The Impact of Europe's Carbon Border Adjustment Mechanism on Non-EU Businesses

May 05, 2023 | Report

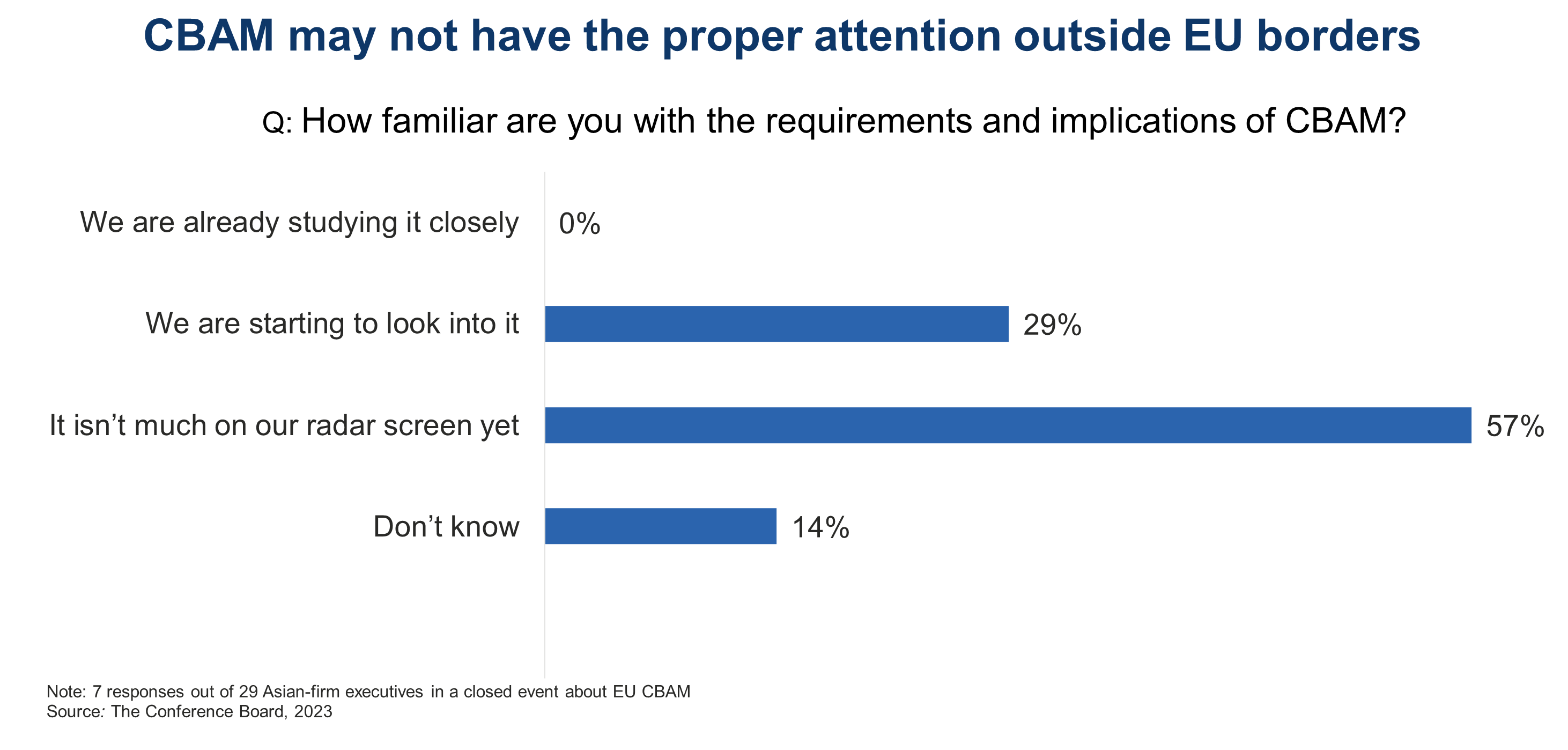

On April 18, the European Parliament approved the controversial Carbon Border Adjustment Mechanism (CBAM), which attributes a carbon price to certain imported products, such as aluminum, cement, fertilizers, electricity, hydrogen, or iron & steel. While CBAM is a “game changer” for sustainable trade, not all firms may have the same level of awareness or understanding of its potential impact. For example, during an event organized by The Conference Board in April 2023, no Asia-based company had a deep familiarity with CBAM and its potential impact.

Insight for What’s Ahead: CBAM entails an ongoing administrative burden for non-EU businesses beyond the transition phase, as quantities, embedded emissions, and any carbon price due in the country of origin will have to be reported for imported goods within the scope of CBAM. Understanding the requirements and implications of CBAM before it goes into effect in October 2023 could mitigate its adverse impacts on a company’s business operations.

By assigning a carbon price to imports, CBAM aims to level the playing field by taxing items produced in places with less-stringent emissions regulations. But non-EU businesses whose products fall under CBAM may not have the opportunity to play on the promised level field due to language barriers, cultural differences, or even poor communication with stakeholders.

In our EU Carbon Border Adjustment Mechanism: A Primer for Stakeholders, we provide insights on CBAM based on the draft at that time. We expect that the EU will organize awareness sessions in countries most affected by CBAM to ensure that stakeholder businesses obtain a good understanding of the requirements and implications of CBAM. Non-EU stakeholder businesses are encouraged to attend such sessions.