EU Carbon Border Adjustment Mechanism: A Primer for Stakeholders

In 2019, the European Commission (EC) announced the European Green Deal as the strategy toward realizing the EU’s ambitious targets of achieving by 2030 a 55 percent reduction in carbon emissions from 1990 levels and becoming a climate-neutral continent by 2050. As part of these efforts, the EU is expected to introduce the Carbon Border Adjustment Mechanism (CBAM) in 2023.

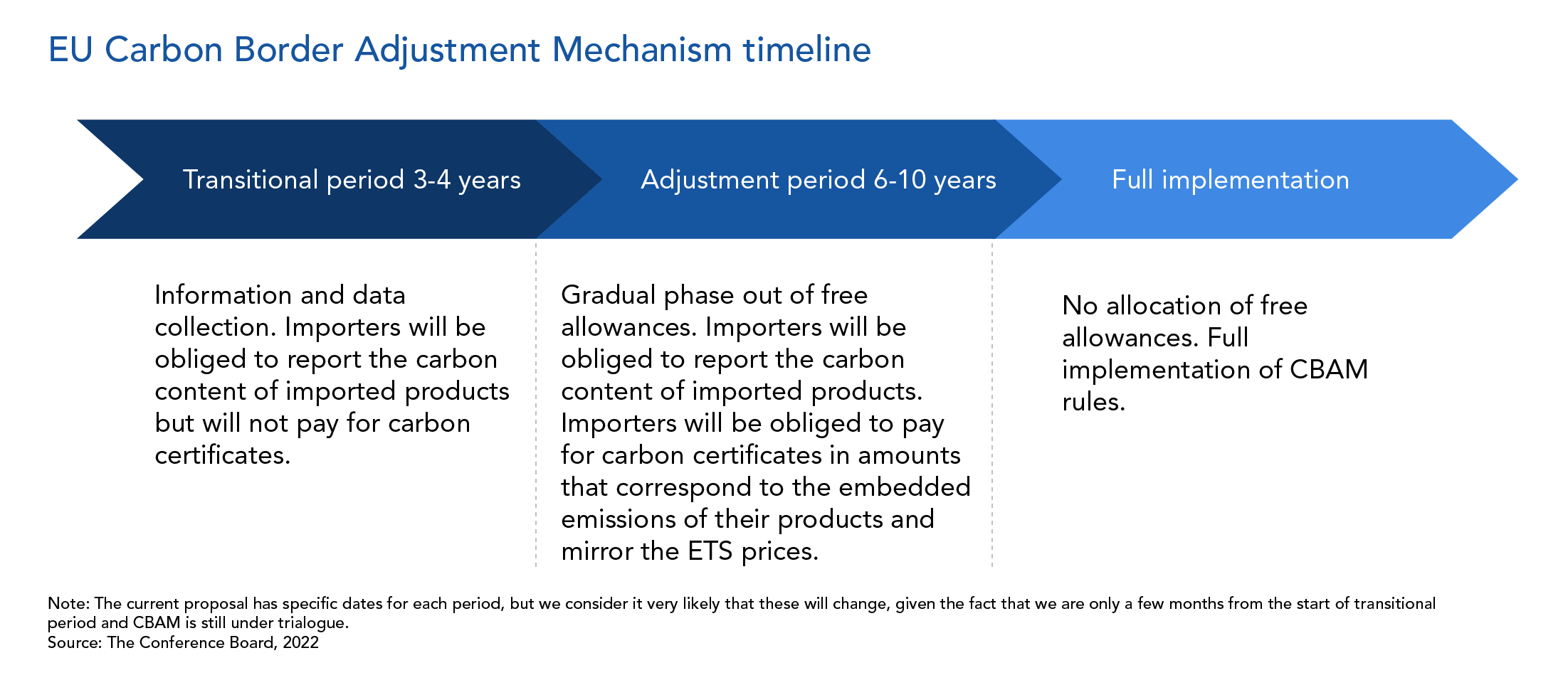

CBAM, a carbon tariff imposed on imported carbon-intensive products, will complement the current EU Emissions Trading System (ETS) and primarily target five energy-intensive industrial sectors: iron & steel, cement, fertilizers, aluminum, and electricity generation. Over the 2023–2025 period, a simplified system would be in force, with reporting obligations on the emissions embedded in relevant imports. Starting in 2026, EU importers would pay a financial adjustment that corresponds to the emissions embedded in their imports.

Insights for What’s Ahead

- As the CBAM proposal is currently under discussion between the EC, the Council of the European Union, and the European Parliament, companies in Europe need to follow these developments closely. The initial scope of CBAM has not yet been finalized and could be extended to cover more sectors as well as indirect emissions from purchased or acquired energy (scope 2) and value chain emissions (scope 3). More details—such as the transitional period, penalties, governance, export adjustment issues, and details of the phaseout period of free allowances—are yet to be determined. Importers of products currently in the EC’s CBAM proposed list of goods must be ready to account for and report embedded emissions in imported goods starting in 2023. Then they should prepare to buy CBAM certificates during the transition period (2023–2025).

- CBAM is a novel measure toward creating a level playing field for European businesses. During a recent event organized by The Conference Board Governance & Sustainability Center, 77 percent of executives from various European businesses expressed their view that CBAM would increase the competitiveness of EU businesses. This is despite the ongoing debate as to whether the benefits from eco-innovation resulting from stringent legislation will be large enough to outweigh the costs of regulations.

- CBAM is likely to elicit a wide range of international responses; we are likely to see protest and retaliation from both developing and developed countries. Business partners from Brazil, China, and India have expressed concern about the potential impact CBAM might have on businesses that supply to the EU; they view the CBAM proposal as a protectionist measure masquerading as a climate policy. The US has said CBAM should only be an option of last resort. While the EU stresses that CBAM will be compatible with the World Trade Organization’s rules and EU Free Trade Agreements in that it will ensure equal treatment of domestic and foreign producers, CBAM will still result in additional costs and administrative work.[1] Nonetheless, CBAM is expected to pave the way for similar mechanisms in other regions as EU trading partners may choose to introduce their own carbon border adjustments. This will allow them to raise significant revenue that would otherwise be paid to the EU.

- Companies in sectors that aren’t currently subject to CBAM should consider assessing their future CBAM exposure. While the scope of goods currently includes electricity, cement, fertilizer, iron, steel, and aluminum, future iterations may very well extend to companies in sectors that are not energy intensive. Importers of goods in other energy-intensive sectors such as refineries, hydrogen, organic chemicals, and polymers should also start preparing now. It is very likely that they will be included in CBAM in a few years, if not in the initial phase.

- Companies outside Europe, especially those that supply Europe and are covered by CBAM, will be adversely affected. They will face not only the cost of carbon certificates, but the administrative burden around reporting the carbon content of products, buying required certificates, and submitting proof of carbon tax paid abroad, if applicable. They are likely to share this burden with their supply partners.

What is CBAM and how will it work?

CBAM is a proposed carbon tariff imposed on imported carbon-intensive products. It will be a regulation, not a directive; that is, it will be applicable and enforceable by law in all EU member states.

One of the main objectives of CBAM is to prevent “carbon leakage”—moving GHG-intensive production from the EU to countries with more lenient emissions regulations and subsequently importing these produced goods into the EU.

CBAM aims to create a level playing field for EU producers by subjecting specific GHG-intensive goods to an import levy.

The CBAM proposal currently includes goods from five energy-intensive industrial sectors: iron & steel, cement, fertilizers, aluminum, and electricity generation. Importers of these goods are expected to fulfill CBAM requirements from the start of the transitional period in January 2023; the subsequent planned adjustment period will go live starting in January 2026.

Companies that want to import goods produced outside the EU will have to purchase certificates corresponding to carbon emissions generated in the production of those goods. The EC will calculate the price of CBAM certificates to reflect the average weekly price of ETS auctions. This means that CBAM certificates will be pegged to the ETS, ensuring that the price of CBAM certificates is as close as possible to the price of ETS allowances while also ensuring that the system remains manageable for the administrative authorities.

The impact of initiatives such as CBAM is likely to be felt in Europe and beyond. Businesses that identify potential impacts, plan measures, and act in a timely manner will be better prepared to navigate the changing climate regulatory landscape and build a competitive advantage.

[1] European Commission, Carbon Border Adjustment Mechanism: Questions and Answers, July 14, 2021.