While a US recession appears imminent, five factors suggest that it may not be accompanied by a large increase in the unemployment rate. Labor shortages may ease over the coming year but are unlikely to disappear.

Insights for What’s Ahead

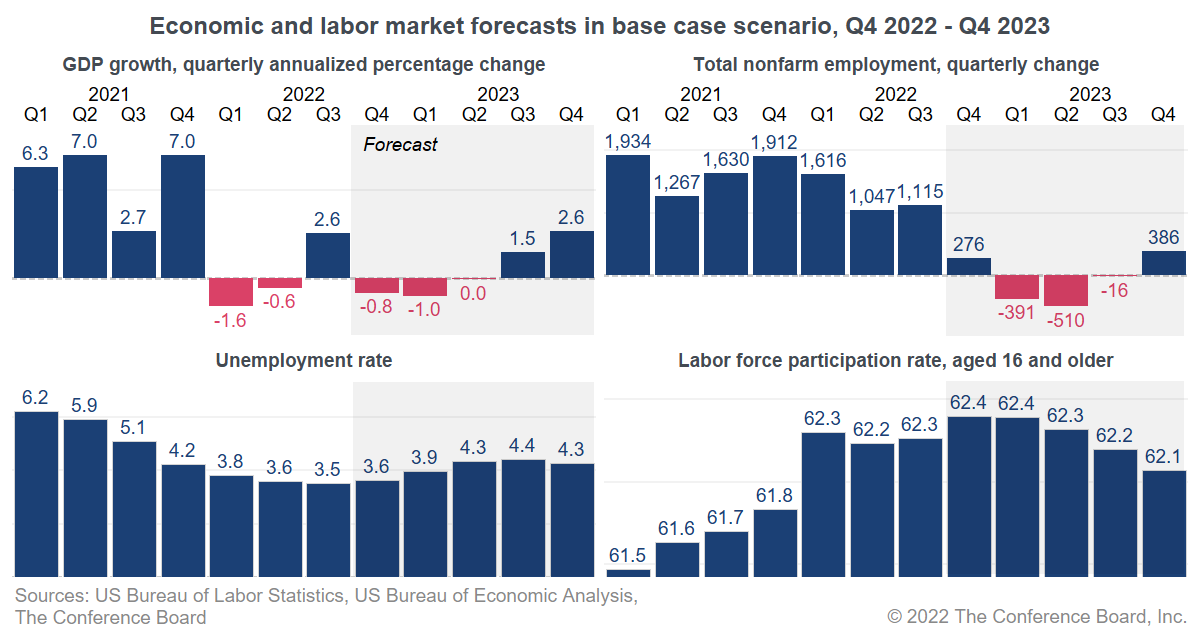

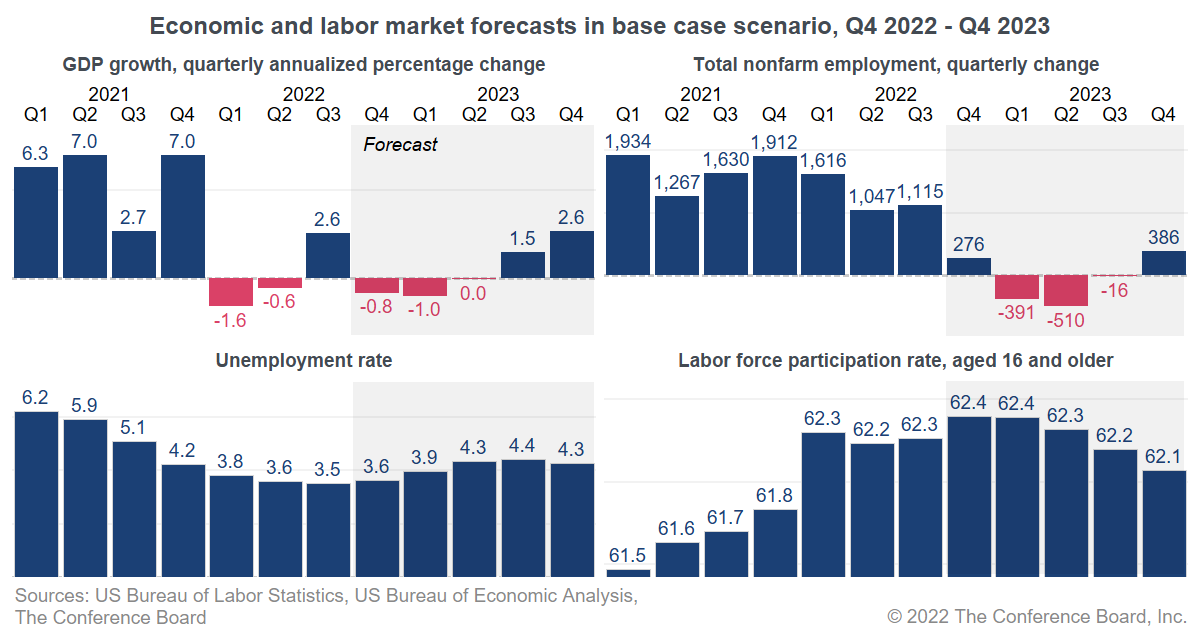

- The unemployment rate is projected to reach almost 4.5 percent in 2023, up from 3.5 percent in September 2022. It is increasingly likely that the US will fall into recession before year-end 2022. Besides an increase in the unemployment rate, about 900,000 jobs could be lost in the first half of 2023, according to The Conference Board base case labor market projections. Labor force participation may fall to 62.1 percent in Q4 2023, down from 62.3 percent in September 2022.

- While these projections are grim, an unemployment rate of 4.5 percent and employment losses of 900,000 would still be relatively low in a historical context. In October 2009, the unemployment rate reached 10 percent, and job losses totaled 8.6 million during the Great Recession; in April 2020, the unemployment rate reached 14.3 percent, and job losses summed up to 22 million during the COVID-19 recession.

- Several factors explain why unemployment may only increase by about 1 percent. A tight US labor market, understaffing, expected declining participation, and an aging workforce emphasize that US labor supply is challenged. On top of that, the recession is projected to be short, and demand for workers may increase again in the second half of 2023. Employers may be more careful in laying off workers.

- There may be some temporary easing of labor shortages in 2023 as demand for workers diminishes. However, recruitment and retention difficulties will not disappear, with the unemployment rate projected to remain relatively low. Once the US economy starts growing again, severe labor shortages could soon reappear.

Figure 1

Unemployment is projected to rise, employment to fall, and participation to decrease during 2023, driven by an anticipated recession starting in Q4 2022

These projections highlight the large change the US labor market may undergo over the coming year. Although the robust 2022 labor market would weaken in 2023, the relatively small projected increase in the unemployment rate would mean that labor shortages might lessen but not completely disappear.

The following five factors suggest why the unemployment rate may only slightly increase:

- A relatively shorter recession is projected, with economic growth contracting from Q4 2022 to Q1 2023. In such a short period, job losses may also be more limited.

- Employers may try to hold on to workers in a very tight labor market as rehiring could be difficult and expensive.

- Understaffing is more common, represented by the historically high number of job openings compared to hires. The need for layoffs will therefore be lower as companies have not yet returned to full employee capacity.

- Workers who lose their job, or current job seekers, may stop actively looking for work and drop out of the labor force. Indeed, labor force participation is projected to decline. Only people who are actively looking for work are considered unemployed.

- Demographic factors are constraining labor supply. The working-age population is not growing anymore, driven by baby-boom retirements and a decline in international immigration. This means fewer people are entering the labor force to actively look for work.

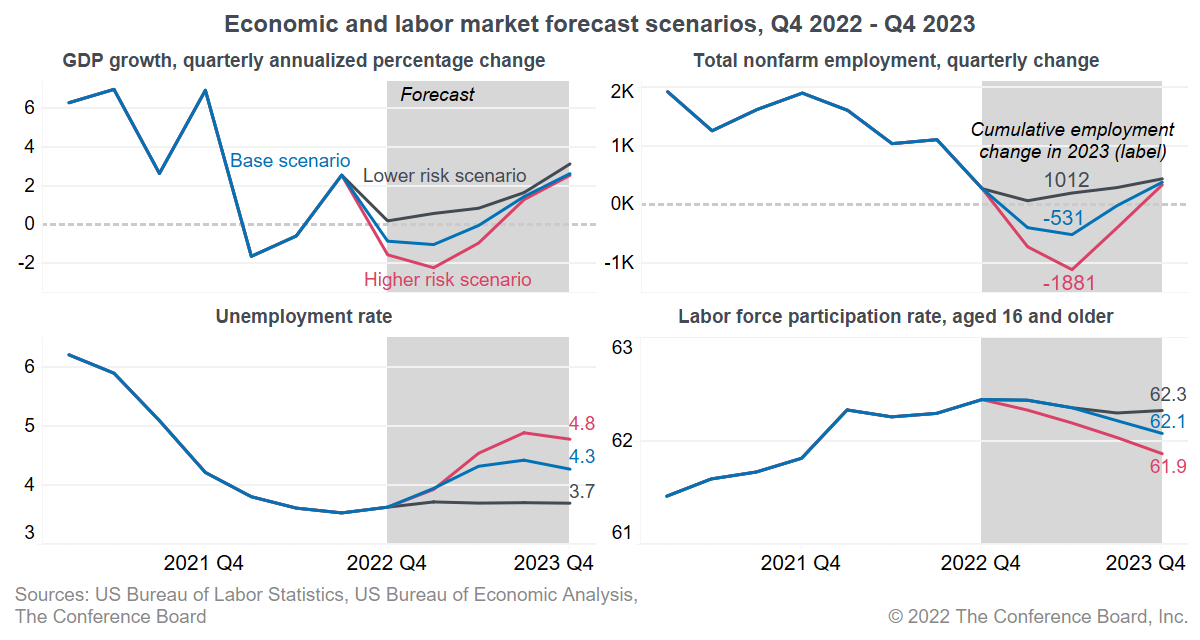

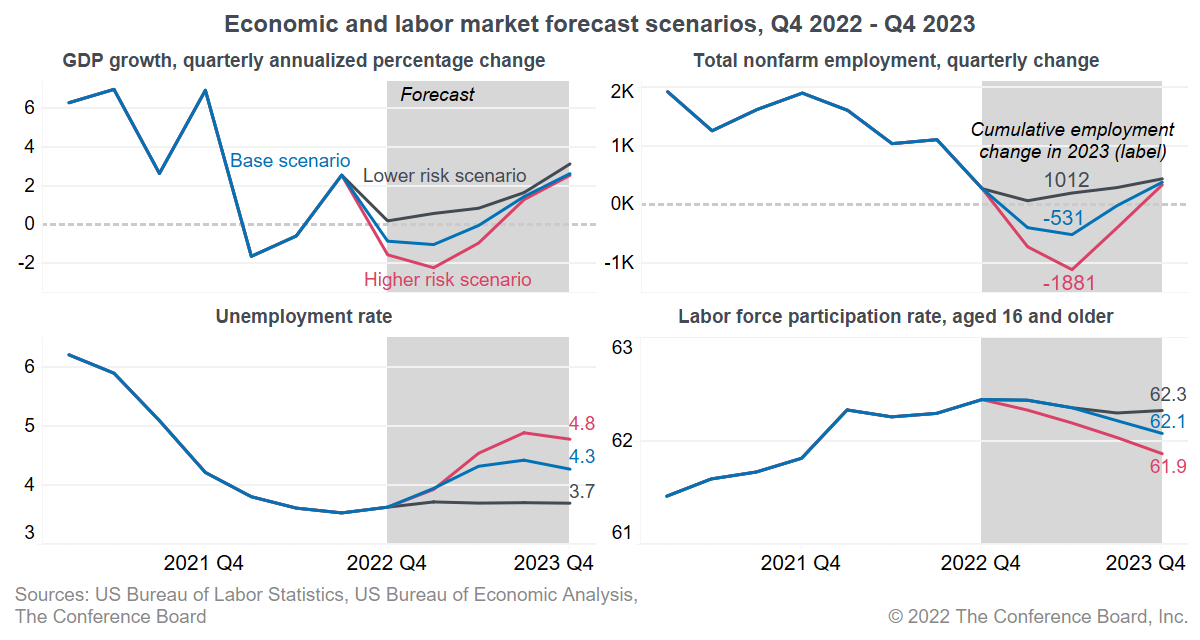

As of October 2022, economic growth is projected to decline by 0.8 percent in Q4 2022 and by 1 percent in Q1 2023 in the base case scenario. Some upsides, but especially downside risks to the outlook, are visible in the different scenarios highlighted in Figure 2.

Higher-risk scenario: The Federal Reserve increases the federal funds rate to 5 percent, inflation is more stubborn, housing prices experience a steeper drop, and overall volatility in financial markets increases. Economic growth drops by 2.2 percent (annualized) in Q1 2023. During 2023, the unemployment rate reaches 4.9 percent, participation falls to 61.9 percent, and employment drops by 1.9 million.

Lower-risk scenario (less likely): Inflation declines faster than currently anticipated, reducing the need for higher interest rates. The US economy does not experience an economic contraction, and the labor market remains tight, albeit with slower job growth.

Figure 2

Unemployment could reach almost 5 percent and job losses almost 2 million in 2023 in a higher-risk scenario for the US economy

The lower- and higher-risk scenarios to the US economy are described in further detail in The Conference Board report: StraightTalk® Wide Bands of Uncertainty (September 2022).