Q3 Retail Sales Tracking Positively Despite August Setback

17 Sep. 2024 | Comments (0)

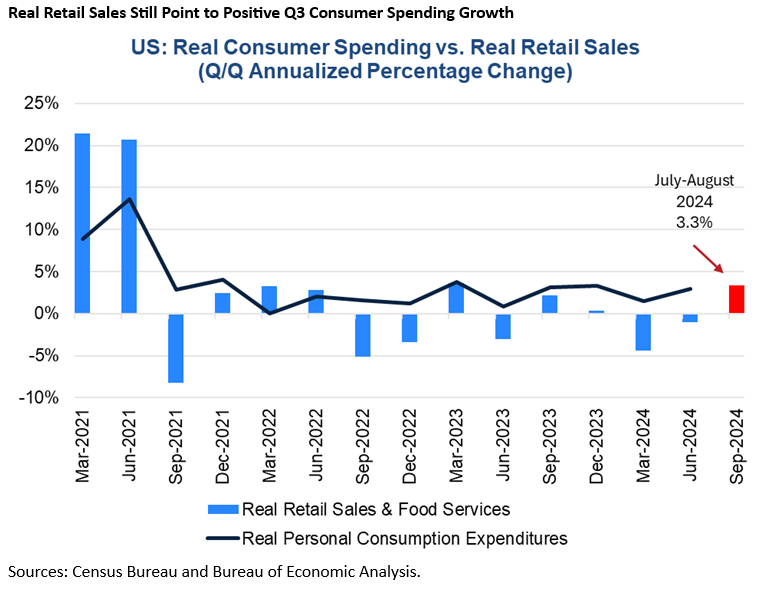

Nominal retail sales ticked up by just 0.1 percent in August and sales edged down by 0.1 percent in real terms. Despite the August setback, real retail sales over the July-August span were still 3.3 percent annualized above Q2, suggesting that Q3 consumer spending growth will still be positive even if consumption momentum slowed over the course of the quarter. We project real GDP will grow by 0.8 percent annualized in Q3.

Trusted Insights for What’s Ahead®

- Weak nominal and real retail sales in August may have reflected a pullback in spending after July’s splurge, but also concerns about recession in the aftermath of the August equity market meltdown and increasing worries about the labor market.

- Indeed, The Conference Board Consumer Confidence Survey revealed an increase in the number of write-ins from consumers saying the stock market and unemployment were having a major impact on the economy. Consumers were also less upbeat about expectations for the stock market and job prospects going forward.

- However, Q3 real consumer spending is still likely to be positive, thanks to outsized consumption in July.

- Ahead of Wednesday’s September FOMC meeting, today’s retail sales data will not alter the Fed’s decision about the path of monetary policy rates, which is a reduction in restrictiveness.

- We also do not anticipate that the Fed will cut interest rates by more than 25 basis points at the September meeting as inflation is moving in the right direction, the labor market is roughly balanced between supply and demand, and tracking data suggest the US likely is not in recession currently.

- We reiterate that interest rate cuts exceeding 25 basis points would signal material concern about the economy that might spook both Wall Street and Main Street.

Report Highlights

Nominal retail sales rose by just 0.1 percent month-over-month in August following an outsized and upwardly revised 1.1 percent increase in July.

Solid sales at healthcare and personal care, sporting goods, miscellaneous, and nonstore retail outfits were mostly offset by declines in sales at motor vehicle, furniture, building material, food and beverage, gasoline, clothing, and general merchandise stores, and at restaurants and bars.

Nominal sales excluding motor vehicles and parts dealers also rose by 0.1 percent month-over-month in August. Retail control, defined as total sales excluding auto, building supply, gas station, and food services store sales rose by 0.3 percent month-over-month in nominal terms.

After accounting for inflation, real retail sales dipped by 0.1 percent month-over-month in August. Still over the July-August span, real retail sales were 3.3 percent annualized above Q2 real sales, which decline by 1 percent annualized.

The pullback in August retail sales notwithstanding, the surge in July spending on goods, bars, and restaurants still points to a healthy gain in real consumer spending in the third quarter. However, if September sales are also weak or down, that development would provide negative momentum for spending heading into Q4.

We project that real consumer spending will increase by 2.0 percent annualized in Q3 2024 but decelerate to 1.6 percent annualized in Q4 2024. Overall real GDP may expand by 0.8 percent annualized in Q3 and 1.0 percent annualized in Q4 (see US Economic Forecast).

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global …

0 Comment Comment Policy