Members of The Conference Board get exclusive access to the full range of products and services that deliver Trusted Insights for What's Ahead ® including webcasts, publications, data and analysis, plus discounts to conferences and events.

30 November 2023 / Quick Take

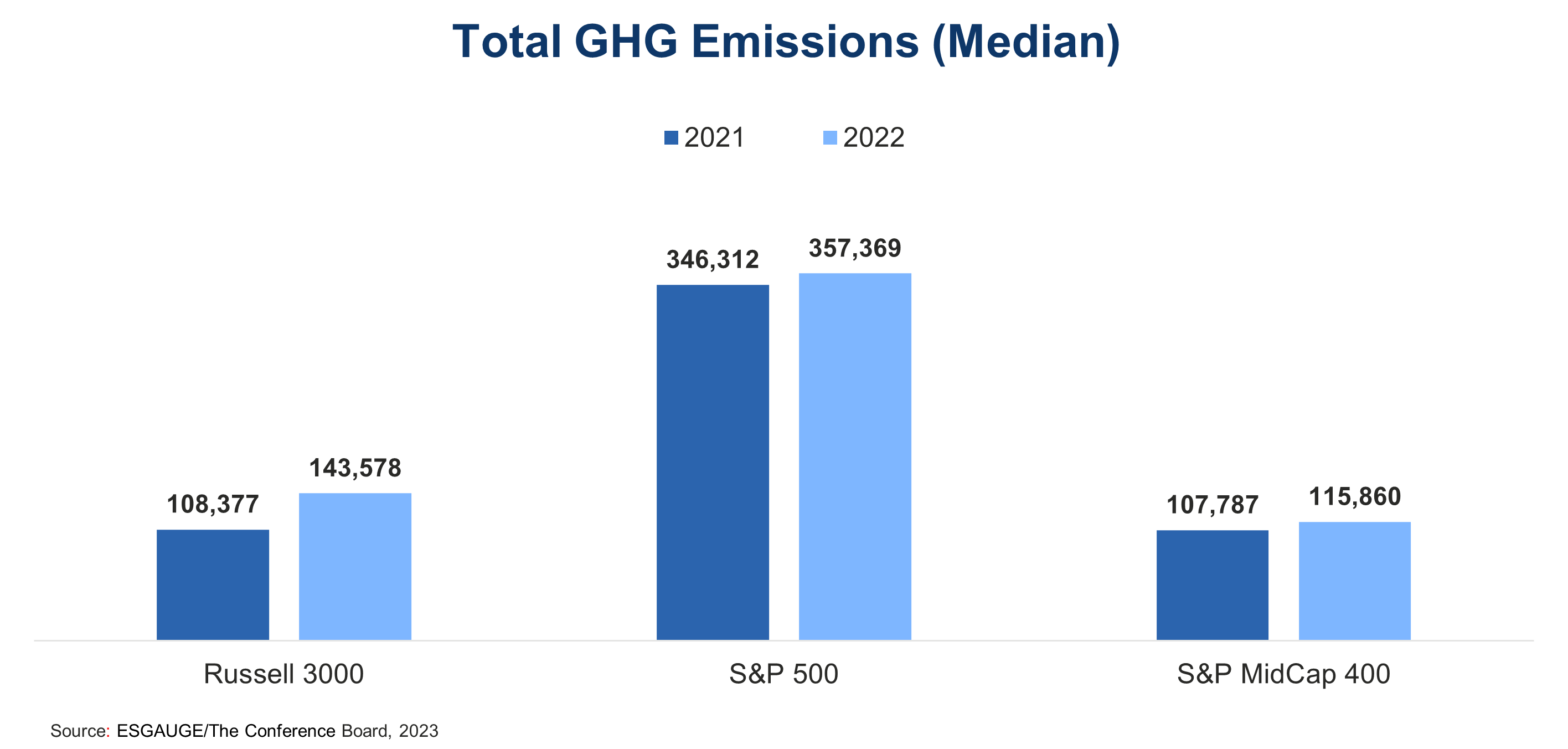

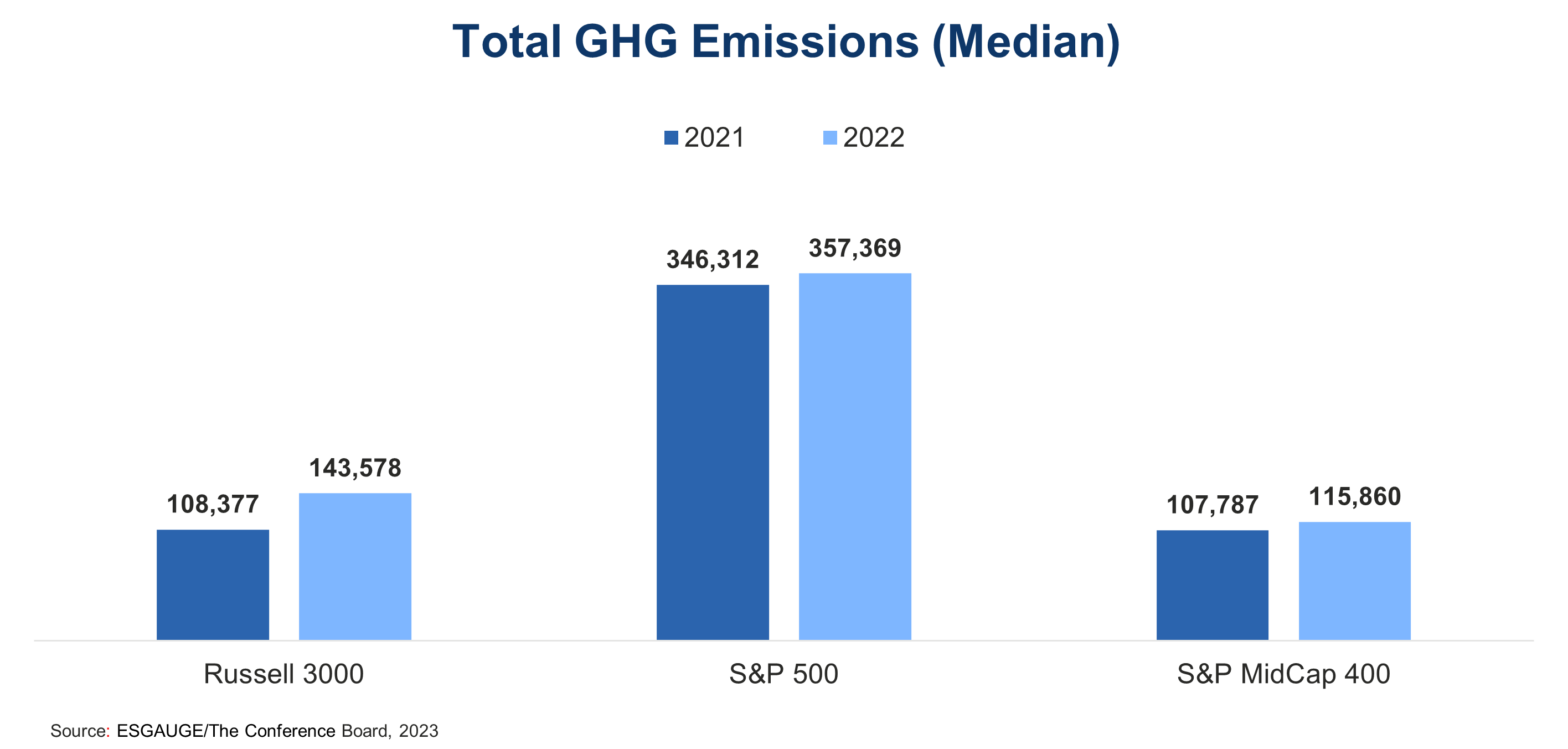

In 2022, S&P 500 companies’ greenhouse gas (GHG) emissions increased by only 3%, a significant contrast to the 32% increase seen in Russell 3000 companies. This indicates that larger companies are more effectively addressing a key element of climate change.

The next frontier for GHG reductions will be Scope 3 emissions, the GHG emissions that occur indirectly due to a company's activities but are beyond their direct control, such as emissions originating from their supply chain. All the major emerging regulatory disclosure regimes focus on Scope 3 emissions—albeit in different ways. These frameworks include the European Union’s Corporate Sustainability Reporting Directive (CSRD), the accompanying European Sustainability Reporting Standards, the California's Climate Corporate Data Accountability Act, and the US Security and Exchange Commission (SEC) Proposed Rules on Climate-Related Disclosures.

Currently, 74% of the S&P 500 and 43% of the Russell 3000 disclose Scope 3 emissions. Given the increased scrutiny that will accompany increased disclosure, companies should consider how to combine conversations with upstream suppliers and downstream customers about 1) the level of Scope 3 emissions and 2) ways to incentivize suppliers and customers to decarbonize.

For more information on climate reporting, see Large US Firms Make Meaningful Progress on GHG Emissions. And for more data on environmental and other ESG disclosures, please visit our Live Dashboards on ESG Advantage, powered by ESGAUGE.

In 2022, S&P 500 companies’ greenhouse gas (GHG) emissions increased by only 3%, a significant contrast to the 32% increase seen in Russell 3000 companies. This indicates that larger companies are more effectively addressing a key element of climate change.

The next frontier for GHG reductions will be Scope 3 emissions, the GHG emissions that occur indirectly due to a company's activities but are beyond their direct control, such as emissions originating from their supply chain. All the major emerging regulatory disclosure regimes focus on Scope 3 emissions—albeit in different ways. These frameworks include the European Union’s Corporate Sustainability Reporting Directive (CSRD), the accompanying European Sustainability Reporting Standards, the California's Climate Corporate Data Accountability Act, and the US Security and Exchange Commission (SEC) Proposed Rules on Climate-Related Disclosures.

Currently, 74% of the S&P 500 and 43% of the Russell 3000 disclose Scope 3 emissions. Given the increased scrutiny that will accompany increased disclosure, companies should consider how to combine conversations with upstream suppliers and downstream customers about 1) the level of Scope 3 emissions and 2) ways to incentivize suppliers and customers to decarbonize.

For more information on climate reporting, see Large US Firms Make Meaningful Progress on GHG Emissions. And for more data on environmental and other ESG disclosures, please visit our Live Dashboards on ESG Advantage, powered by ESGAUGE.

Former Senior Researcher, Governance & Sustainabil…

The Conference Board

You already have an account with The Conference Board.

Please try to login in with your email or click here if you have forgotten your password.