-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

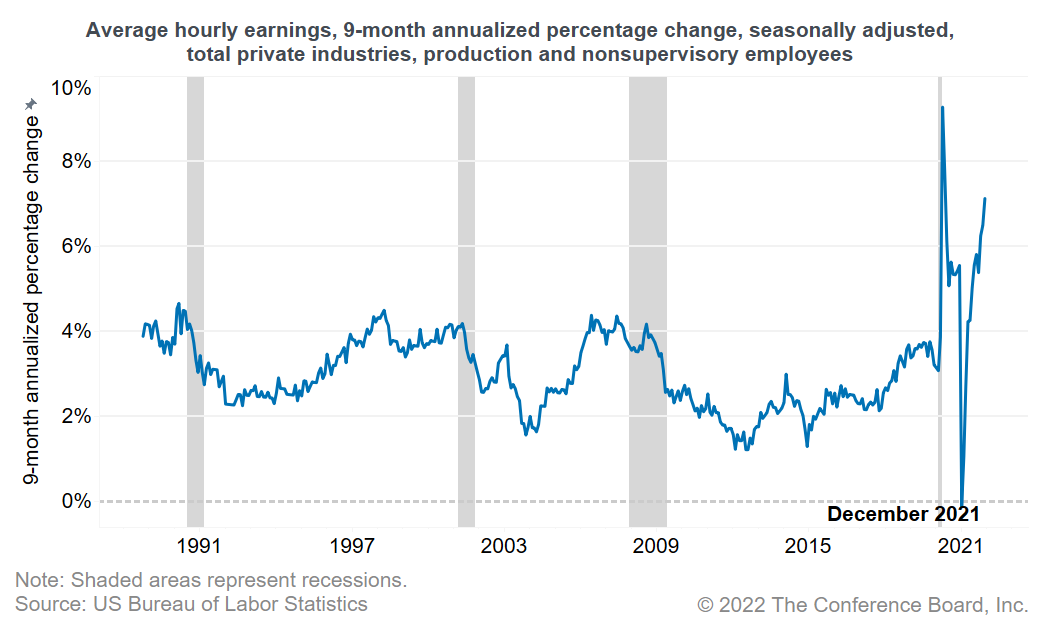

Commentary on December US Bureau of Labor Statistics Employment Situation Report Employment growth remained modest in today’s jobs report, reflecting the ongoing toll of the pandemic on in-person services. As of December, there are no signs that severe labor shortages in the US are easing. Nonfarm payroll employment increased by 199,000 in December, after gains of 249,000 (upwardly revised) in November and 648,000 in October. Job growth in in-person services—including restaurants, hotels, and retail—remains depressed by the rapid spread of the pandemic. The number of jobs in the US economy is still 3.6 million below its pre-pandemic level. Nevertheless, December saw the unemployment rate decline further—from 4.2 to 3.9 percent. In June 2021, six months ago, the unemployment rate was two full percentage points higher, at 5.9 percent. In the preceding six months (December 2020–June 2021), the unemployment rate declined by just 0.8 ppts, despite similar job growth during these two six-month periods. The large drop in the unemployment rate in the past six months reflects a higher proportion of unemployed people landing a job, which may be related to the expiration of the enhanced unemployment benefits. Rapid wage inflation in December suggests that the US labor market is still experiencing severe labor shortages. In the past nine months, average hourly earnings for production and nonsupervisory employees increased by over 7 percent (annual rate). For comparison, in no other nine-month period in the 35 years prior to the pandemic did this measure exceed 5 percent. Such strong wage growth is putting upward pressure on inflation. At 61.9 percent, labor force participation remains low compared with the pre-pandemic rate of 63.4 percent. But it is gradually improving, especially among women. Some people are delaying a return to the labor market because they still fear the virus. In addition, older Americans' labor participation rate declined significantly during the pandemic—and there are no signs of it recovering. In the near term, the exponential spread of the Omicron variant is likely to temporarily lower the supply of labor, as many workers will be sick or quarantined. Employers may resort to temporary help agencies to fill the gaps. By March or April, we expect strong job growth to resume. Employment in many of the in-person services industries are still well below pre-pandemic levels and are likely to grow rapidly in 2022. The US unemployment rate may well reach 3 percent this year, marking a 70-year low. Severe labor shortages will continue. While today’s payroll gains missed market expectations, the continued improvement in jobs data more generally suggests that the US economy has either achieved or is close to full employment. Against this backdrop, the Fed is likely to continue its plans to accelerate quantitative-easing taper and implement at least three 25–basis point interest rate hikes this year.

February Jobs Report Hints at Growing Uncertainty

March 07, 2025

Stability Underneath January’s Noisy Jobs Report

February 07, 2025

Q4 ECI Wage Deceleration Slows

February 07, 2025

Robust Job Gains Close 2024

January 10, 2025

November Job Gains Rebound from Disruptions

December 06, 2024

Storms and Strikes Muddy October Jobs Report

November 01, 2024