Core Inflation Uptick Continues to Suggest 25bp Cut

10 Oct. 2024 | Comments (0)

Total Consumer Price Index (CPI) inflation continued to slow on a year-over-year basis in September but picked up excluding food and energy.

The data suggest that the PCE deflator, which the Fed bases monetary policy from, likely also will reveal continued stickiness in underlying inflation in September when released at the end of this month.

Stubborn services inflation reflects glacial slowing in shelter costs, but also rising costs for other services caused by structural changes in the economy.

We continue to believe tracking US data suggest a 25bp cut remains the most probable at the November FOMC meeting.

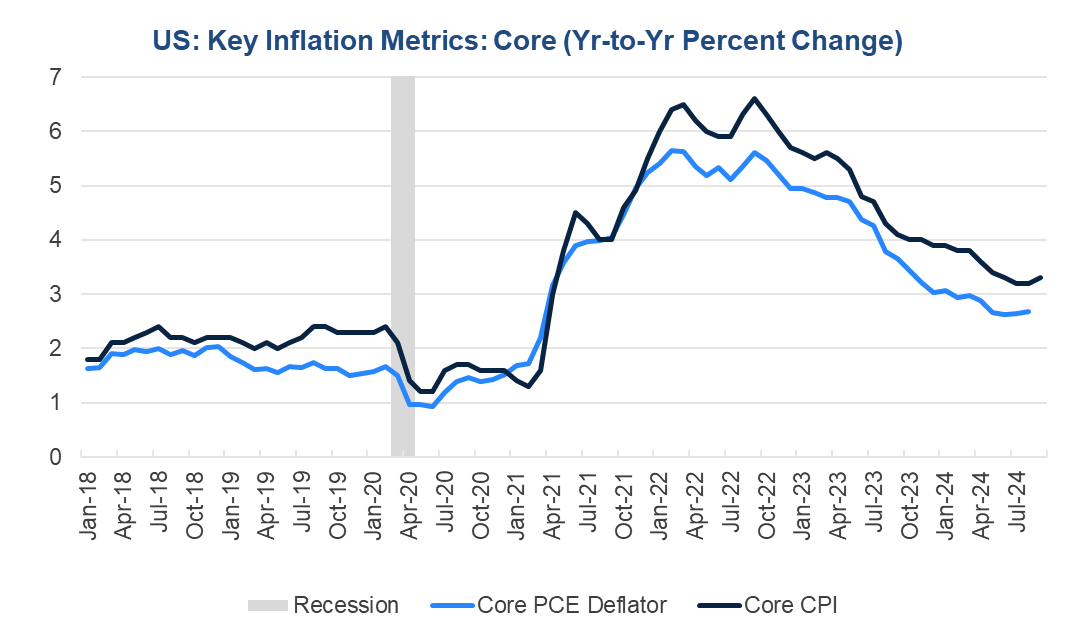

Figure 1. Core CPI inflation ticked up

Sources: Bureau of Labor Statistics, Bureau of Economic Analysis, and The Conference Board.

Trusted Insights for What’s Ahead™

- Continued health in the labor market, strong tracking for Q3 real GDP growth, and sticky core inflation suggest the Fed may cut interest rates by 25bp in November.

- We anticipate 25bp of cuts in November, a 25bp cut in December, and 25bp per meeting in 2025, lowering the federal funds rate target range to 3.00-3.25 percent about a year from now.

- This path is also consistent with our call for consumer inflation to stabilize at the Fed’s 2-percent target around mid-2025.

- The devastating human toll and destruction of recent hurricanes notwithstanding, the Fed may look through some of the negative impact on October employment and economic activity.

- This is because the effects of hurricanes tend to reverse quickly as people return to work and rebuilding efforts spur household consumption, business investment, and government spending.

Report Highlights

Total Inflation Continues to Cool

Total CPI rose by 0.2 percent month-over-month in September, following two consecutive months of increases at the same pace. Prices for food, shelter, transportation services, medical care services, apparel, and motor vehicles were all higher in the month. The monthly gain was offset in part by falling fuel oil and gasoline prices. On a year-over-year basis, CPI inflation slowed from 2.5 percent to 2.4 percent, the lowest reading since March 2021. Goods inflation was 1.3 percent lower this year compared to a year ago. However, services prices were an elevated 4.7 percent in September relative to last year at this time.

Figure 2. Total CPI inflation continued to cool

Sources: Bureau of Labor Statistics, Bureau of Economic Analysis, and The Conference Board.

Figure 3. Energy price deflation lowering overall prices

Sources: Bureau of Labor Statistics and The Conference Board.

Services Keeping Core Inflation Sticky

Core CPI, or total prices less food and energy, rose by 0.3 percentage point for a second consecutive month. This caused the year-over-year rate to increase from 3.2 percent to 3.3 percent. It appears that while overall inflation continues to slow as prices for energy and select durable goods like furniture and autos fall, services inflation is more stubborn. This reflects a sluggish retreat in shelter costs which had been largely tracking previous declines in rents and home prices but have stalled in recent months. Additionally, housing insurance costs are increasing due to more frequent and expensive natural disasters in the US.

Figure 4. Services keeping core inflation sticky

Sources: Bureau of Labor Statistic, and The Conference Board.

Fed challenged by structural changes

Persistent stickiness in several subcomponents of consumer price inflation reflect structural changes in the economy that may be here to stay. In the CPI, costs for health care services and health insurance continue to levitate and transportation services costs including motor vehicle fees, car insurance, and airfares remain elevated or are rapidly rising. Higher costs for many services reflect ongoing labor shortages as Baby Boomers retire in industries requiring in-person work. This is more apparent in the PCE inflation data. Health care and health insurance costs are higher likely due to aging of the US population and labor shortages. The costs of owning a vehicle are rising probably because cars are becoming more high-tech and thus, more expensive to maintain, repair, and replace. These dynamics are also evident in PCE inflation. These factors are resisting the Fed’s efforts to drive inflation back to the 2-percent target more quickly.

Figure 5. Shelter costs not cooling as fast as expected

Sources: S&P Global, Bureau of Labor Statistics, Bureau of Economic Analysis, and The Conference Board.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global E…

0 Comment Comment Policy