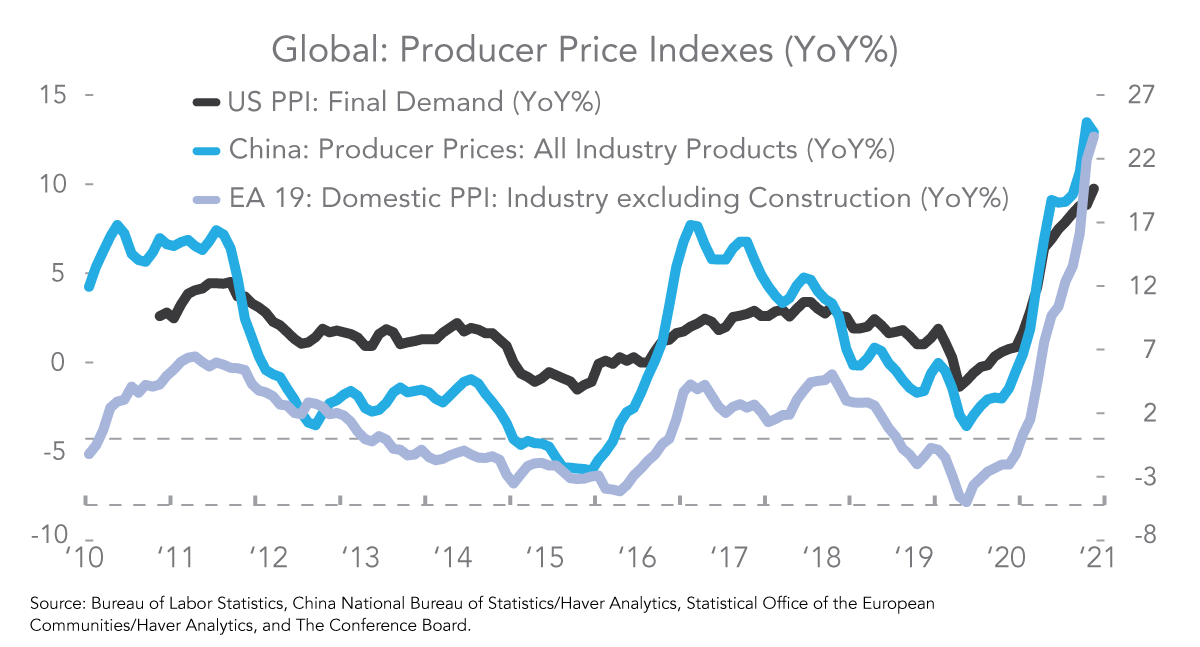

Producer prices are surging in major economies

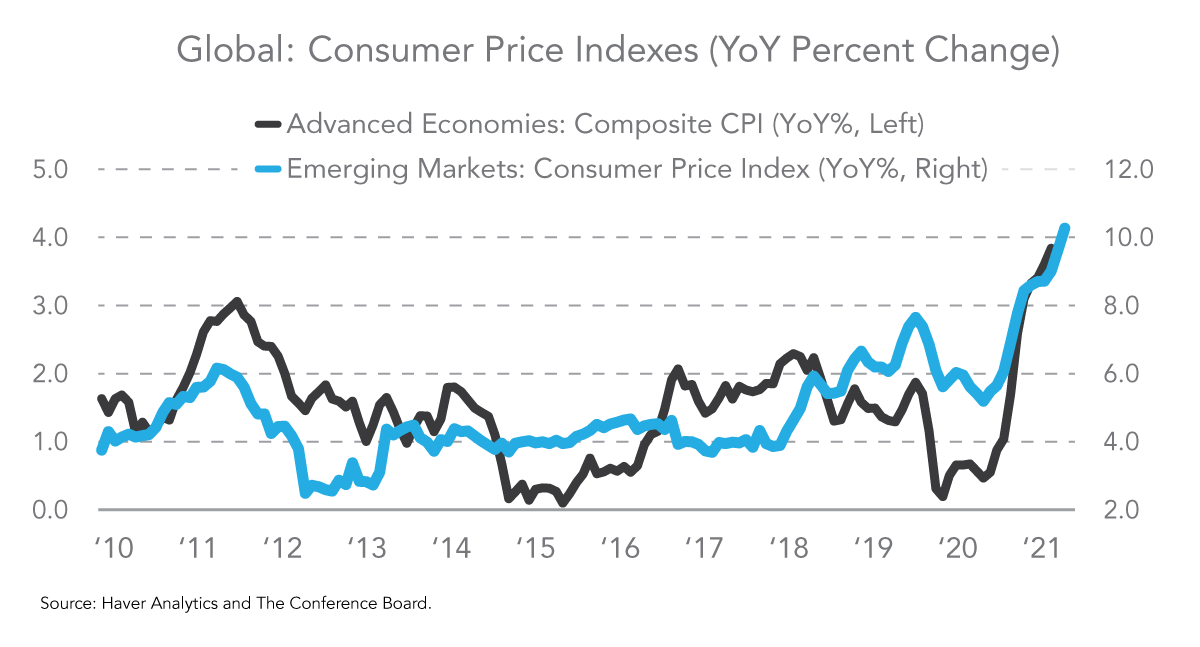

Consumer prices are rising dramatically for advanced and emerging economies

So, what are the implications for marketing and communications?

History has shown that an inflationary market can make it harder to hit volume targets and may result in practices that damage brand equity: prices go up, critical price points are broken, demand falls, sales fall, people panic.

History has also shown how to rise to these challenges and still grow your business.

Some of the challenges are obvious: Pricing, promotions, planning targets etc. Others are a little more nuanced: retaining talent, maintaining focus on strategy, managing stakeholders, and shaping the narrative.

The key is to decide on what you believe you can achieve through this turbulent period and scenario plan for what’s ahead. Everything from maintaining share to driving lasting change to your business model is in play. Car companies right now are selling unit volumes of about 15M units, down from 17M pre-pandemic. This is not due to demand or rising prices but lack of supply. Their profitability is higher than ever as inventory has evaporated and working capital use has plummeted. In the meantime, car companies are training consumers to order in advance and wait, thereby cutting the need for huge inventories on lots.

Here are six insights to provoke your thinking and help shape your story. These are equally applicable to business-to-business marketers and communicators as they are to business-to-consumer ones:

- Keep a big-picture focus on the economy: Any marketing textbook will have an early chapter devoted to the economic conditions in which a business and its customers are operating. The critical indicators always include GDP growth, interest rates, inflation, and the disposable income of those you wish to do business with. Ensure that all your marketing and communication teams are aware of the trends in these metrics and what is driving them so they can better shape their actions for the possibilities that lie ahead. The drivers are not all numerical either: consumer sentiment is often a leading indicator of economic performance. It is very easy for marketers to overlook this, believing it is the CFO’s job, but without the right knowledge, your stories might develop in a not-so-wise direction.

- Revisit what you think you know: Reevaluate your existing customer segmentations and get back to understanding the people you serve. Explore their reaction to price increases and their pain points that revolve around spending money. Inflation does not hit everyone equally, even those with the same disposable income. What you knew about customer A before inflation began to bite, may no longer be true. There will be stress behaviors that might manifest. Redefine your customer base with this understanding and develop pricing and promotional strategies accordingly.

- Size is important: When input prices rise, all marketers immediately think of two things. Pass the price on (net of costs that can be cut elsewhere) to the customer or reduce the cost of what is produced by reducing size. This is as true for services as it is for products. The candy industry has done this forever. However, marketers need to consider the consumer perception of value. A tiny Milky Way for the same price might feel less valuable than a bigger one for slightly more. This often leads to value-packs, super-sizes, and bundles. Marketing works, especially creative consumer/trade promotions to gain share. All these tactics are valid but remember that the opportunity during this time is to win the appreciation of your customer, and that can last long after inflation has begun to recede. P&G famously explored this during the turbulence of 2008; they nurtured value and managed pricing to the extent that they won share in many categories—share which they retained for almost a decade thereafter. Of course, the notion of value is dependent upon the understanding of your customer.

- Branding is even more important: One of the most powerful ways to maintain the perception of value is, of course, to nurture the emotional and rational story of your brand. This was at the heart of the P&G story and was repeated in the success of many brands staying actively visible in the early months of the pandemic compared to those who went quiet. In many sectors, there will be the temptation for people to trade down to lower priced or own-label brands. Target is completely challenging the idea that an own-label brand should be lower price or lower quality, and they are rewriting the rule book for this. The actions they take on their owned brands during this inflationary period will be very enlightening. Remember that branding is not only applicable to consumer products. It is equally true of business-to-business offerings, service companies, and even institutions. Also, the audience for your brand building is not only the end consumer. Your colleagues, your employees, your stakeholders, suppliers, and other engaged parties must all be taken into consideration.

- Digital has changed the balance of power: In previous inflationary periods, the digital ecosystem was not as widely accessible nor as developed as it is today. We have no historical evidence for how this will affect customer behavior. However, we can hypothesize and ask, “What if?” With huge penetration of devices and connection, all consumers are more actively able to compare prices for all products and services at any given moment. This will increase the dangers of leading with raised pricing too soon or breaking notional price points when your competitors do not. However, digital might not always lead to lower-priced purchases. Digital is also an opportunity to create value and justify price increases though convenience, speed, and customization. There is the example of Chipotle leveraging its app to deliver customized burritos at a 17 percent premium. Dominos is also using its digital and data infrastructure to maintain pricing advantages. Similarly, all companies can act like consumers and use digital, data, and machine magic to manage the prices they are paying for their input costs and logistics. This is unexplored territory—using digital to defend against inflationary impacts—and the advantage will go to those who are brave, experiment, learn, and succeed.

- The truth matters, but not to everyone: Finally, in communications, there has been a relentless march toward greater transparency and the shared narrative. Very few brands or companies talk openly with their consumers about the challenges of inflation and the reasoning behind price increases. It is difficult to do so, and not many end consumers will care. Commodities can do this because their prices go up but also back down. Not many DTC companies or retailers would be willing to raise their brands’ prices and then lower them again once input costs begin to decline. It might be a bold move for some brands to explore this, considering the raised visibility and comparability of brand actions for consumers. It might also be a refreshingly honest way of winning and holding onto the trust of your consumer. That is the consumer perspective, but your employees must know the truth, as must your investors, your Board, and other stakeholders. Having a clear, concise, and compelling narrative for pricing, packaging, product, and promotional cost/value management actions is critical. Therefore, think carefully about how you will explain your approach.

Of course, these six action areas are interlinked. No one area alone will suffice to help you win in the situation that lies ahead. Neither are they the same for all types of businesses because consumers may be impacted differently by rising prices. Premium luxury brands that cater to the very rich will think differently than those who manage everyday essentials at affordable prices. Business providers who have differential and critical expertise with little competition will have to respond differently than those who are in more commoditized service sectors.

To demonstrate this, let us consider a case history from Russia, at a time when inflation and uncertainty was rife: 1998. The ruble crashed; credit was scarce; banks closed; inflation accelerated, reaching 84 percent annually; and consumers had a terrible time.

Mars, Incorporated, had been expanding its business and production in Russia over the preceding years and marketing had some tough decisions to make. Many international companies cut their losses and pulled out of Russia. Mars took the longer-term view.

Their small retailers were affected by consumer behaviors but also by the financial woes of the entire economic system. They were not willing to pay for inventory that would sit on their shelves and rapidly devalue.

Applying some of the six principles outlined above, Mars’ marketing team knew the economics would not improve quickly; they understood the changed circumstances of their customers; they felt that smaller orders or smaller product would undermine the proposition of their candy brands and the relationships with their customers. They came up with the simple but elegant solution of selling on consignment. Their distributors provided product, and the retailers paid them only for what they sold after the fact. At the same time, with other brands pulling out, they invested in brand building in the media, maintained their product quality, and sold this story to their stakeholders with great credibility.

Mars emerged from this intense period with a strengthened market presence, a committed distributor network, and powerful brand equity which has resulted in Russia being one of the most financially valuable regions in the Mars network 20 years later.

So, while we may be in for a rough road ahead, innovative marketing and communications professionals can find the sweet spot to succeed. Just ask Mars.