Strong January retail sales growth won’t last

15 Feb. 2023 | Comments (0)

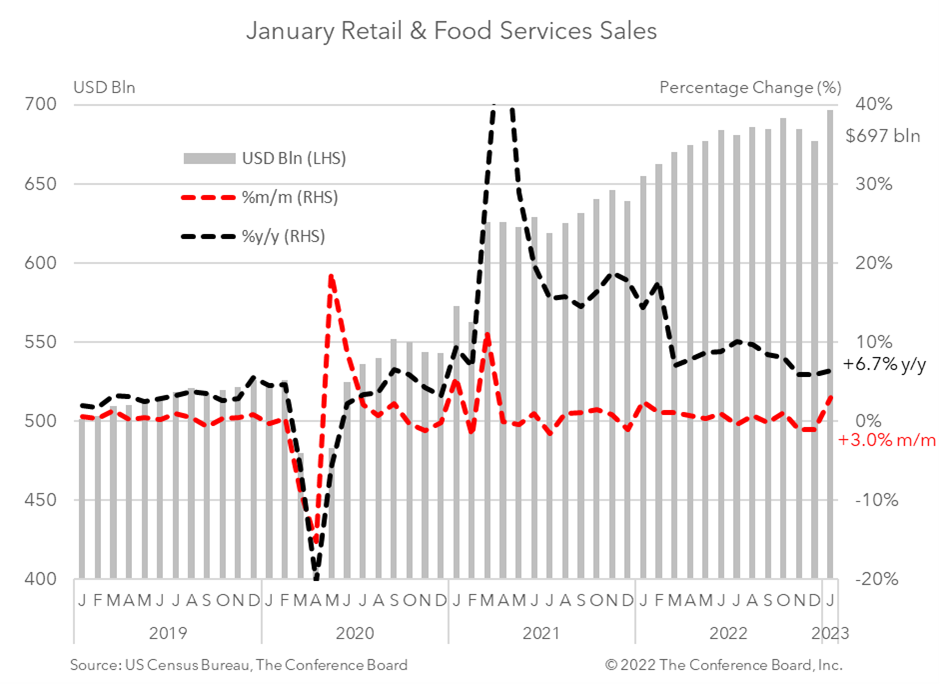

Retail sales spiked in January, starting the year on an unexpectedly strong note. Sales rose 3.0 percent month-over-month and were up 6.7 percent from a year earlier in nominal terms. Even after adjusting for inflation, retail sales growth rose by 2.4 percent month-over-month – the largest uptick since March 2021. Unseasonably warm weather helped drive spending activity for the month and likely front-loaded demand for the quarter. As this distortion fades in February and March, consumption activity should dip back into contractionary territory. We maintain that the US economy will slip into recession in early 2023.

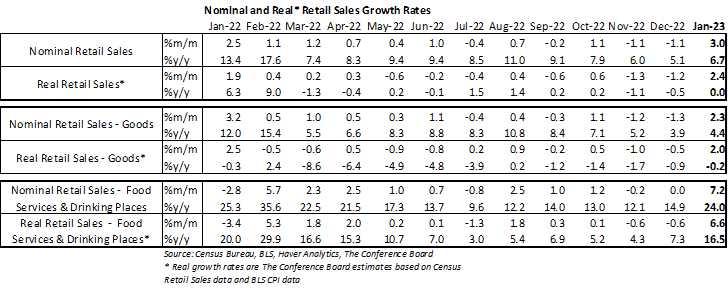

Consumer demand for goods jumped in January — rising by 2.3 percent from the previous month in nominal terms. Spending on motor vehicles and parts surged by 5.9 percent in January from December, while retail sales excluding motor vehicles and parts rose by 2.3 percent. Spending at gasoline stations was flat from the month prior. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose by 1.7 percent from the previous month. Sales at department stores spiked by an incredible 17.5 percent for the month while sales at non-store retailers rose 1.3 percent. When adjusting goods spending for CPI inflation, the real growth rate was about 2.0 percent from the previous month.*

Meanwhile, spending at food services and drinking places rose 7.2 percent month-over-month, vs. 0.0 percent in December. However, after adjusting for CPI inflation the real growth rate was about 6.6 percent from the previous month.*

* Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data

-

About the Author:Erik Lundh

Erik Lundh is Senior Economist, Global at The Conference Board. Based in New York, he is responsible for much of the organization’s work on the US economy. He also works on topics impacting…

0 Comment Comment Policy