Shareholder Voting Trends (2018-2022): Executive Summary

Shareholder Voting Trends (2018-2022) provides an overview of shareholder resolutions filed at Russell 3000 and S&P 500 companies through mid-July 2022, including trends regarding the volume and topics of shareholder proposals, the level of support received by those proposals when put to a vote, and the types of proposal sponsors. It is accompanied by a live dashboard, which contains the most current figures and enables data cuts by market index, business sectors, and company size groups.

Several factors lead to a challenging proxy season for companies:

- The number of shareholder proposals filed by investors;

- The number of proposals going to a vote, because of the difficulty of negotiating proposal withdrawals or omitting them through the no-action letter process;[1] and

- The level of support for proposals that come to a vote.

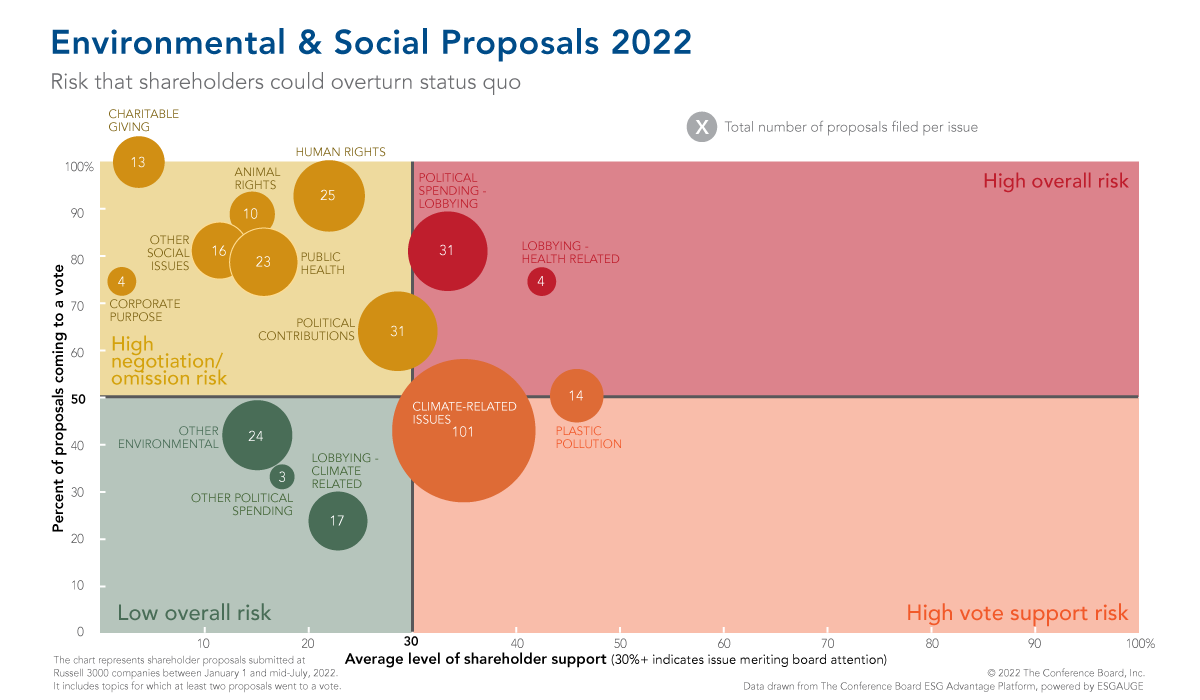

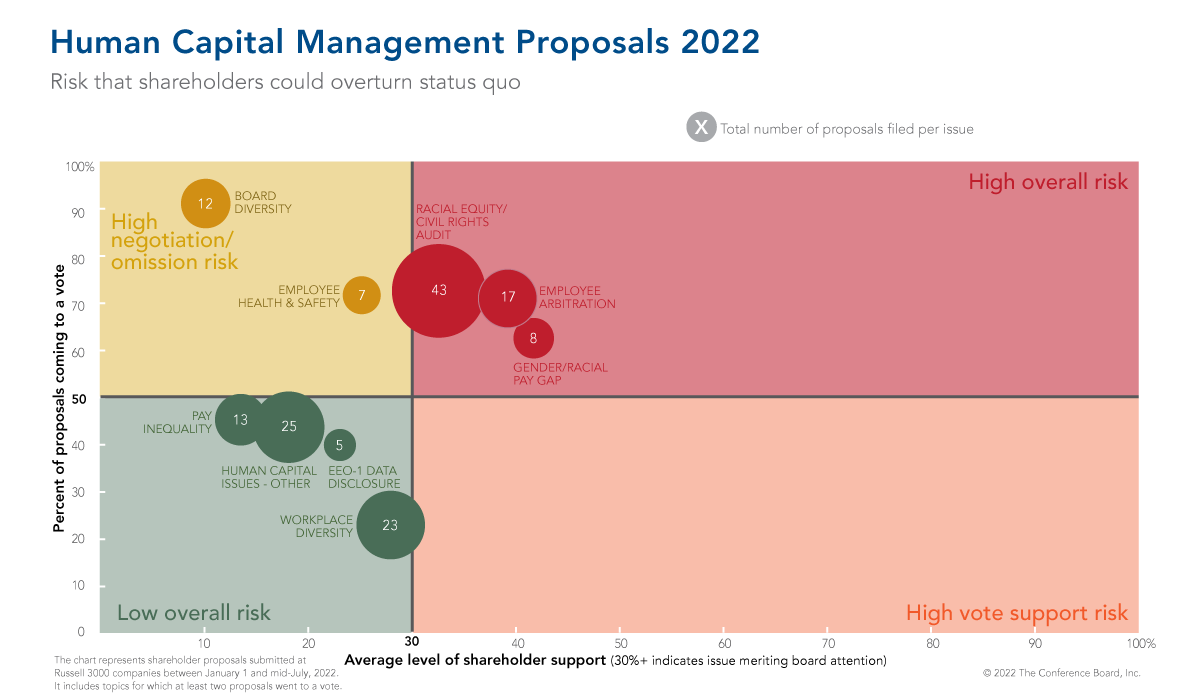

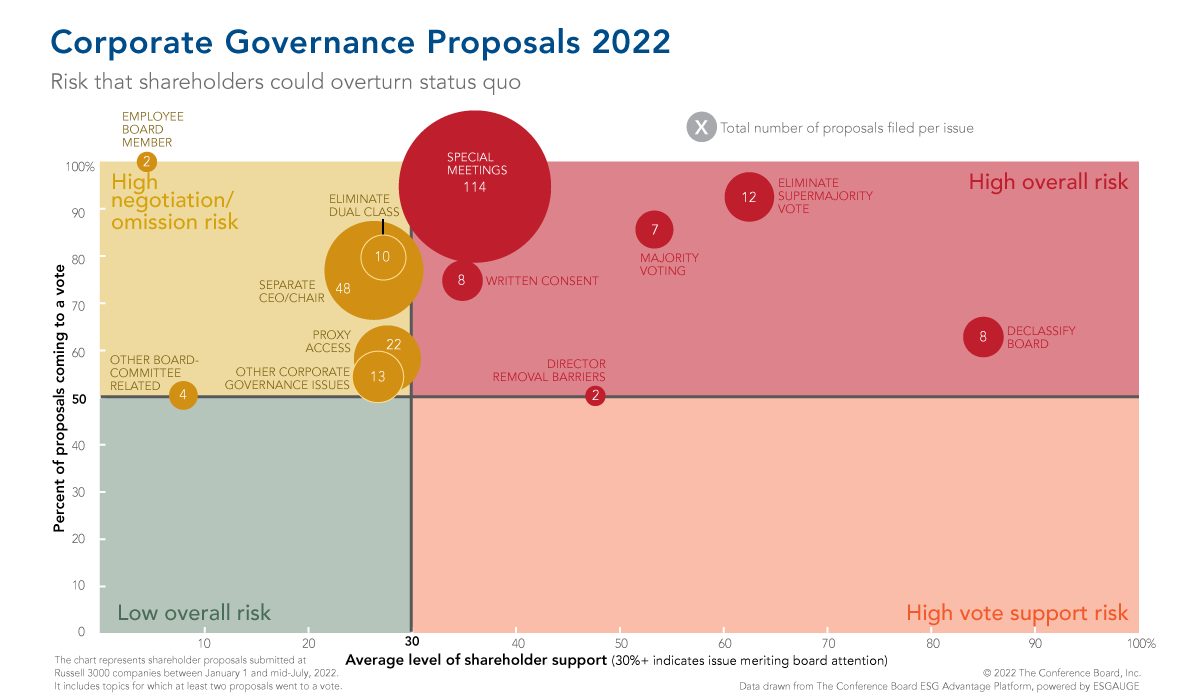

Our insights on the proxy season are accompanied by graphics that map the ESG-related shareholder proposals from the 2022 proxy season against these three dimensions. They illustrate which topics have caused most tension between companies and investors.

AUTHOR

Governance Proposals, Say-on-Pay Votes, and Director Elections