April 14, 2020 | Chart

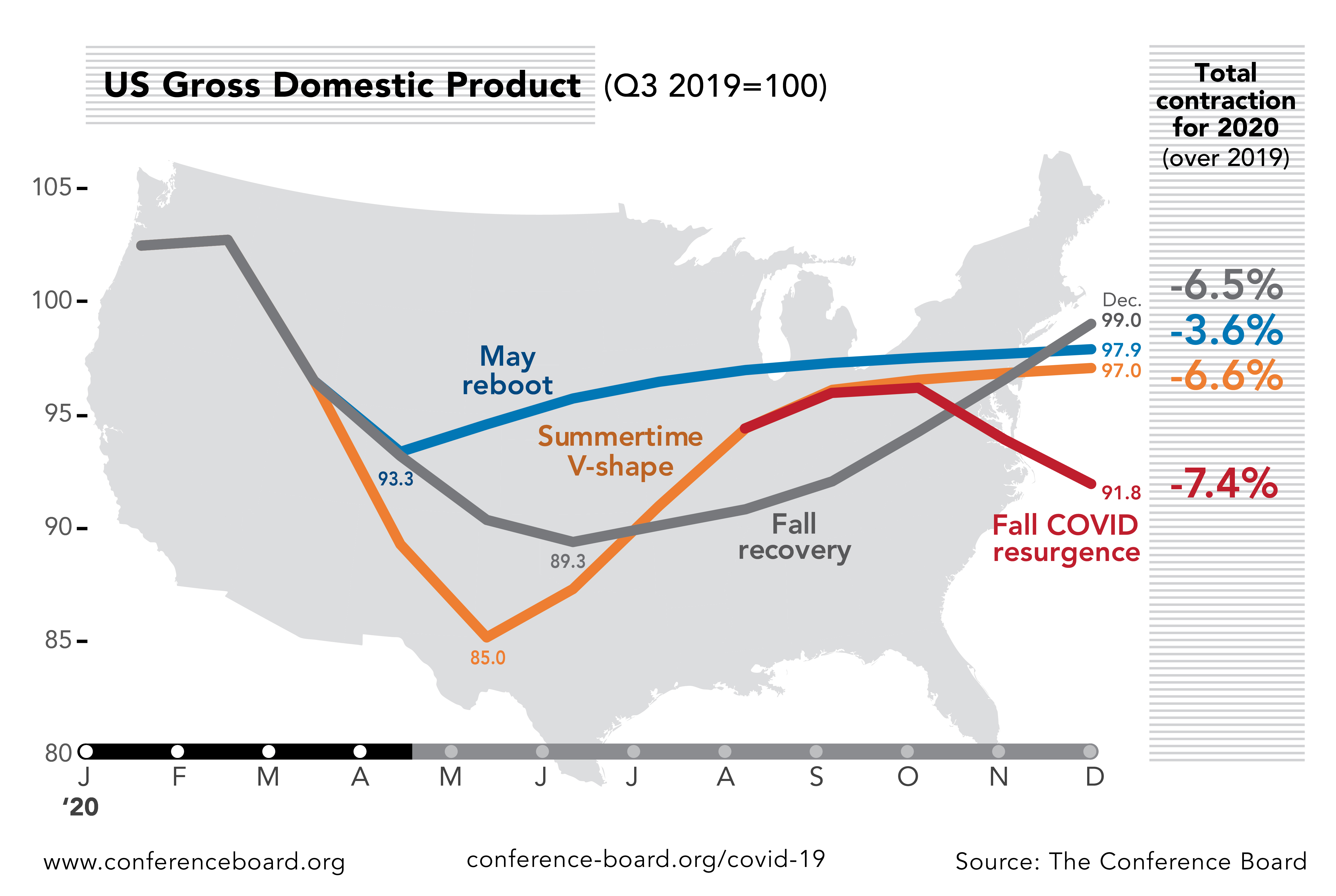

The trajectory of COVID-19 and the economic response over the next few months are uncertain. To help businesses navigate this volatile period, The Conference Board has developed and updated four scenarios for the US economy for the remainder of 2020:

May reboot (quick recovery): New COVID-19 cases for the US peak by mid-April. Economic activity may gradually recover in May, beginning with the most impacted sectors, such as restaurants and travel. Even in this optimistic scenario, annual GDP growth contracts by 3.6 percent.

Summertime V-shape (deeper contraction, bigger recovery): New COVID-19 cases peak in early May, creating a deep economic contraction in Q2, especially for consumption. While we may see a strong recovery in Q3, annual GDP growth will still contract by as much as 6.6 percent.

Fall recovery (extended contraction, U-shaped recovery): Government policies, such as social distancing, help to “flatten the curve” but extend economic weakness to Q3. The recovery will be slower but more controlled than in the “Summer V-shape” scenario, giving businesses more time to prepare for the recovery. GDP contracts by 6.5 percent.

Fall COVID-19 resurgence (economy contracts again in Q4, a W-shaped recovery): Attempts to keep new COVID-19 cases under control in the fall fail, requiring the reimplementation of stringent measures in October. The economy would begin to contract again in Q4, following a recovery in Q3. Annual GDP growth contracts to 7.4 percent—substantially more than in all other scenarios.

Access a full description of the scenarios here.

July 27, 2022 | Newsletters & Alerts

May 11, 2022 | Newsletters & Alerts