Sustainability Practices: 2019 Edition: Trends in Corporate Sustainability Reporting in North America, Europe, and Asia-Pacific

February 04, 2020 | Report

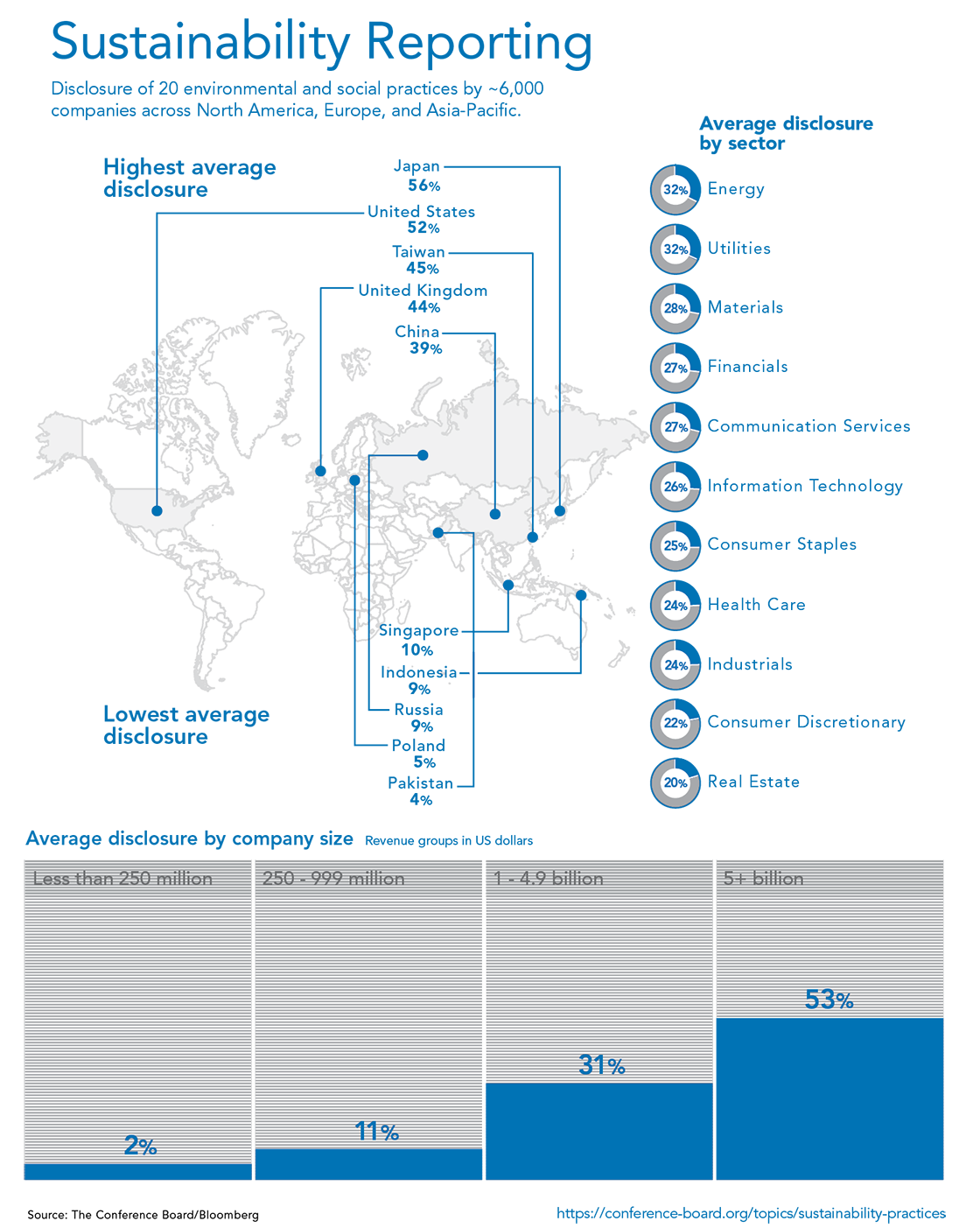

Disclosure across a wide spectrum of sustainability issues is on the rise, driven by stakeholder pressure and a combination of soft and hard regulation in various jurisdictions. These drivers are shifting sustainability reporting from a largely voluntary practice to one increasingly expected—and in some cases required—of companies. In this edition we analyzed data on sustainability disclosure and performance on 90+ environmental and social practices for nearly 6,000 companies in 26 markets, spanning Asia-Pacific, Europe, and North America.

ARTICLE

Disclosure across a wide spectrum of sustainability issues is on the rise, driven by stakeholder pressure and a combination of soft and hard regulation in various jurisdictions. These drivers are shifting sustainability reporting from a largely voluntary practice to one increasingly expected—and in some cases required—of companies. In this edition we analyzed data on sustainability disclosure and performance on 90+ environmental and social practices for nearly 6,000 companies in 26 markets, spanning Asia-Pacific, Europe, and North America.

-

Complimentary.