August 15, 2022 | Article

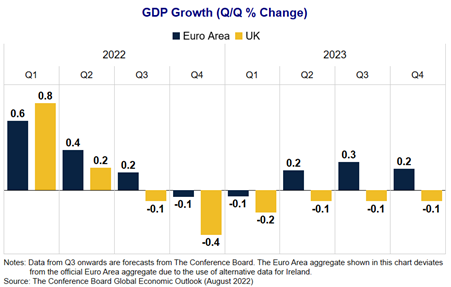

Better-than-expected Euro Area growth in the first half of this year warranted an upgrade to the 2022 European forecast. However, war, inflation, central bank tightening, and flagging confidence point to a recession in Europe ahead that will dampen growth in 2023.

Output growth in the Euro Area defied slowdown fears in the first half of 2022. Particularly, Italy and Spain beat expectations as they benefited from a resurgence in tourism, while high exports brought France back into positive growth territory. As for Germany, although the economy stagnated in Q2, a significant upward revision to Q1 helped it to at least maintain a lukewarm growth outlook in H1 2022.

Despite the strong first half of the year, recent indicators suggest the Euro Area has entered Q3 on very weak footing. Purchasing manager surveys descended into contractionary territory for the first time in well over a year, inflationary pressures persist, consumer confidence plummeted to new lows, and geopolitical tensions worsened. More recently, the European Central Bank’s announcement to raise interest rates might slow activity further.

Looking forward, upward revisions to Q1 and higher-than-expected Q2 figures prompted us to raise our 2022 GDP growth forecasts for the Euro Area. But as headwinds may intensify over the coming months, we lowered our 2023 GDP growth estimates, assuming now a technical, mild recession will happen later this year, especially if the energy crunch from significantly reduced natural gas supplies from Russia tightens. For the UK, tighter monetary policy and higher inflationary pressures, coupled with Brexit-fueled labor shortages and investment disruptions, all point to an economy that is likely to fall into a more severe and long-lasting recession.

For more analysis, see our Economy Watch Europe report.