-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

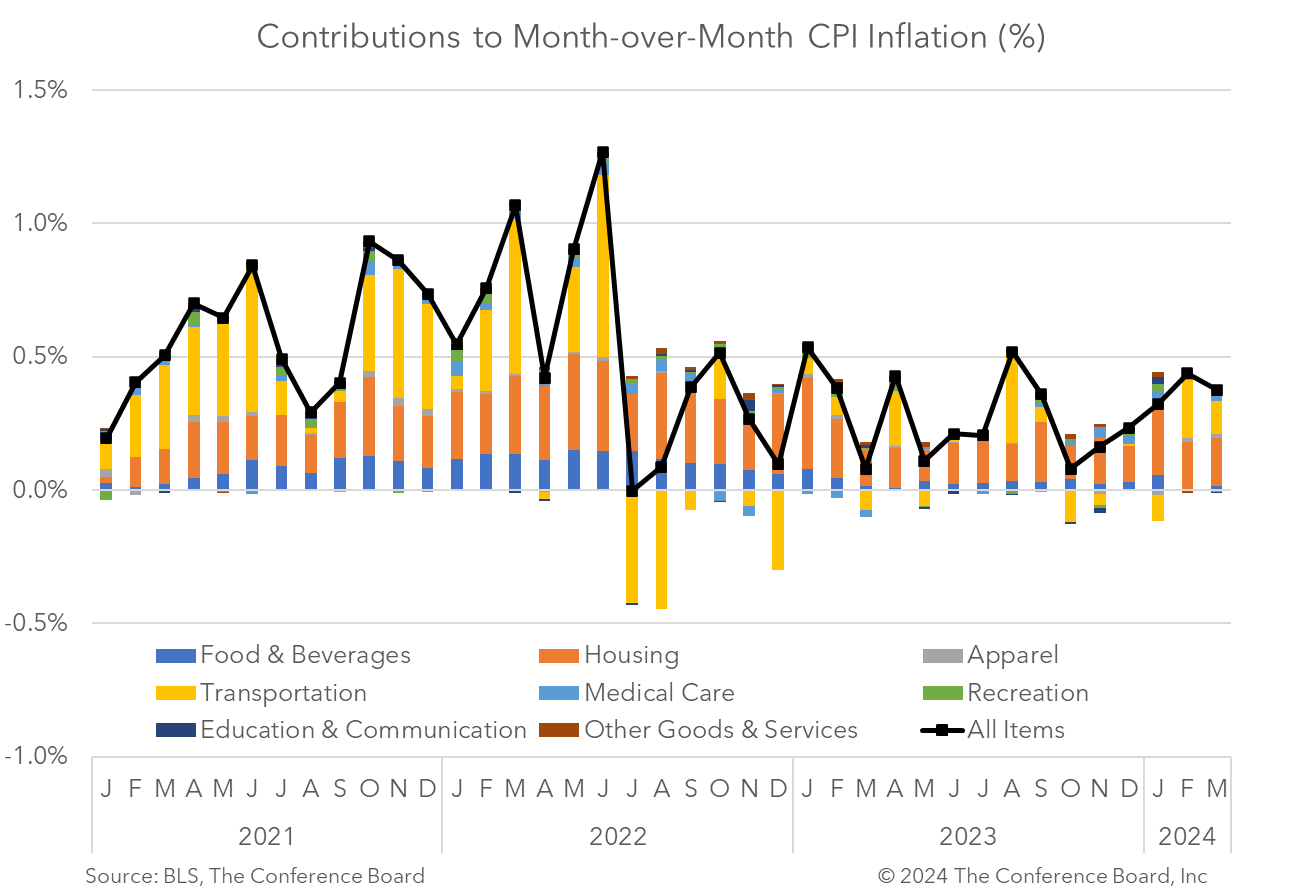

The March Consumer Price Index (CPI) showed that inflation rose by 3.5% in March from a year earlier, vs. 3.2% in February and 6.4% at the beginning of 2023. Meanwhile, core CPI, which excludes volatile food and energy prices, rose by 3.8% in March from a year earlier, vs. 3.8% y/y in February and 5.5% y/y at the beginning of 2023. Following hotter-than-expected January and February CPI data, these March numbers continued to show stubbornness. While the headline CPI did cool slightly in month-on-month terms (from 0.44% to 0.38%) base effects in 2023 drove the year-on-year reading 0.3 percentage points higher. Goods inflation ticked down for the month, but services inflation continues to be problematic. Shelter prices, including both rent and Owners Equivalent Rent (OER) are continuing to cool in year-on-year terms, but month-on-month increases have yet to converge toward their pre-pandemic norms. Meanwhile, prices for insurance continued to rise – especially motor vehicle insurance. Today’s data provide a preview of the PCE deflator—the Fed’s preferred measure for guiding policy—later this month. Given what the CPI signals for the PCE deflator and Fed Chair Powell’s previous statements, the Federal Reserve will likely hold rates steady at the conclusion of the May 1st FOMC meeting. While we continue to expect the Fed to cut rates in June, more progress on inflation will need to occur between now and then. If it doesn’t, the Fed may have to postpone cuts until later this year. Headline CPI rose by 0.38% m/m and 3.5% y/y, vs. February’s 0.44% m/m and 3.3% y/y. Month-on-month shelter and gasoline price increases accounted for more than half of the all items increases, according to the Bureau of Labor Statistics (BLS). Gasoline prices rose 1.7% from the month prior. Within the shelter category, rent prices rose 0.4% m/m, vs. 0.5% in February, but Owner Equivalent Rent (OER) price increases remained steady at 0.4% m/m. However, in year-on-year terms inflation for both of these shelter types continued to cool. Food prices rose 0.1% m/m. Core CPI rose by 0.36% m/m and 3.8% y/y, vs. February’s 0.36% m/m and 3.8% y/y. According to the BLS, the core CPI was driven by shelter, but insurance prices were also a major contributor. Insurance prices continued to rise for the month, with motor vehicle insurance prices rising 2.6% from the month prior. Other indexes that rose for the month were personal care, education, and household furnishings and operations.

DATA DETAILS

Administration acts with Congress to reverse methane fee

March 25, 2025

Fed Keeps Cutting Bias amid “Transitory” Tariff Inflation

March 19, 2025

Retail Sales Show Consumers Are More Frugal amid Uncertainty

March 17, 2025

The EU's Retaliatory Tariffs Will Hit Beef, Bourbon and More

March 14, 2025

February CPI Offers Some Reprieve

March 12, 2025

Replacing EB-5 Visas with “Gold Cards”: Impact on CRE Market

March 07, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024