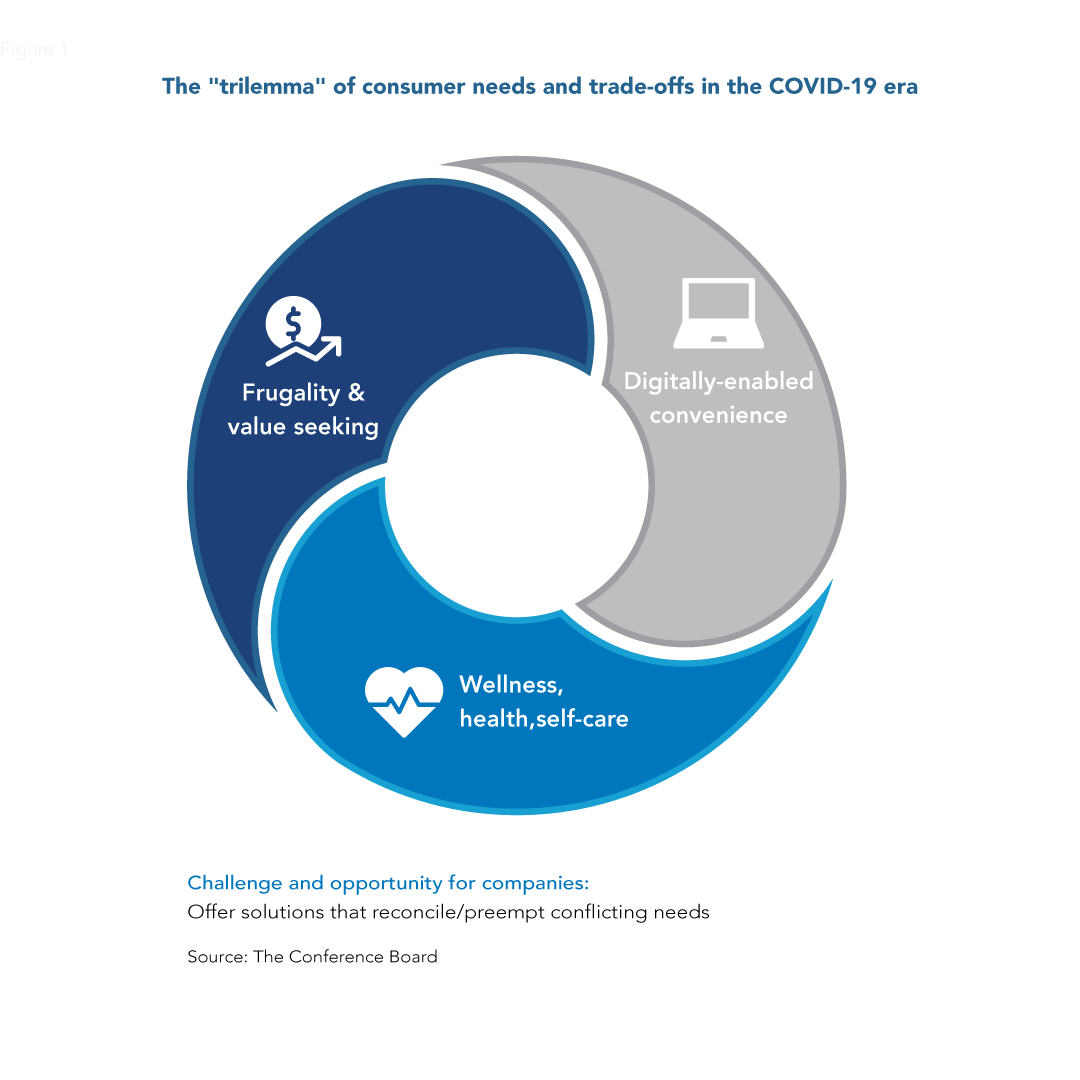

The challenge and opportunity for companies is to innovate and find novel solutions that address people’s needs, ideally more than one at a time, while preempting conflicts for consumers.

Some needs, preferences, and behaviors may conflict. For example, online shopping (digital convenience) may be more expensive due to delivery costs and create a conflict with frugality. The challenge and opportunity for companies is to innovate and find novel solutions that address people’s needs, ideally more than one at a time, while preempting conflicts for consumers.

Increasingly digitalized lifestyles are setting higher expectations for convenience

Over the course of the pandemic, consumers have become accustomed to the convenience that digital capabilities afford: “anytime-anywhere” access and useful tools such as filtering, customer reviews, and inventory information, which improve the buying experience and save time and effort. Consumers learn processes with one business and expect an equally good experience in other contexts. The demand for digital capabilities at all stages of the customer journey may only grow—in both consumer industries and

B-to-B—and may even affect demand for convenience in offline touchpoints. Hence, one of the biggest legacies of COVID-19 may be companies’ further advancement of digitalization and omnichannel operations as a result of enhanced consumer expectations.

Omnichannel integration promises biggest benefits. Omnichannel combines the best of the online and offline worlds: the convenience, efficiency, and wealth of information of online touchpoints and the physical, face-to-face interaction, brand immersion, touching and trying on, and pick-up/return capabilities of offline touchpoints. The greatest opportunity for companies is to take a holistic view—ideally from the outset rather than retrofitting operations—and integrate online and offline capabilities and touchpoints for an optimized customer experience. Such channel integration has financial benefits for businesses, including higher customer retention rates and greater customer life-time values. Mobile phones as ubiquitous devices within reach at all times will play an integral part in further advancing omnichannel operations.

Offline touchpoints will remain essential. Offline touchpoints and in-person interactions play an immensely important role as a complement to online ones: for discovery; try-on, taste, smell, and touch-and-feel experiences; brand immersion; advice by store associates; social interaction; community events; as well as for the pick-up and return of online orders. If anything, the collapse of revenue for many businesses due to the closure of brick-and- mortar stores and other offline service points (including those with online capabilities) has demonstrated that physical locations are essential. Still, businesses may have to redefine the functions and features of physical locations to complement online channels.

Overall costs of online sales may rise. Factors that are increasing costs include: last-mile fulfillment; assembly and delivery fees; labor-intensive “order online, pick up in store” models; and customer acquisition. Pick-up models, which are essentially personal shopper operations, generate additional work and labor cost for stores. As a result, online purchases—and labor-intensive pick-up orders (such as in grocery)—may become more expensive in the future, potentially more so than offline ones.

Greater frugality and value seeking may endure beyond the pandemic

Unemployment directly caused by COVID-19 as well as ongoing economic uncertainty may make many people cautious about spending. The frugality fostered by COVID-19 may last beyond the full reopening of businesses because jobs may only be restored slowly over time, while fiscal support by the government will eventually end. Even then, reopened hospitality and entertainment categories will compete with consumers’ new spending patterns (e.g., streaming services, online ordering) formed during the pandemic, which could reinforce frugality.

New consumer patterns may boost inexpensive, value-priced products, services, brands, and retailers. Private labels, those brands exclusive to a retailer, may grow at the expense of national brands, and some of this switching may last. Companies may try to support their business through promotions in discretionary categories. These should be designed to incentivize desirable shopper behaviors (e.g., loyalty, basket size, new customer acquisition) and include add-ons rather than lower prices that cut margins. It’s also an opportunity for businesses in rentals and other “sharing economy” industries. Suppliers of affordable meal options, including food trucks and grocers selling ingredients for home-cooked or semiprepared meals may also get a boost. In fact, any novel offerings and business models that provide value at a good price would be well positioned.

Enhanced focus on health, personal well-being, and self-care

The COVID-19 health threat and heightened stress caused by the pandemic have reinforced many people’s interest in healthy living. Self-care has shifted to true well-being as opposed to pursuit of healthy lifestyles for self-expression as a kind of status symbol, a prepandemic trend among certain consumer segments. Apart from healthy behaviors, the pandemic’s challenges have fostered behaviors for stress relief and reward such as the consumption of comfort food and alcohol. Overindulgence itself can become a health issue, creating new wellness needs. Either type of coping behavior—renewed emphasis on wellness or addressing the impact of overindulgence—has made health an even more important consumer topic, creating business opportunities now and in the future. The interest in and need for self-care will benefit goods and services focused on exercise, diet, beauty, and mental healthcare, among others—all offering opportunities for innovation.

Marketing and innovation strategies for consumer needs in the COVID-19 era and beyond

The challenge and opportunity for companies is to find novel solutions that address the emerging consumer needs while preempting conflicts and trade-offs for consumers. For example, telehealth and walk-in clinics offer care at more affordable prices. To prepare for the future when effective COVID-19 treatments and/or vaccines are available, companies should start thinking about how consumer needs may shift in the postpandemic era and how their offering should evolve as a result.