May 02, 2022 | Chart

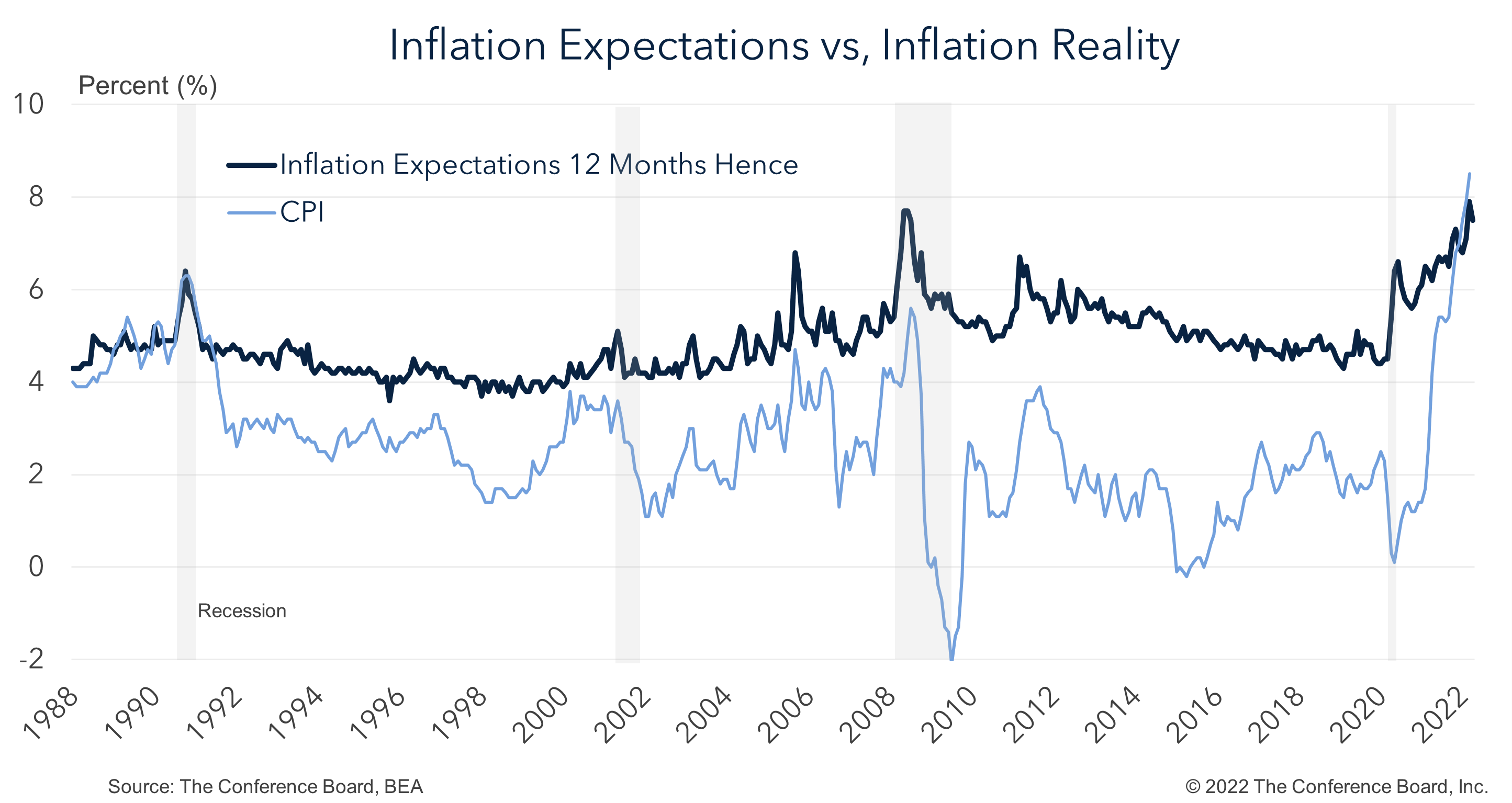

According to the April Conference Board Consumer Confidence Survey®, US inflation expectations remain extremely elevated. While the most recent reading of 7.5 percent is down slightly from March’s all-time-high of 7.9 percent, US consumers continue to expect the current wave of inflation to continue into 2023.

In 2020 and 2021, the COVID-19 pandemic brought with it disruptions to global supply chains, elevated demand for durable goods, and other factors that drove inflation higher. Those forces began to moderate towards the beginning of 2022 – leading to a decline in inflation expectations. However, Russia’s invasion of Ukraine in February 2022 yielded a surge in energy and food prices that may keep inflation rates high even if pandemic-induced drivers moderate. While The Conference Board expects consumer inflation rates to peak in Q2 2022 and then gradually slow, our forecast calls for inflation rates well-above the Federal Reserve’s 2 percent target through the end of 2023.

For more information about inflation expectations and US Consumer Confidence more broadly, please visit our website.