September 07, 2022 | Article

Global recessions are events with large economic and financial disruptions occurring simultaneously in many countries around the world. During global recessions, financial conditions tend to tighten, business confidence to decline, and policy uncertainty to increase. The International Monetary Fund and the World Bank define a global recession as an annual contraction in world real GDP per capita accompanied by a broad decline in various other measures of economic activity, including industrial production, trade, capital flows, oil consumption, and unemployment.[1]

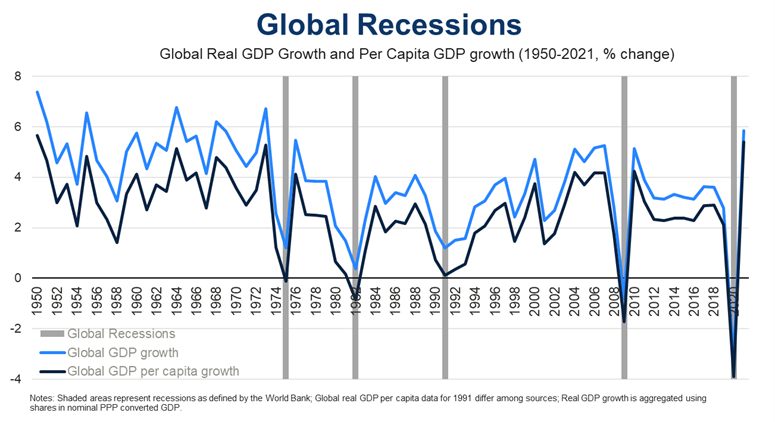

Since the Second World War, the global economy has witnessed five global recessions—in 1975, 1982, 1991,[2] 2009, and 2020—and four global downturns, namely in 1958, 1998, 2001, and 2012.[3] Historical data also show periods identified as global downturns where global growth is very low by historical standards, but global real GDP per capita does not contract and several activity indicators remain robust. Furthermore, the experience of individual economies may show more variation during global downturns compared to recessions. Since the 1950s, global recessions have become increasingly more synchronized. The 2020 recession was the deepest and most internationally synchronized after the Global Financial Crisis of 2008–2009.

While the five global recessions since 1950 have coincided with US recessions, the US experienced six additional recessions in the same period. By contrast, some large emerging economies such as China and India did not register declines in their real GDP per capita during the 2009 global financial crisis even though they experienced growth slowdowns. Other factors that make global recessions harder to identify are the need to rely on low frequency (annual or quarterly) aggregate global data, which tends to smooth out fluctuations, and the possibility of offsetting fluctuations across various large economies.

The global recession of 1975 had its origins in the shock to world oil prices following the Arab oil embargo of 1973. A second oil shock in 1979, when oil prices more than doubled in one year, led to another global recession in 1982. However, the 1982 recession was also triggered by tightening of monetary policies in the US and other advanced economies and a Latin American debt crisis. The next global recession almost a decade later resulted from a confluence of factors, including geopolitical uncertainty (Gulf War, collapse of the Soviet Union), a credit crunch in the US, problems with the European Monetary System’s exchange rate mechanism, and the transition in Central and Eastern Europe and the former USSR to market economies. The 2009 global recession followed the worst financial crisis since the Great Depression (1929–1939). The last global recession to date in 2020 was triggered by economic shutdowns in response to the global pandemic.

While we do anticipate recessions in several large economies, including the US, UK, Germany, and Brazil, a global recession is not currently our base case forecast. Our current forecast therefore is more akin to a global downturn. However, the occurrence of one extreme event, or even a combination of several smaller unfavorable events, could thrust the world back into recession. This would involve deeper growth slowdowns or recessions than currently foreseen in the three major economic blocs (China, the US, and Europe), an escalation of the war in Ukraine, and/or worsening global food and energy shortages.

For more information about our recession scenarios, Members can access our (June 2022) report: StraightTalk® The Many Roads to Recession.

[1] This section draws heavily on the World Bank Policy Research Working Paper 9172, Global Recessions; another useful reference is IMF, World Economic Outlook. Crisis and Recovery, April 2009.

[2] Global real GDP per capita figures for 1991 differ among sources. The Conference Board Total Economy Database relies on the Maddison Historical Statistics data, which do not show a contraction in 1991 but growth of 0.1 percent. The World Bank relies on data from the Penn World Table, which shows a minor contraction of 0.1 percent for 1991.

[3] For the 2020 global recession, see various recent IMF World Economic Outlook reports including World Economic Outlook. A Long and Difficult Ascent, October 2020.