Downskilling: Employers can no longer have their cake and eat it too

16 Feb. 2018 | Comments (0)

No longer is the US labor market an employer’s market. For years after the Great Recession, firms had access to applicants with quality and educational credentials exceeding hiring managers’ wildest dreams. Since then though the US labor market has experienced one of the largest turnarounds in recorded history. During and after the Great Recession, the unemployment rate sharply climbed to 10 percent in late 2009 and remained above 9 percent through 2011—representing one of the weakest labor market episodes performances ever. Since then the unemployment rate has gradually dropped to 4.1 percent in January 2018, an unusually low rate. Employers have thus moved from a prolonged period of unusual ease in hiring, into one where they are faced with gradually growing difficulties to recruit. According to several employers’ surveys of recruitment difficulty, it is now more difficult to hire qualified workers than it was in 2007, the last pre-recession year, in which the U.S. labor market was quite tight.

Even more extreme is the rise in vacancy duration, or “time to fill” positions. According to DHI hiring indicators, in 2014, vacancy duration already surpassed 2007 rates, and in late 2017, it takes an average of 25% more days to fill a vacancy now compared with 2007. That is somewhat surprising, because it is hard to argue that the US labor market is much tighter, if at all, than in 2007. One potential explanation for the unusual recruiting difficulties, beyond the tight labor market, has to do with job opening requirements: during the years of weak labor markets following the Great Recession, employers took advantage of market conditions and “up-skilled” the positions (raised the educational and experience qualifications for job openings). Employers got used to these higher qualifications and were somewhat reluctant to down-skill as the labor market got tighter. That has led to extended vacancy duration which will eventually result in reducing hiring standards back to previous levels.

Is there supporting evidence for this explanation of slow-to-fill job vacancies? Several studies using job vacancy online postings show that labor market conditions do have an impact on desired qualifications in job openings. We also hear from our member companies anecdotal stories that are in line with the earlier up-skilling and current down-skilling.

In this blog post we attempt to document whether changes in education levels among new hires can be seen in the official employment statistics. And we do indeed find evidence that such changes took place in this business cycle.

Ideally, we would be able to observe the educational attainment of new hires to study whether changes in average education levels took place, but in this blog we are limited to using the economy-wide employment statistics rather than data focused on new hires. To overcome this limitation, we only look at workers within 6 years of a typical entry age into employment, as a large share of these workers were recent new hires. For the rest of this blog, when we report results for the group of workers with Master’s degree and above, we use workers age 25-30. For the group with a bachelor’s degree, we use age 22-27, for workers with a high school diploma or some post-secondary education but no BA, we use age 18-24, and for high school dropouts we use age 16-21.

We divide employment into two groups of occupations: high-education occupations and low-education occupations[1]. The high-education group comprises about 40 percent of total employment, and the low-education group makes up the other 60 percent.

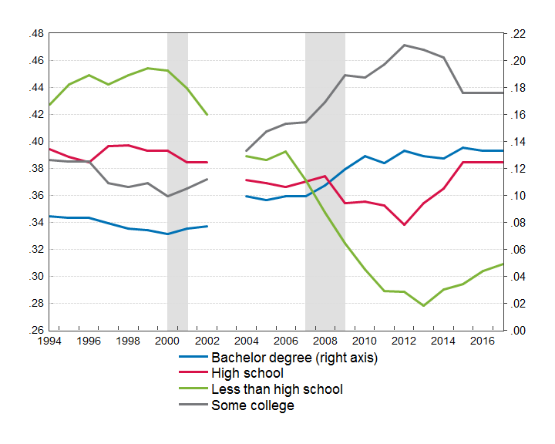

The results are plotted in the two charts below (before you get confused, we just want to alert the readers that the lines don’t need to add up to 100%, because each share is from a different age group). We start by examining whether there were educational share changes among the low-education occupations (Chart 1). The chart shows that during the Great Recession and in the 2-3 years following it, in low-education occupations the share of workers with a BA or some post-secondary education increased, while the share of workers with a high school diploma or less declined. That result suggests that during these years, new hires became more educated.

Since 2012 or 2013 though, this trend has mostly reversed. The share of workers with a high school diploma or less increased, the share with some post-secondary education declined, and the share of workers with a BA flattened. These results suggest that in recent years, as the labor market has tightened, employers’ new hires became less educated.

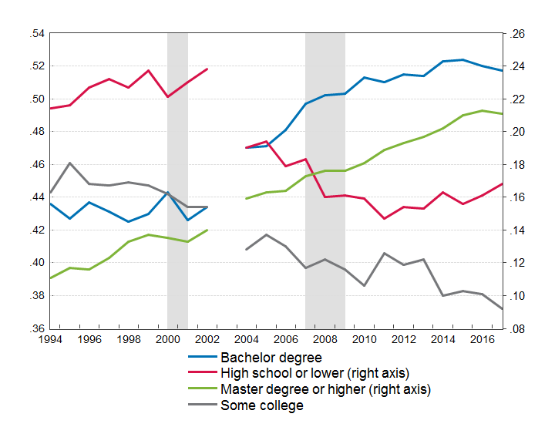

A similar, but somewhat less clear cut, story appears when we look at the high-education group in Chart 2.

Chart 1: Workers in a specified education group as share of total employment in its specified age cohort, for low skilled occupations, 1994 to 2017.

Source: IPUMS-CPS, University of Minnesota, www.ipums.org

Notes:

- The workers covered by this chart are from the low-education group.

- Each line shows the share of the educational group within employment in a certain age group.

- For the group with a BA we use age 22-27; for workers with a high school diploma or some post-secondary education but no BA, we use age 18-24; and for high school dropouts we use age 16-21.

- We provide a break in 2003 because of a slight change in the occupation classification.

Chart 2: Workers in a specified education group as share of total employment in its specified age cohort, for high skilled occupations, 1994 to 2017.

Source: IPUMS-CPS, University of Minnesota, www.ipums.org

Notes:

- The workers covered by this chart are from the high-education group.

- Each line shows the share of the educational group within employment in a certain age group.

- For the group with a MA and above we use age 25-30; for workers with just a BA we use age 22-27; for workers with a high school diploma or some post-secondary education but no BA, we use age 18-24.

- We provide a break in 2003 because of a slight change in the occupation classification.

In sum, the evidence for changes in education levels of new hires in the past decade is quite visible, especially among low-education occupations. Workers with a high school diploma or less were pummeled during and after the Great Recession, but are now much more likely to have a job and to climb up the job-education ladder. This trend is likely to continue as the labor market gets tighter. In the period of the very tight labor market in the late 1990s and 2000s, the share of workers with a BA and some post-secondary education declined, and the share of high-school dropouts increased, among the low-education occupations.

With the time to fill positions skyrocketing, some employers may choose to compromise on the educational requirement of their new hires. Others prefer to raise wages and maintain educational requirements. The time of “having your cake and eating it too” seems to be over.

[1] . We rank all occupations by the share of the workers with at least a BA within an occupation. The high education group consists occupations with high share of BAs and vice versa. The high education group consists of about 40 percent of total employment.

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

-

About the Author:Frank Steemers

The following is a bio or a former employee/consultant Frank Steemers is a Senior Economist at The Conference Board where he analyzes labor markets in the US and other mature economies. Based in New …

0 Comment Comment Policy