Coal: A Hidden Risk for Your Business

While November’s COP 27 meeting in Egypt stressed the urgency for a "phase down" of coal, the world's most dominant source of energy, as a critical step to ensuring a clean energy future, countries around the globe are building 187 new coal-fired power plants, increasing total capacity by 178GW or almost 10 percent. Coal is considered the dirtiest source of energy not only because it is the most carbon-intensive fossil fuel, but also because burning coal releases a number of airborne toxins and pollutants, such as particulates and various heavy metals that affect our health. Companies have a vital role to play in phasing out coal-fired energy production to meet targets in the reduction of global greenhouse gas emissions and limit global temperature rise to 1.5 degrees Celsius above preindustrial levels.

Insights for What’s Ahead

Companies that rely on residual-mix energy may see increases in their emissions, which exposes them to potential liability risks. Companies usually have the option to purchase green energy (e.g., electricity through contractual agreements) or remain in the cheaper, residual mix of their power provider. The more coal in the residual mix, the higher the carbon intensity of the mix. Due to the ongoing energy crisis in Europe, a higher share of coal-based electricity production is expected in the short-term, which will have an impact on companies’ emissions. However, recent years have seen a surge in climate change-related cases initiated by governments and nongovernmental organizations. Companies that make climate commitments but do nothing or very little toward them may be held accountable for their current inaction in the future.

Companies with coal-based energy use hidden in their value chain face increased risk in the form of regulatory interventions.Changes in upcoming international legislation (e.g., the ISSB Sustainability Disclosure Standards, the EU CSRD proposal) will require companies to disclose their value chain emissions. Furthermore, Carbon Border Adjustment Mechanisms (CBAMs)—to be introduced soon in Europe—will place a considerable administrative burden on companies and a carbon price on direct and value chain emissions of imported products.

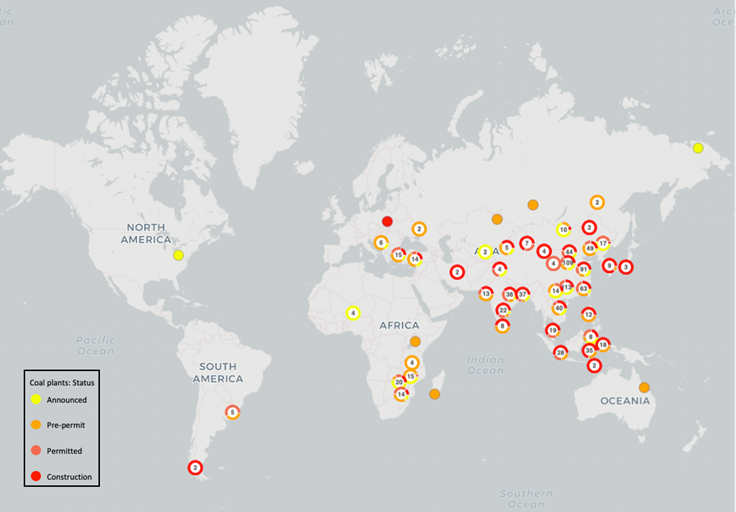

New coal-fired power plants

Source: Global Energy Monitor

Coal Has No Place in the Long-Term Net-Zero Journey

Though the share of coal in total energy supply is still increasing globally, coal needs to be replaced as an energy source in regions’ and companies’ long-term pathways toward net zero, as they set ambitious climate targets. In Europe, despite the short-term comeback due to energy security reasons, coal is still expected to be phased out by 2030 in most countries to meet the EU’s commitment to reduce CO2 emissions by at least 55 percent by 2030 and to become the world’s first climate-neutral bloc by 2050. In other regions, such as China and other parts of Asia, there is no clear timeline when coal will be phased out, but commitments to do so remain in place.

The transition is not without social and economic risk. For example, coal-related activities provide jobs to around 230,000 people in mines and power plants across 31 regions and 11 EU countries.

Companies have a role to play in the energy transition and can drive an accelerated coal phaseout globally, by limiting the coal exposure of their direct and value chain emissions portfolio.

In their pathway toward net zero, companies need to be pragmatic. While companies may not necessarily be able to counteract use of coal in the energy mix, they need to explore green power purchase agreements to decarbonize, while anchoring their costs and limit liability risks. High energy costs will not necessarily halt green energy investments. Our recent The Conference Board Measure of CEO Confidence™ for Europe by ERT reveals that despite myriad challenges, including very high energy prices, a large majority of CEOs and Chairs (91 percent) signal strong and clear intentions to either increase their investment in green energy or make no changes in their energy transition plans in the short term. Additionally, a sizable share of respondents (59 percent) plan to permanently increase their investments in green energy technologies, versus 48 percent temporarily.

In their net-zero journeys, companies need to make science-based commitments with clear targets and milestones. Disclosing value chain emissions adds transparency and credibility to their plans as it enables progress monitoring. Efforts to reduce value chain emissions will also limit transition risks coming from increasingly stringent legislation and climate change litigation.