-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

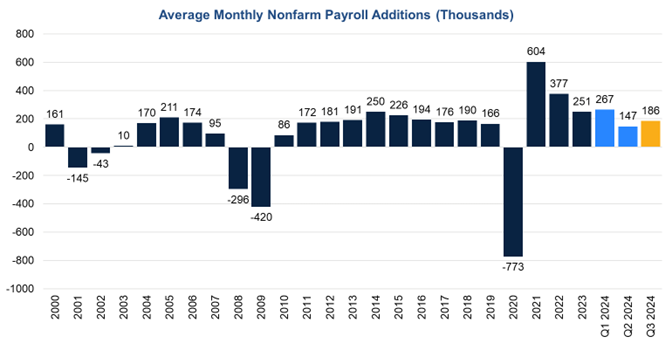

The US labor market proved resilient in September, adding 254,000 to payrolls for the highest gain since March. Leading into today’s release, June–August showed an average of 116,000 monthly payroll gains; revisions to July and August data now bring average gains over that period to 140,000, before September’s outsized growth. The unemployment rate ticked back down to 4.1%, with the number of unemployed workers falling by 281,000.

This report underscores that the Fed’s decision to cut rates last month was preemptive against risks that had yet to materialize. The report alleviated concerns of an abrupt hiring slowdown with upward revisions to recent months.

This is the first of five core datapoints that Fed policymakers will receive ahead of their November 7 meeting, along with Q3 GDP, PPI, PCE, and CPI. We see September’s jobs report as helping solidify policymakers’ consensus around two 25bps hikes to end 2024; however, additional data could still shift this narrative.

Figure 1. September’s job gains bring average payroll growth to 186,000 in Q3

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025

February Jobs Report Hints at Growing Uncertainty

March 07, 2025

Stability Underneath January’s Noisy Jobs Report

February 07, 2025

Q4 ECI Wage Deceleration Slows

February 07, 2025

Robust Job Gains Close 2024

January 10, 2025

November Job Gains Rebound from Disruptions

December 06, 2024