August 15, 2022 | Article

Despite weakening growth prospects across multiple economies, the global economy is currently not in recession. Jobs in many economies are plentiful, and business and household balance sheets are generally in good shape. Global trade and industrial production through May were still expanding well above average growth rates seen over the previous decade. And despite quarterly GDP contractions in China and the US, GDP reports elsewhere continue to beat expectations.

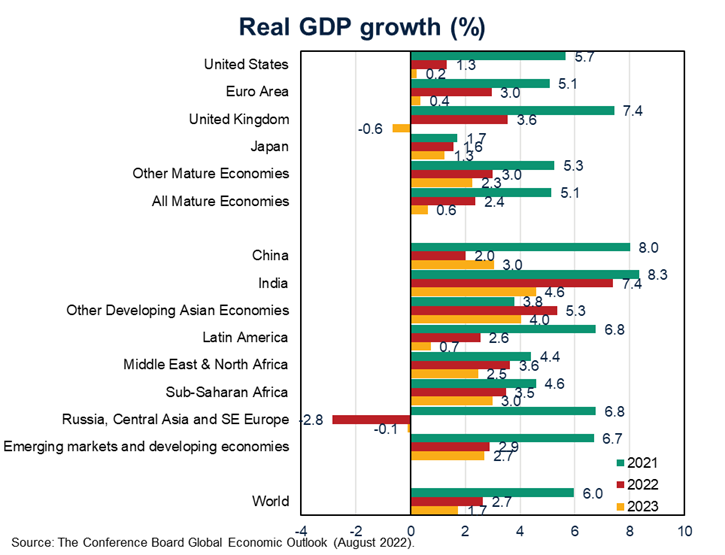

However, headwinds to global growth are expected to increase in coming quarters. Global leading indicators point to weakening momentum, and global purchasing manager indexes are sliding and nearing contractionary territory. Indeed, The Conference Board now expects mild recessions to occur in the US and Europe later in 2022 and into early 2023. China may escape recession but will at best experience only a modest recovery as it is rebounding from lockdowns earlier in the year. Our forecast for global GDP is for 2.7 percent growth in 2022 and 1.7 percent in 2023.

Notwithstanding two consecutive quarters of negative GDP growth, we do not believe the US economy is currently in recession given strength across a number of sectors and the extremely tight labor market. However, we do expect that a broad downturn is on its way. This outlook is associated with persistent inflation and rising hawkishness by the Federal Reserve. We forecast that 2022 real GDP growth will come in at 1.3 percent year-over-year and that 2023 growth will slow to 0.2 percent year-over-year. These are downgrades from our July forecast expectations.

Given stronger-than-expected Q2 data and upward revisions to Q1, forecasts for the full year 2022 are revised upward for the Euro Area. But as headwinds are intensifying, we lowered our 2023 GDP growth estimates, assuming a technical recession is likely to occur later this year. Business and consumer sentiment has turned sour relatively quickly, and our leading indicators for the UK and Germany are currently signaling recessions ahead. Despite mitigation plans at the country and EU level to account for reduced natural gas imports from Russia, the region is unlikely to avoid rationing over the winter months, which will limit economic activity. Inflationary pressures are not abating, forcing central banks in the region to tighten more quickly, cooling economic activity further. Our GDP forecast for the Euro Area for 2022 is 3.3 percent and 0.3 percent for 2023.

The full-year 2022 GDP growth projection for China was downgraded by 0.3 percentage points to account for a weaker-than-expected services recovery in the second half of the year. The change partly reflects renewed surges in COVID-19 infections over July and August that are dampening consumption. Still, another monthlong full-city lockdown, which occurred in Shanghai in the second quarter, is not our base case. Our annual growth forecast for official Chinese GDP for 2022 is currently at 3.7 percent, while our 2023 forecast is unchanged at 5.3 percent.

Weakening demand and faster policy tightening in the US and Europe are negatively affecting other major emerging economies, but there are important differences among them. Russia has likely entered recessionary territory, and Turkey and Brazil are expected to experience severe weakening in growth over the second half of the year. However, economic prospects for India, as well as other developing Asia, and economies in the Gulf Region are relative bright spots in an otherwise somber outlook.

For more analysis, please see our monthly updated Global Economic Outlook page.