July 27, 2022 | Article

Consumer confidence fell for a third consecutive month in July. The decrease was driven primarily by a decline in the Present Situation Index—a sign growth has slowed at the start of Q3. The Expectations Index held relatively steady, but remained well below a reading of 80, suggesting recession risks persist.

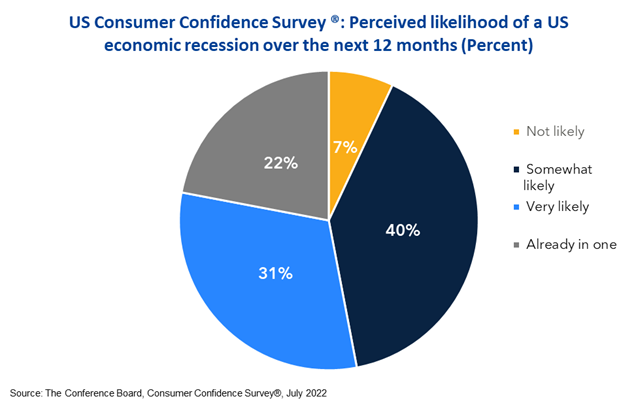

A special poll conducted in the July Consumer Confidence Survey® examined the perceived likelihood of a US economic recession over the next 12 months (chart below). More than 3 out of 10 ten consumers said it was very likely the US would experience a recession over the next 12 months, while an additional 4 out of 10 say recession is somewhat likely. Meanwhile, 2 out of 10 consumers said they believe we are already in the midst of a recession.

While The Conference Board does not believe the US economy is currently in a recession, we are forecasting that US economic growth will slow over the course of this year and that a shallow recession will occur in late 2022 and early 2023. This outlook is associated with persistent inflation and rising hawkishness by the Federal Reserve. We forecast that 2022 Real GDP growth will come in at 1.7 percent year-over-year and that 2023 growth will slow to 0.5 percent year-over-year.

For more information about how US consumers are feeling see Consumer Confidence Declined Moderately in July or listen to the Indications Podcast.