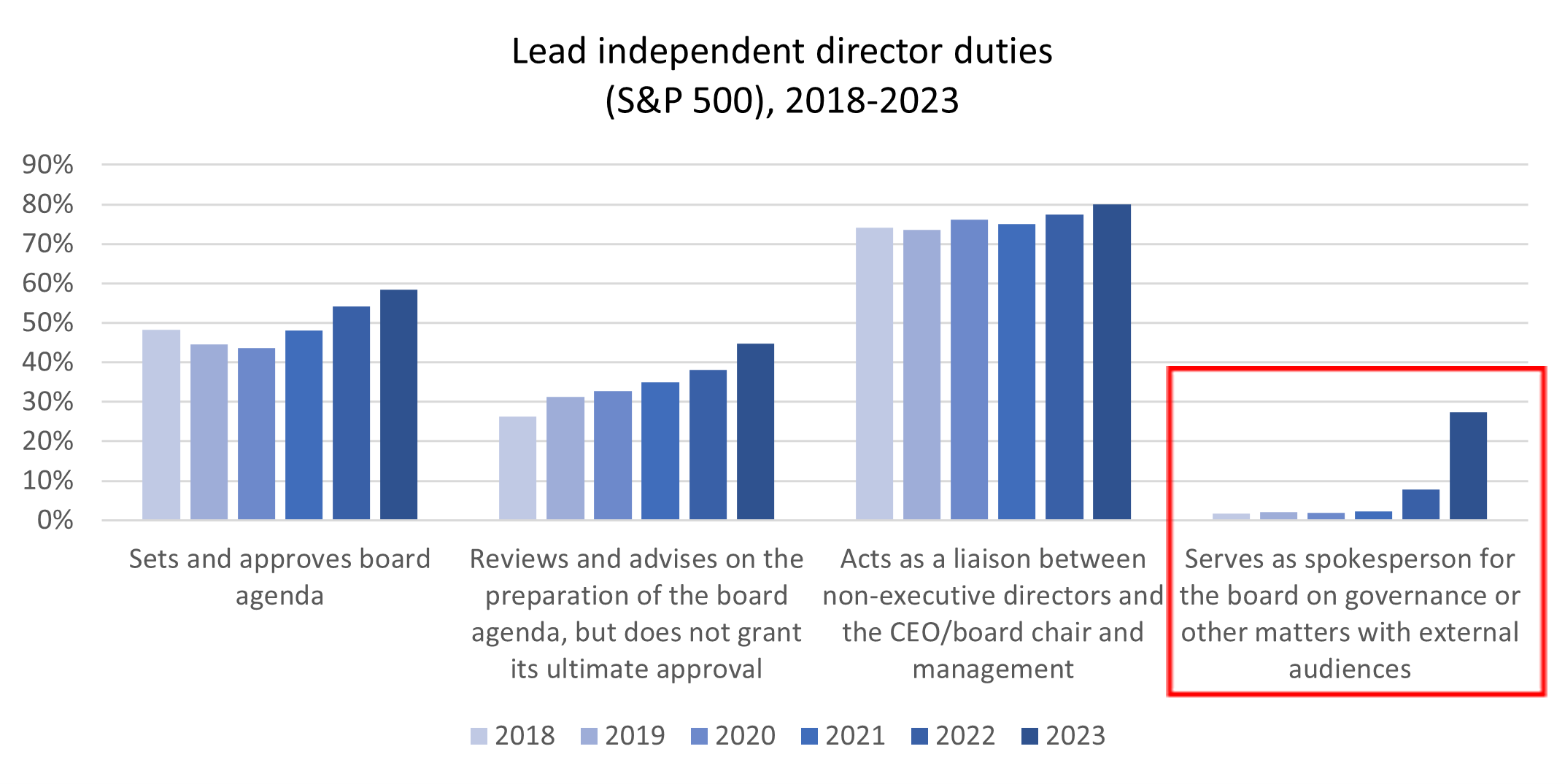

In 2023, 27% of S&P 500 companies reported that their lead independent director (LID) serves as the spokesperson for the board on governance and other matters with external audiences—a significant increase from 8% in 2022 and 2% in 2018.

Trusted Insights for What’s Ahead®

Expect this trend to continue as investors are no longer looking just to speak with compensation committee chairs about executive pay or nominating chairs on governance practices but want to understand the board’s role in addressing broader business challenges the LID can speak about with authority. This trend also reflects directors’ increasing role in directly engaging with investors and the SEC’s role in asking companies to increase their disclosures on the role of the LID.

Duties of lead independent directors are expanding

Note: This chart does not list all possible LID duties. For a complete overview, visit our live, online dashboard.

Source: ESGAUGE/The Conference Board, 2023

Having the LID meet with investors can yield multiple benefits for companies, especially at the 44% of S&P 500 companies that have a combined CEO/chair role. Shareholder proposals on CEO/chair separation were the top governance topic in the 2023 proxy season, and investors are willing to vote against such proposals if the board can demonstrate effective oversight and leadership.

Our latest report featuring data from analytics firm ESGAUGE and produced with the support of Debevoise & Plimpton, the KPMG Board Leadership Center, Russell Reynolds Associates, and the John L. Weinberg Center for Corporate Governance addresses the current state of companies’ board leadership and committee structures.

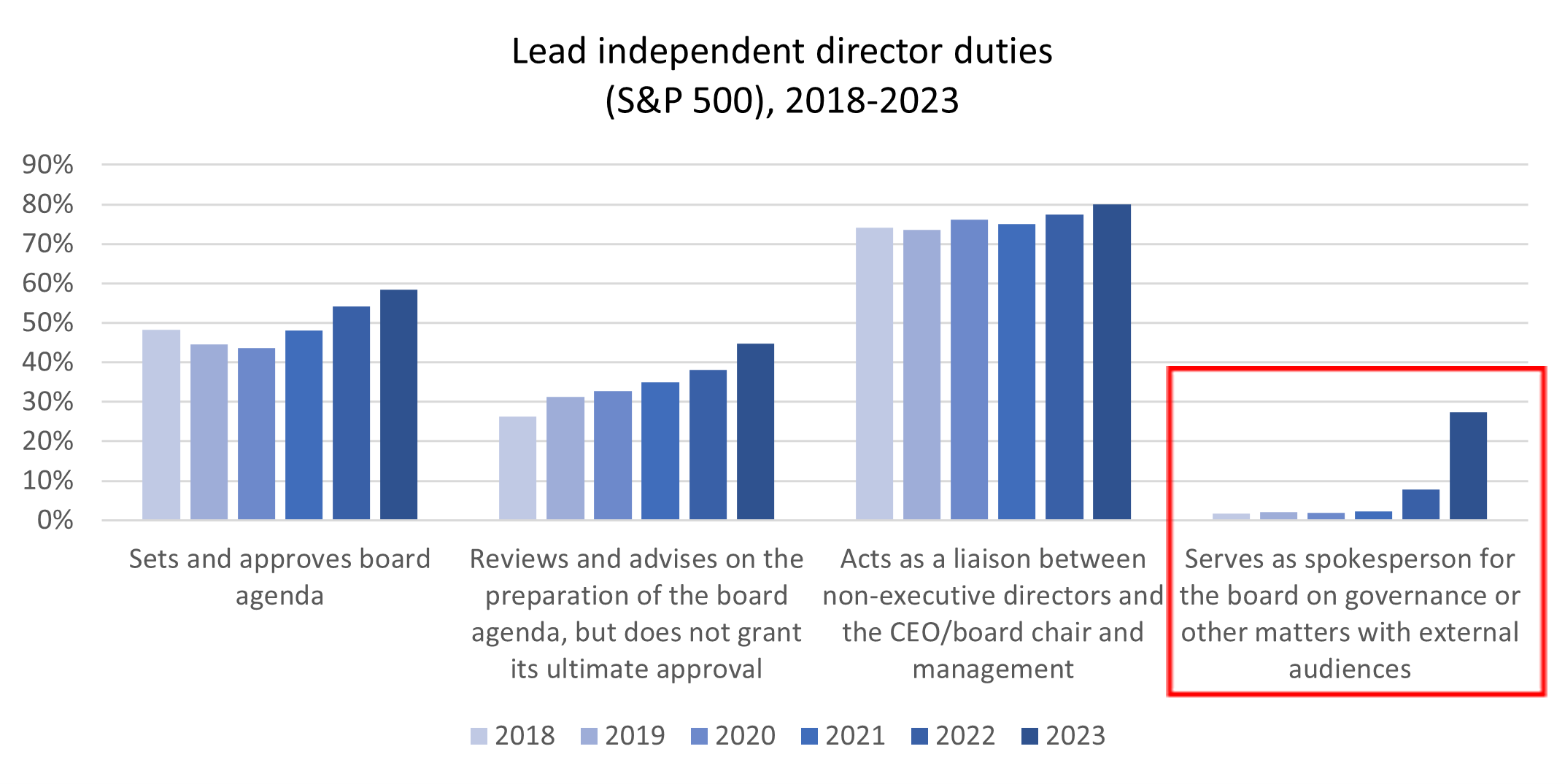

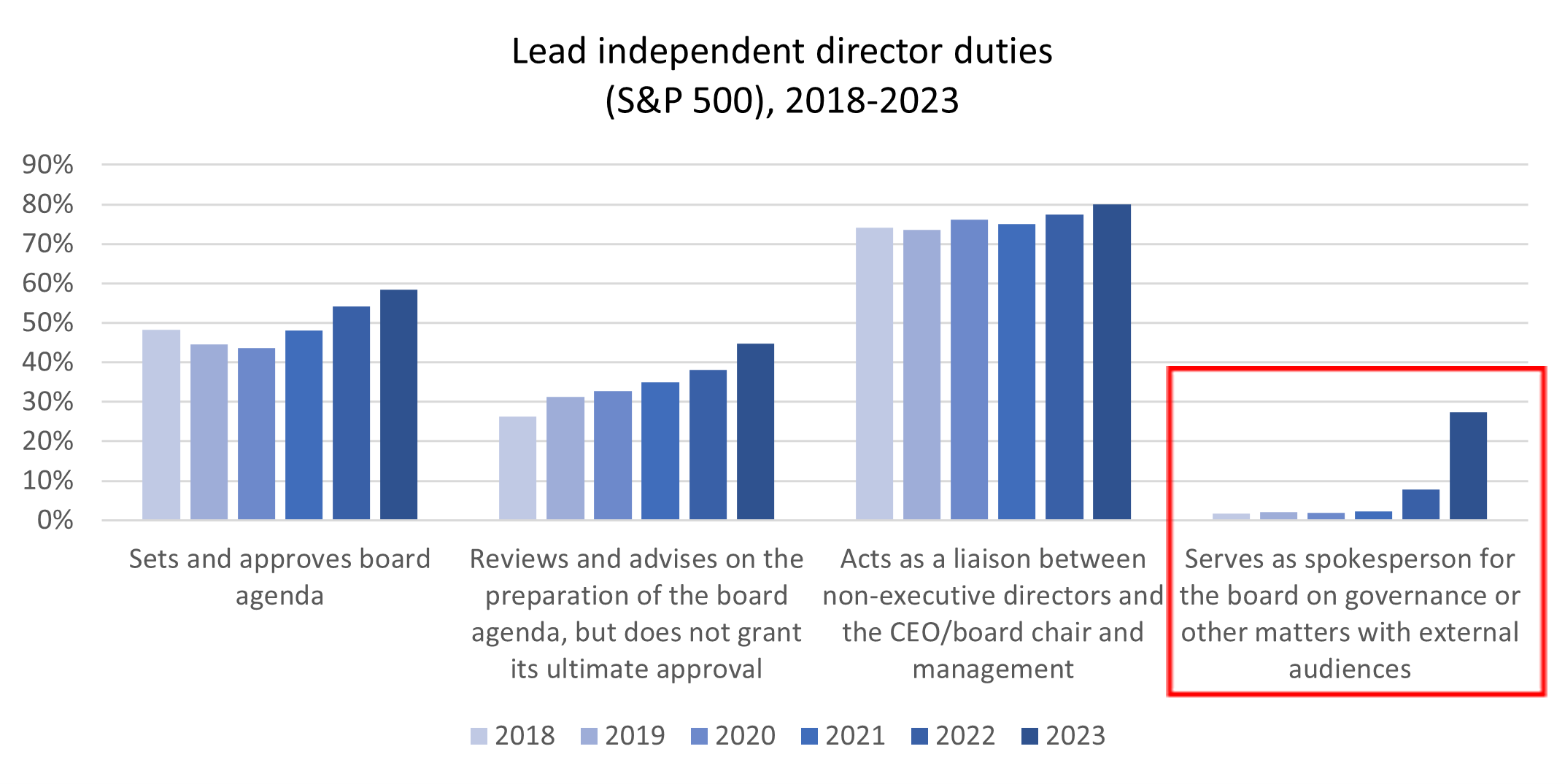

In 2023, 27% of S&P 500 companies reported that their lead independent director (LID) serves as the spokesperson for the board on governance and other matters with external audiences—a significant increase from 8% in 2022 and 2% in 2018.

Trusted Insights for What’s Ahead®

Expect this trend to continue as investors are no longer looking just to speak with compensation committee chairs about executive pay or nominating chairs on governance practices but want to understand the board’s role in addressing broader business challenges the LID can speak about with authority. This trend also reflects directors’ increasing role in directly engaging with investors and the SEC’s role in asking companies to increase their disclosures on the role of the LID.

Duties of lead independent directors are expanding

Note: This chart does not list all possible LID duties. For a complete overview, visit our live, online dashboard.

Source: ESGAUGE/The Conference Board, 2023

Having the LID meet with investors can yield multiple benefits for companies, especially at the 44% of S&P 500 companies that have a combined CEO/chair role. Shareholder proposals on CEO/chair separation were the top governance topic in the 2023 proxy season, and investors are willing to vote against such proposals if the board can demonstrate effective oversight and leadership.

Our latest report featuring data from analytics firm ESGAUGE and produced with the support of Debevoise & Plimpton, the KPMG Board Leadership Center, Russell Reynolds Associates, and the John L. Weinberg Center for Corporate Governance addresses the current state of companies’ board leadership and committee structures.