Oil Price Scenarios: March 9, 2022 Update

March 11, 2022 | Chart

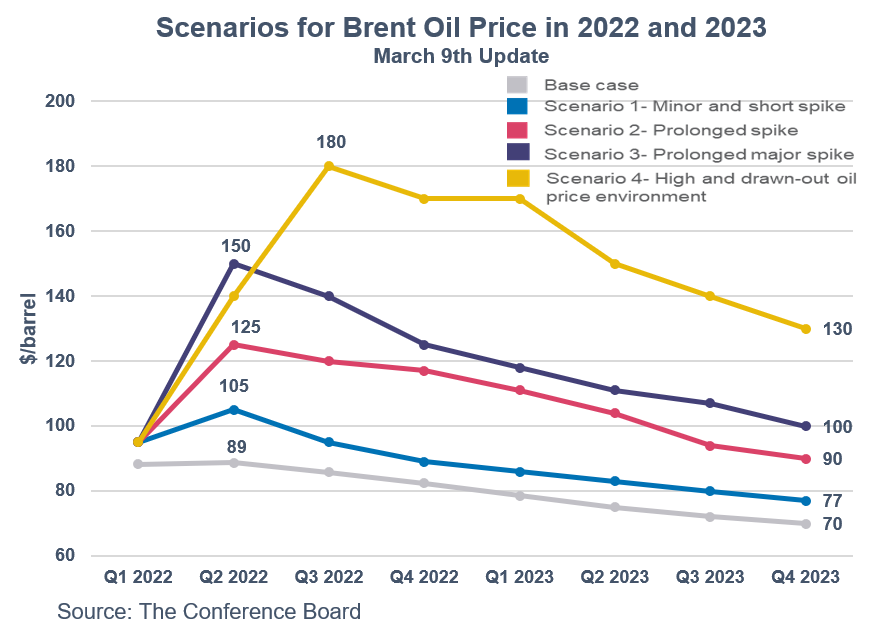

Uncertainty and volatility cloud the oil market more than ever. Although 2021 closed with low global oil inventory levels, a fragile market balance, and heightened geopolitical tension, a “Russian military operation in Ukraine” was a low probability scenario. However, with the scenario becoming reality on February 24, we recraft a set of scenarios that could affect the oil market that take into account developments in the war in Ukraine and the effect of sanctions by the EU, US, and other NATO members that might be imposed in the future.

- Oil Price Scenario 1 – Sanctions are imposed on Russia; however, the politicization of the oil market stays largely contained to a US ban on Russian oil imports. This results in a minor and short spike in oil prices.

- Oil Price Scenario 2 – Russia intensifies its aggression on Ukraine. Attempts to reach a settlement face delays. Major oil companies continue the process of exiting Russian projects. Oil prices go through a prolonged spike. This is currently the baseline scenario behind our most recent Global Economic Outlook update.

- Oil Price Scenario 3 – Intense military shelling jeopardizes gas pipelines from Russia to Ukraine. Oil importers shy away from Russian oil as a result of credit restrictions and fear of energy sanctions. Thus, Russian oil and gas are not reaching end markets. OPEC+ intervention in the market remains negligible in the face of rising fuel shortages. The oil supply gap widens, resulting in a prolonged major spike.

- Oil Price Scenario 4 – An oil and gas embargo is imposed on Russia (Russian oil exports averaged 4.6mb/d in 2020). China absorbs some of the volume at a discounted price. The US and OECD oil exporters intervene extensively by increasing shale production and releasing barrels from the Strategic Petroleum Reserve, and OPEC and Iran try to fill the gap. However, the market remains unbalanced, resulting in a high and drawn-out oil price environment despite an oil demand slump.