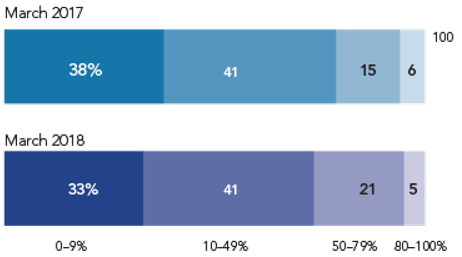

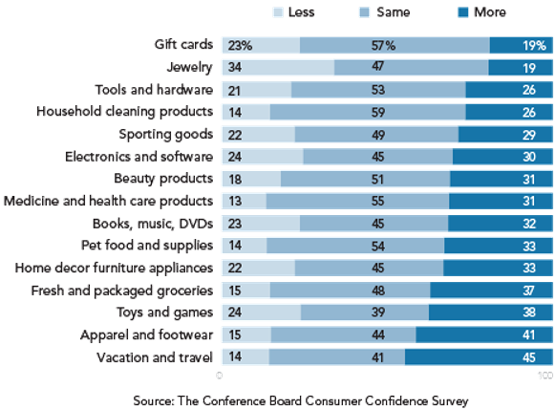

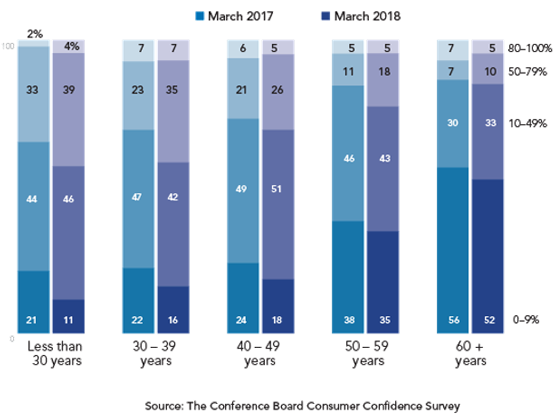

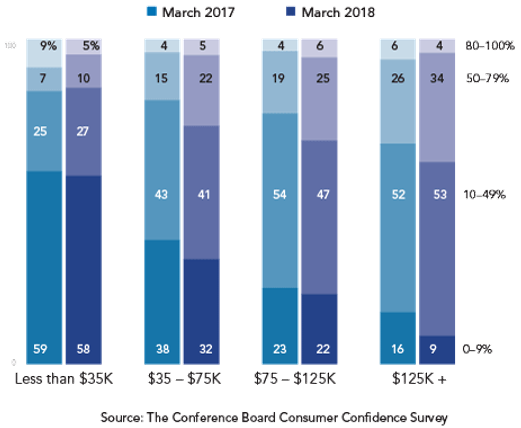

Consumers who make half or more of their purchases online rose to 26 percent, up from 21 percent a year ago The intent to spend on online purchases has grown across a wide range of products and services compared to five years ago. For example, 45% of consumers intend to spend more online on vacation and travel. Similarly, 37% intend to spend more online on fresh and packaged groceries. Categories such as jewelry and tools are less affected. Consumers increasingly turn to online shopping for making their purchases Percent of purchases made online last year Plans to spend on online purchases in 2018 v 2013 Consumers who make half or more of their purchases online rose across all age and income groups except to those in their 60’s or those with annual household incomes under $35,000 Consumers aged 30 or younger and claim to make half or more of their purchases online has increased from 35 to 43 percent. Even consumers in their 50s who claim to make half or more of their purchases online has increased from 16 to 23 percent. Online shopping has increased across all age groups Percent of purchases made online last year, by age group The percent of households earning $125K or more and claim to make half or more of their purchases online has increased from 32 to 38 percent. Online shopping has increased particularly among more affluent consumers Percent of purchases made online last year, by household income Connected Spenders Last year, we introduced the Connected Spenders – a specific cohort of consumers around the world who are willing to spend, are fully engaged with the global economy, and have access to goods and services they desire. One of the most direct implications of Connected Spenders and their growing role in the economy is that they are important drivers of the rise in online commerce. We project that Connected Spenders will account for half of global consumption by 2025—and will exhibit unique demographics and behaviors around the world. Our recent survey suggests that even in a market like the U.S. where internet penetration is already widespread, e-commerce continues to grow across product categories among consumers of various demographic and socioeconomic backgrounds. We encourage you to get to know Connected Spenders better and learn how you can leverage this new source of growth.

Making Intangibles Tangible: Who is to Blame When Brands are Written Down?

September 11, 2019