Shareholder Voting Trends (2018-2022): Governance Proposals, Say-on-Pay Votes, and Director Elections (Brief 3)

September 27, 2022 | Report

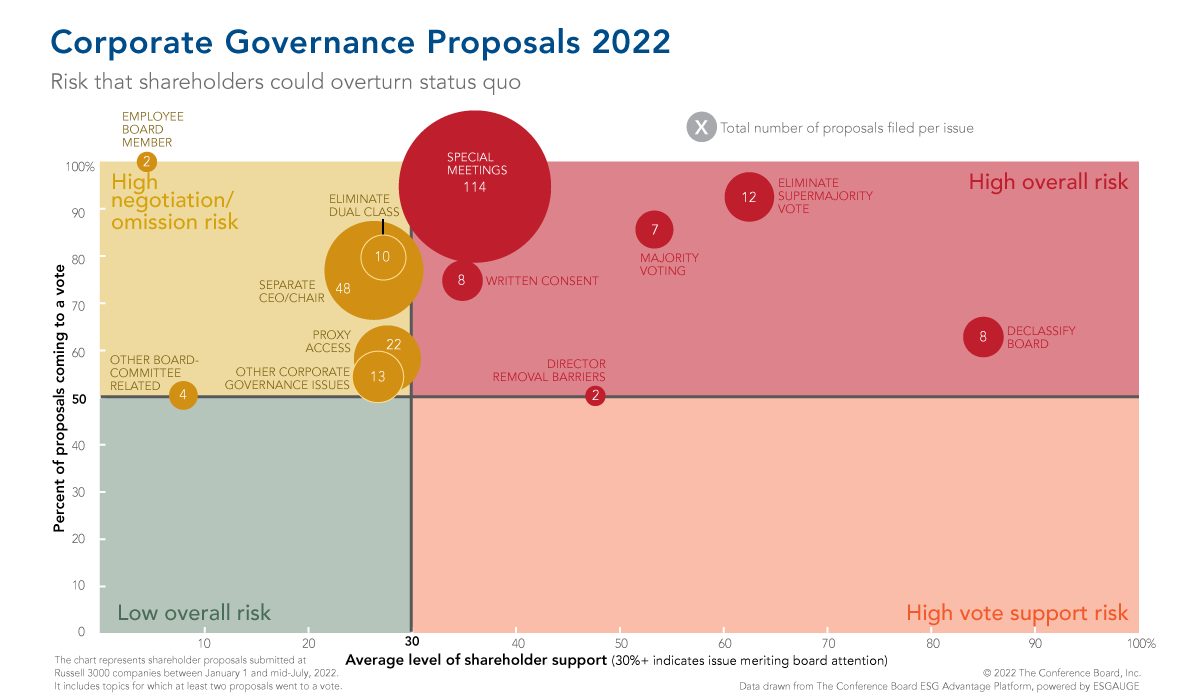

Governance-related shareholder proposals are still the most likely, overall, to go to a vote and receive significant shareholder support

Some investors are now specifically targeting smaller firms on declassifying boards and adopting a majority voting standard. Shareholders granted majority support to five resolutions to declassify the board structure as well as four resolutions to change the standard for the election of directors from plurality to majority voting. Plurality voting and staggered boards can be seen as protections against activism, but they can also invite activism. Staggered boards can also be perceived as an impediment to board refreshment, and companies may wish to consider shifting to annual elections if it helps them adjust the composition of the board in a way that keeps pace with strategic needs.

Support for company proposals on say-on-pay resolutions and director elections has declined, and institutional investors have introduced voting policies to hold individual business leaders accountable for shortcomings in the ESG area. In 2022, 75 directors nominated by management did not get elected.

AUTHOR

-

Complimentary.