Updated August 30, 2023

After a six-month lull, concerns about the US banking sector are resurfacing. A series of rating agency downgrades of banks heavily exposed to commercial real estate (CRE)—office space in particular—is renewing concerns. Meanwhile, mounting credit card debt and increasing charge-offs may also weigh on small- and medium-sized banks. Lending standards are tightening, and regulators are considering expanded restrictions for at-risk institutions. Uncover the latest troubles in the US banking sector and discover best practices for executives to navigate through uncertain times.

Click here for must see charts: 2023 Banking Crisis: US By the Numbers, 6-Month Update

Updated May 15, 2023

Must See Charts Updated: The worst of the banking crisis appears to be over, but stress in financial markets remains as uncertainty over additional shoes to drop looms large. Policymakers and regulators have assessed the causes of the crisis and are considering steps to prevent a similar crisis from occurring again. This update provides the latest on key metrics to watch amid the crisis and consideration of new risks to banks that might be just around the corner. Click here for must see charts: 2023 Banking Crisis: US By the Numbers

Insights for What’s Ahead

- Banks are still borrowing from the Fed to remain liquid, and this has stabilized at an elevated level. Money being withdrawn from the FDIC has fallen from a daily average of nearly $70 billion to just $12 billion. Outflows of deposits from small banks to large banks or various financial assets persist but at a slower rate.

- Policymakers are considering a variety of changes following internal reviews by the Fed and FDIC in early May. The FDIC recommended separating business deposits from its $250,000 insured limit, which would require congressional action. The FDIC also released a proposal for special assessment fees to recoup losses from the sales of SVB and Signature that would exempt the smallest banks. Losses on the sale of First Republic will be recovered separately through regular fees. Regulators at the Federal Reserve are examining whether stricter requirements should be reimposed on mid-sized banks with assets between $100 billion and $250 billion, particularly related to stress testing.

- So far, credit spreads remain narrow, and liquidity appears to be adequate. Still, the Fed anticipates some tightening in financial conditions (akin to a 25-basis point interest rate hike) due to the banking crisis. Businesses, small and large, may be more affected than consumers, who have already pulled back on big-ticket items requiring financing.

- Markets are still awaiting more shoes to drop. These might include difficulty for corporations to obtain cash from either banks or capital markets. Additionally, commercial real estate loan defaults may place added stress on small banks at a delicate time, and the looming debt ceiling may place upward pressure on borrowing costs and depress the value of US Treasury assets held by banks.

- Against this backdrop, The Conference Board continues to anticipate one more Fed interest rate hike as the banking crisis appears generally under control, but inflation remains uncomfortably high. Tight monetary policy is likely to induce a short and shallow recession, potentially starting in 2Q 2023, that results in some weakening in the labor market.

- Click here for must see charts: 2023 Banking Crisis: US By the Numbers.

Updated May 2, 2023

CED Policy Update: Banking Crisis Updates; Fed and FDIC Publish Reviews of Supervision

Insights for What’s Ahead

Amid the sale of First Republic Bank to JPMorgan, the Federal Reserve and the FDIC released reports reviewing the role of supervision in recent bank failures and policy considerations moving forward.

- The Federal Reserve’s report on SVB and FDIC’s report on SBNY each found lapses in regulatory oversight but also revealed repeated inaction by both management teams to address identified issues. Each agency plans to review its escalation and enforcement processes.

- The Federal Reserve’s review of SVB detailed plans to review capital and liquidity requirements for mid-sized banks (over $100 billion in assets) while revisiting how the agency assesses risk of uninsured deposits and its handling of growing banks transitioning between size classes. Nearly all the potential changes outlined can be made through standard rulemaking under existing authorities.

- The FDIC’s review of SBNY cited resource and staffing challenges as key contributors to supervisory issues at SBNY while also stating it will review its guidance related to uninsured deposits and to liquidity management.

- The FDIC’s separate review of deposit insurance recommends a targeted increase in insurance limits on business payment accounts, along with other provisions to support stability.

Read the full policy update here: Banking Crisis Updates; Fed and FDIC Publish Reviews of Supervision

Updated April 6, 2023

Must See Charts: The worst of the banking crisis appears to be over, but some stress in financial markets remains. Additionally, policymakers and regulators are still sifting through the rubble to consider what steps must be taken to prevent a similar crisis from occurring again. This latest update provides quick insights on the current state of play, how financial markets are reacting to events to date, and what to expect next. Click here for must see charts: 2023 Banking Crisis: US By the Numbers.

Insights for What’s Ahead

- Banks are still borrowing from the Fed to remain liquid, although it appears to be stabilizing. Money being withdrawn from the FDIC has fallen from a daily average of nearly $70 billion to just $5 billion. Outflows of deposits from small banks to large banks or various financial assets seem to have paused.

- Policymakers are considering a variety of proposed changes for medium-sized banks, deposit insurance, and regulatory scrutiny. Reaching consensus on action in a divided Congress will be difficult unless the crisis were to deepen. But congressional investigations of the failures are the first order of business. Regulators are examining whether stricter regulations should be reimposed on banks having assets between $100 billion and $250 billion. There is bipartisan interest in considering proposals to protect small and medium sized banks, including increasing the amount of insurance for deposits. Regulators are undergoing reviews to search for failures in oversight.

- So far, credit spreads remain narrow, and liquidity appears to be adequate. Still, the Fed anticipates some tightening in financial conditions (akin to a 25-basis point interest rate hike) due to the banking crisis. Businesses, small and large, may be more affected than consumers, who have already pulled back on big-ticket items requiring financing.

- Other shoes to drop might include difficulty for corporations to obtain cash from either banks or capital markets. Additionally, CRE loan defaults may place added stress on banks at a delicate time.

- Against this backdrop, The Conference Board continues to anticipate two more Fed interest rate hikes as the banking crisis appears under control, but inflation remains uncomfortably high. The Fed’s tighter monetary policy is likely to induce a short and shallow recession, potentially starting in 2Q 2023, that results in some weakening in a fairly robust labor market.

- Click here for must see charts 2023 Banking Crisis: US By the Numbers.

CED Policy Brief: Banking Crisis Update & Policymakers' Reaction

Updated March 29, 2023

This week, lawmakers are holding the first hearings over the handling of Silicon Valley Bank and Signature Bank. The hearings mark the first forum for Congress to press relevant regulators beyond Treasury Secretary Yellen and Fed Chair Powell to uncover details on the actions of the banks’ management. CED’s new Policy Brief breaks down how policymakers are reacting to the banking crisis.

The policy response will have an important impact on how banks manage risk as more and more banks are considered too systemic to fail, the extent of federal regulation and engagement in the US banking system, and the future of small and medium-sized banks.

In the coming weeks, there are several key areas to watch:

- Accountability: Lawmakers will scrutinize the banks’ risk management practices and public disclosures, while legislation has been introduced that would allow clawbacks of compensation for executives at failed banks.

- Regulator Reviews: Federal Reserve supervision is under review, with proposals for an independent investigator general as well as restrictions that would prohibit bank executives from serving on regional Fed boards. It would also bar Fed employees from investing in institutions under its jurisdiction.

- More Regulation or More Rigorous Regulatory Oversight: The big debate among policy makers is whether more regulation is needed over medium and small banks, or whether the Federal Reserve needed to adjust its stress tests to address the impact of higher interest rates on the health of the banks and whether it missed clear warnings of problems at SVB.

- Deposit Insurance Debate: Expanding FDIC deposit insurance either temporarily or permanently is the subject of ongoing discussion. Some lawmakers are opposed to universal insurance and expanding the role of the federal government in the banking system; while others are expressing concerns around smaller banks and business deposit accounts, which may benefit from an adjustment. How this debate plays out will have a major impact on the US banking system and whether it becomes much more consolidated. It will also have a major impact on how banking management, depositors and the market generally discipline risk.

Tuesday’s Senate Banking Committee Hearing

On Tuesday, the Senate Banking Committee hosted the primary regulators with oversight of the collapses of Silicon Valley Bank (SVB) and Signature Bank, featuring testimony from the Federal Reserve Vice Chair for Supervision Michael Barr, FDIC Chair Martin Gruenberg, and Under Secretary of the Treasury Nellie Liang. The executives of SVB and Signature, Gregory Becker and Joseph DePaolo, were absent from the hearing despite Committee Chair Sherrod Brown (D-OH) and Ranking Member Tim Scott (R-SC) issuing a joint letter requesting testimony from the CEOs. With a separate hearing Wednesday before the House Financial Services Committee, the two sessions are the first in what is likely to be a monthslong probe by lawmakers to understand the bank failures.

Vice Chair Barr called SVB’s failure a “textbook case of mismanagement” and assured the Committee that a full internal review of Federal Reserve supervision would be published by May 1. Chair Sherrod Brown (D-OH) struck a similar tone, remarking “the scene of the crime does not start with the regulators before us. Instead, we must look inside the bank, at the bank CEOs and at the Trump-era banking regulators, who made it their mission to give Wall Street everything it wanted.” However, the committee largely split along party lines. “Clear as a bell were the warning signs,” said Ranking Member Scott (R-SC), “by all accounts, our regulators appear to have been asleep at the wheel.”

It had been reported that Fed supervisors initially sent warnings to SVB management as early as the fall of 2021 regarding inadequate management of interest rate and liquidity risks. Barr offered new details on those interactions, some of which pre-date his role as Vice Chair that began in July 2022. Supervisors’ concerns grew in 2022 as those initial “matters requiring attention” (MRA) requests were not satisfactorily addressed by SVB and as rising interest rates were expected to begin pinching banks.

However, when asked by Sen. Mike Rounds (R-SD) the expected response time to an MRA or the more immediate MRIA, Barr only offered that it depended on the complexity of the request and repeated follow-ups were made. Sen. Jon Tester (D-MT) later followed up asking why the Fed didn’t act on the failure of management to address the flagged issues, “It looks to me like the regulators knew the problem, but nobody dropped the hammer.” While Republican committee members focused on the Fed’s supervisory role, Democrats focused on the 2018 rollback of Dodd-Frank rules that may have lowered the guardrails on midsize banks allowing for fragilities. Barr was also critical of those rollbacks from Congress and the implementation of the statute completed by prior regulators in 2019. When pressed by Sen. Elizabeth Warren (D-MA) over whether the three officials agreed that the government needs to strengthen rules for banks to prevent future collapses, all three agreed. "I anticipate the need to strengthen capital and liquidity standards for firms over $100 billion," said Barr.

Concerns were also raised that the money for the deposit insurance fund, which by law comes from a special assessment on other banks, would have the smaller community banks bearing the burden of these failures. FDIC Chairman Gruenberg responded that a recommended formula, which the FDIC has some discretion over, would be announced in early May.

Policymakers Focus on Accountability, Await Further Investigations

President Biden had called on Congress to empower the FDIC to clawback executive compensation from banks requiring government assistance. Lawmakers of both parties are receptive to that idea. “As far as clawbacks, there are provisions under law that apply to other sectors of the world of finance that perhaps should be applied here. We're going to take a look at that,” said Rep. Patrick McHenry (R-NC). Dodd-Frank provided the FDIC with clawback authority however the rule would need to be expanded to include banks the size of SVB and Signature. Legislation has been introduced by Sen. Richard Blumenthal (D-CO) in the Senate and Adam Schiff (D-CA) in the House to recover compensation through bonuses and stock sales through a tax paid into the FDIC’s deposit insurance fund.

US regulators have also announced their own reviews. The Fed’s internal report will be released by May 1 reviewing its supervision of the banks. The FDIC has launched an investigation into the conduct of management of the two banks. The DOJ and SEC have also announced separate investigations into the collapses that will review actions of senior executives for instances of possible fraud and failure to disclose material risks.

Those investigations have not stopped some policymakers from moving forward on additional accountability measures. The odd pair of Sens. Rick Scott (R-FL) and Elizabeth Warren (D-MA) are leading legislation to establish an independent investigator general at the Federal Reserve and the Bureau of Consumer Financial Protection. Sen. Bernie Sanders (I-VT) introduced legislation that would prohibit bank executives from serving on Fed boards that regulate their banks. The proposal would also bar Fed employees and board members from owning stock or investing in institutions the Fed is charged with regulating.

Many in Congress have objected to altering policies that regulate banks until hearings and various investigations are complete. Questions remain as to whether this was a banking regulation problem or an oversight problem by the regulators and if the main problem was that regulators were too slow to respond to the impact of raising interest rates so quickly on the stability of the banking system. The primary legislation already proposing to tighten regulation comes from Sen. Elizabeth Warren (D-MA) and Rep. Katie Porter (D-CA), which would repeal a portion of the 2018 law that partially rolled back Dodd-Frank provisions, easing the requirements for some mid-sized banks. That 2018 deregulation gives the Fed the power to apply stronger rules on a “tailored” basis to firms in the $100-250 billion asset range, which Senate Democrats have urged Vice Chair Barr to exercise.

Deliberations to Expand Bank Deposit Insurance

Last week, Treasury Secretary Janet Yellen offered mixed signals on the willingness of regulators to offer broader insurance to US deposits. On Tuesday, Yellen stated “our intervention was necessary to protect the broader U.S. banking system. And similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.” However, her comments on Wednesday sent jitters through markets, saying that Treasury officials had neither considered nor examined the possibility of extending federal insurance to all US bank deposits. The next day, she reassured House lawmakers that agencies stand “prepared to take additional actions if warranted.”

The distinction lies in keeping emergency options available to regulators should financial fragilities continue, versus the apparent distaste among policymakers to raise the FDIC’s insurable deposit limit on a permanent basis. Any permanent limit increase faces an uphill battle as congressional action would be required. That effort has been led by Sen. Elizabeth Warren (D-MA) who proposed raising the limit to between $2 million and $10 million. Senate Banking Committee Chair, Sherrod Brown (D-OH) and committee member Sen. Mike Rounds (R-SD), among others, have expressed openness to reviewing the adequacy of FDIC deposit limits as an area of bipartisan collaboration, potentially considering a separate cap for business deposits.

House conservatives so far have opposed any blanket guarantee, with the House Freedom Caucus saying in a statement “any universal guarantee on all bank deposits, whether implicit or explicit, enshrines a dangerous precedent that simply encourages future irresponsible behavior to be paid for by those not involved who followed the rules.” House Financial Services Chair Patrick McHenry (R-NC) has held that the focus be on doing what is necessary to maintain financial stability, while gathering additional facts before moving forward with any policy changes.

The deliberations have met a growing chorus of trade groups representing community and midsize banks calling for expanding deposit coverage to “halt the exodus of deposits from smaller banks.” Newly released data for the week ending March 15 (the week of SVB and Signature’s collapse) showed small banks losing $109 billion in deposits, compared to inflows of $120 billion at the largest 25 banks. In the same week, nearly $121 billion was plowed into money market funds as investors fled to high-quality, liquid assets.

However, questions remain as to whether regulators possess the authority to apply a temporary industry-wide deposit guarantee if further emergency action were necessary. One avenue said to have been under consideration is using emergency action backed by the Exchange Stabilization Fund, which is the only funding source under complete Treasury secretary authority as opposed to Congress. Sheila Blair (FDIC Chair 2006-2011) has said that unilateral authority is questionable, as Congress removed the provision under Dodd-Frank that allowed the FDIC to unilaterally raise the cap if a “liquidity event” posed systemic harm. Instead, a fast-track procedure for congressional approval could be invoked with coordination between the Federal Reserve and the Treasury.

Other Banking Crisis Updates

Last Sunday, the FDIC announced it had agreed to sell the deposits, loans, and branches of Silicon Valley Bridge Bank (SVB) to First Citizens Bank & Trust Company. Raleigh-based First Citizens Bank was the 30th largest US lender at the end of 2022 and will assume roughly $56 billion in deposits, $72 billion in loans, and 17 branches at a discount of $16.5 billion. According to the FDIC, $90 billion of securities and other assets will remain in receivership and the total loss from SVB’s collapse to the Deposit Insurance Fund is estimated at $20 billion. As part of the deal, the FDIC also offered First Citizens a $70 billion line of credit to boost liquidity, allowed the bank to complete the purchase by issuing a $35 billion bank note to the agency, and agreed to cover losses in excess of $5 billion over the next 5 years on the commercial loans it assumed. Regarding shareholders, all shares of Silicon Valley Bank are owned by its holding company SVB Financial Group, which was not included in the closing of the bank or resulting receivership. Upon the closing of the bank, the FDIC directed all shareholders to not contact the Receiver or file a claim but instead to contact the holding company directly.

The news comes one week after the FDIC struck a similar arrangement for Signature Bank to be assumed by New York Community Bancorp and its Flagstar Bank subsidiary—estimated to cost the FDIC $2.5 billion. While the exact costs will be determined at the conclusion of FDIC receivership, the roughly $23 billion in losses incurred from the two bank collapses will pull from the $128 billion Deposit Insurance Fund and be recouped through special assessment fees on banks. The FDIC plans to release its proposed special assessment in May for public comment.

US officials were reported to also be considering further liquidity support through expansion of its emergency lending facility, with a particular eye on the troubles of First Republic Bank. However, it was determined late last week that no immediate action was needed as First Republic and its peer banks were seen as stabilizing. Banks tapped Federal Reserve liquidity facilities at record levels amidst the collapse of SVB and Signature, borrowing $165 billion in the week ending March 15, compared to $112 billion reached during the Great Financial Crisis. Newly released data for the week ending March 22 showed that bank borrowing held steady, however balances shifted towards the newly created Bank Term Funding Program—rising to $54 billion from $12 billion. That shift indicates that banks with underwater government bonds may continue to rely on the emergency window that allows them to exchange securities at par for loans of up to one year.

Conclusion

The collapse of SVB and Signature Bank and the consequent destabilizing impact in the banking system raises serious concerns about how to shape the regulatory and oversight policies going forward for long-term stability in the banking system. Many legislators believe that understanding the reasons for the collapse, is central to moving forward, which elevates the importance of this week’s congressional hearings.

And, while the emergency response is largely supported by both parties in Congress, it raises important questions as to the impact of those decisions on the risk assessments of the smaller and medium sized banks on two important fronts—if they are small enough to fail what will be the impact on the US banking system as a whole; but, on the other hand, if all depositors may be insured—does that affect adversely how banking management, depositors and the market generally discipline risk. Developing a regulatory process that navigates these two fronts and provides long term stability is the challenge ahead. The policy decisions will have significant impact on the banking structure in the US and whether further consolidation of US banks result.

As regulators face congressional lawmakers on Wednesday and investigations continue, CED will continue to follow the fallout of the banking crisis and policymakers’ reaction in reassessing the regulatory framework for banks moving forward.

US Banking Crisis: The Response from Washington

Updated March 23, 2023

The Fed, US Treasury, and the White House had swift reactions to the banking crisis sparked by the failure of SVB. The actions helped calm markets in the short run and even facilitated rate hikes by the ECB and the Fed. However, the episode is far from over. There are still concerns about more shoes to drop in terms of other banks potentially coming under stress, and what the regulatory and legislative response should be to prevent this from happening again. Policymakers on capital hill have weighed in over the last two weeks (see Policy Brief: Banking Crisis Update and Policymakers Reaction). We note key highlights to date.

Investigations announced:

- Congressional investigations The bank failures as well as regulator’s failed supervision have prompted calls for investigations. The DOJ and SEC have already announced separate investigations into the collapse of Silicon Valley Bank that will review actions of senior executives for instances of possible fraud and failure to disclose material risks. Senators have also requested those investigations review SVB executives’ actions, including lobbying for regulatory rollbacks in addition to stock sales and compensation packages that were executed immediately preceding federal intervention. President Biden has called on Congress to empower the FDIC to punish executives of banks requiring government assistance, including by clawing back pay, levying fines, and barring them from future employment in the banking sector.

- Regulatory investigations The Federal Reserve, which has faced criticism for missing signs of risk at SVB, also announced its own internal review of its supervision and regulation of the bank, with a report expected to be released by 3 May 1. Some legislators have urged that Fed Chair Jerome Powell recuse himself from the internal review. Members of Congress from both parties have already pushed for their own independent investigations.

Deliberations of Policymakers

Some policymakers are calling for tighter regulations and stricter laws, but not everyone is in favor.

- The White House’s plea Attempting to calm, President Biden called on Congress to strengthen rules on banks to minimize the likelihood that similar bank failures happen again. Legislation has already been introduced by progressive Democrats to repeal a portion of the 2018 law that partially rolled back Dodd-Frank provisions, easing the requirements for some mid-sized banks.

- Congress divided While both Democrats and Republicans largely support the emergency actions, the call for further regulation is being challenged from members on both sides of the aisle. Not all Democrats are eager to support new enhanced regulations, which further complicates legislative action in a Congress already under divided party control. There were 17 members of the Democratic conference in 2018 who voted with Republicans to ease regulatory scrutiny for banks with between $50 billion and $250 billion in assets. “I don’t want to embrace solutions until I hear the analysis,” said Sen. Tim Kaine (D-VA), who noted that the existing law gives regulators space to tailor rules on banks in the size range of SVB and Signature. Sen. Jeanne Shaheen (D-NH) voiced a common refrain, “All the regulation in the world isn’t going to fix bad management practices, and it appears that that’s one of the problems and SVB.”

- Stricter laws face uphill battle Even if the bill were to achieve the 60 votes needed to clear the Senate, it faces a steeper climb in the Republican-controlled House. "Building a culture of government intervention does nothing to stop future institutions from relying on the government to swoop in after taking excessive risks," said Sen. Tim Scott (R- SC), the ranking member on the Senate Banking Committee, in a statement. House Financial Services Chair Patrick McHenry (R-NC) echoed Scott: “I have confidence in our financial regulators and the protections already in place to ensure the safety and soundness of our financial system.”

Questions have risen over whether the original Dodd-Frank legislation would have prevented the SVB collapse.

- Deeper analysis of the regulatory framework The larger question still to be discovered is whether the original Dodd-Frank provisions would have prevented SVB’s failure, or if culpability lies with regulators not enforcing current rules, or in the end poor risk management is to blame. Barring a crisis situation that demands immediate legislative action, hearings in both houses of Congress, will be the first order of business. Sen. Angus King (I-ME), who caucuses with Democrats, said “I believe in ready, aim, fire—not ready, fire, aim,” King said. The 2018 rollback raised the asset threshold for a bank to be designated as systemically important from $50 billion to $250 billion, exempting banks between those sizes from associated oversight. SVB ($200B) and Signature ($100B) both fall in that range. Dodd-Frank liquidity regulations, known as the Liquidity Coverage Ratio (or LCR), were split into “full” and “modified” versions. Those requirements mandate that banks hold either 100 percent or 70 percent of high-quality assets compared to estimated cash outflows in a 30-day stress environment. Moving these banks, and SVB in particular, to the lower category lowered the requirements relevant to supervisors.

- SVB probably was a SIFI in behavior (asset duration and share of uninsured deposits) although not in name However other Dodd-Frank provisions would have arguably forced SVB into the more stringent category as it reported more than $10 billion in foreign exposure on its final 2022 reports. If subjected to full LCR, SVB would have bumped up against its regulatory minimum at the end of last year. But the full LCR requirements call for daily reporting. Given SVB’s deteriorating balance sheet as deposits flowed out, LCR triggers would have been activated and invited additional regulatory scrutiny.

Policymakers are considering raising FDIC insurance threshold.

- Temporary threshold increase might be warranted In questioning Yellen, Sen. James Lankford (R-OK) asked “will the deposits in every community bank in Oklahoma, regardless of their size, be fully insured now?" Treasury Secretary’s response during her Senate testimony, was that the protection to depositors of the two failed banks would not be extended to every bank that fails, only to those that pose systemic risks. The impact on smaller community and regional banks is a rising concern, as deposits have flowed quickly towards the country’s largest banks in search of safety. According to Sheila Blair, who led the FDIC from 2006 to 2011, the agency may need to take similar steps as it did in 2008, offering temporary guarantees for all uninsured US bank deposits rather than stepping in case by case. Under the 2010 Dodd-Frank law, the FDIC was provided authority to raise its deposit cap for all accounts if a “liquidity event” posed harm to the financial system. Expedited Congressional approval would be needed for such a move with coordination between the Federal Reserve and the Treasury.

- Permanent threshold increase under consideration Over the weekend Sen. Elizabeth Warren (D-MA) proposed raising the maximum insurable amount covered by the FDIC, which is currently limited to $250,000 per individual or business. She suggested a level of between $2 million and $10 million. That idea seems to have bipartisan support; Rep. Patrick McHenry (R-NC), chairman of the House Financial Services Committee, and Sen. Mike Rounds (R-SD), a member of the Senate Banking Committee, both expressed willingness to review the sufficiency of FDIC deposit limits.

Insights for What’s Ahead

The collapse of SVB and Signature Bank and the consequent destabilizing impact in the banking system raises serious concerns about how to shape the regulatory and oversight policies going forward for long term stability in the banking system. Understanding the reasons for the collapse, is central to moving forward, which elevates the importance of the executive branch investigations and congressional hearings.

And, while the emergency response is largely supported by both parties in Congress, it raises important questions as to the impact of those decisions on the risk assessments of the smaller and medium sized banks on two important fronts—if they are small enough to fail what will be the impact on the US banking system as a whole; but, on the other hand, if all depositors may be insured—does that affect adversely how banking management, depositors and the market generally discipline risk. Developing a regulatory process that navigates these two fronts and provides long term stability is the challenge ahead.

The Fed’s Rates Decision

Despite the ongoing bank crisis, the Federal Reserve continued its campaign to wrestle US inflation to the ground, raising interest rates and dialing down the size of its balance sheet (see The Conference Board FOMC Meeting Reaction).

On Wednesday, March 22, the federal funds rate was raised to a range of 4.75 to 5.00 percent and the bank made no change to its program of reducing holdings of Treasury securities, and agency and agency mortgage-backed securities on its balance sheet. The March Summary of Economic Projections (SEP) also indicated that the Fed may raise the federal funds rate to a terminus of 5.00 to 5.25 percent and maintain it at that level for longer than indicated in the December SEP.

Importantly, the Fed took the meeting as an opportunity to reiterate that the US banking system is “sound and resilient,” supporting today’s action. However, the Fed did state that tightening credit conditions from recent developments (i.e., the banking crisis) may result in tighter credit conditions that will weigh on economic activity, hiring, and inflation. The bank did say that the extent of the effects is uncertain, but the Committee remains highly attentive to inflation risks. In other words, material dampening from the banking crisis probably means fewer interest rate hikes to go, but less or no dampening may mean more interest rate hikes in train.

Insights for What’s Ahead

The Fed’s action is consistent with our expectation that the extent of ringfencing of troubled institutions and the safety nets of easier access to liquidity would be sufficient for it to continue to focus on fighting inflation at the March meeting. The SEP signaling one more interest rate hike is one less than we project. We expect two more hikes to 5.25 to 5.50 percent. Higher rates for longer dovetails with our expectation of no consideration of rate cuts until Q2 2024. However, we expect more cuts in 2024 than the Fed’s SEP signals given our recession call (see The Conference Board US Economic Forecast).

Updated: Monday, March 20, 9:30am EDT

SVB Banking Crisis Update

The banking crisis continues, but several events over the last week and weekend may help calm markets over the next few days.

Weekend Events

As the banking crisis sparked by SVB’s failure continued to unfold, four significant events occurred over the weekend, each aimed to calm the financial market turmoil.

1. On Sunday, UBS Group agreed to merge with Credit Suisse Group for roughly $3 billion, marking the largest bank merger of Systemically Important Financial Institutions (SIFIs) institutions since the financial crisis of 2007-08. The Swiss National Bank provided $100 billion of liquidity to UBS to help facilitate the takeover, and the Swiss government will backstop some of UBS’ losses with roughly $9 billion. The assumption of Credit Suisse by UBS avoided a regulator-led bankruptcy and unwind that would have taken longer and potentially strained the financial system.

Insights for What’s Ahead: The repercussions of this action, while likely unavoidable, include 1) UBS will become an even larger SIFI and the only national institution of its size in Switzerland; and 2) global counterparties (e.g., trade, FX, derivatives, cash management, etc.) will look at other vulnerable national entities in other economies.

2. Also on Sunday, in a joint statement the Fed and the US Treasury welcomed the merger of the two Swiss megabanks to support financial stability. Chair of the Federal Reserve Jerome Powell and Treasury Secretary Janet Yellen reiterated that the capital and liquidity positions of the US banking system are strong, and that the US financial system is resilient. European Central Bank President Christine Lagarde also issued a statement supporting the Swiss authorities actions to restore orderly market conditions and financial stability. She also stated that while the Euro Area banking sector is resilient, the ECB stood ready to provide liquidity.

Insights for What’s Ahead: These statements are important signals to consumers and businesses, but financial markets may continue to remain volatile unless the other tactile containment measures are successful in providing adequate liquidity to the financial system and stops the flight to risk that is weighing on government sovereign debt yields in the US and Europe.

3. One hour later, the Fed along with five other central banks (Bank of Canada, Bank of England, Bank of Japan, European Central Bank, Swiss National Bank) announced a coordinated central bank action to enhance the provision of US dollar liquidity. The action involved US dollar liquidity swap line arrangements. Central bank liquidity swaps are designed to improve liquidity conditions in US and foreign financial markets by allowing foreign central banks to provide US dollar funding to domestic institutions during times of market stress. Stabilizing foreign dollar markets support foreign economic conditions which also benefits the US economy via confidence and trade channels. Sunday’s action would improve US dollar funding by increasing the frequency of 7-day maturity operations from weekly to daily starting Monday, March 20, 2023 and lasting through at least through the end of April.

Insights for What’s Ahead: This joint action will be pivotal to providing US dollar liquidity to financial market actions abroad to help curb greater contagion risks.

4. Again on Sunday, a subsidiary of New York Community Bancorp, Inc. agreed to assume deposits of Signature Bridge Bank from the FDIC. New York Community Bancorp’s Flagstar Bank, NA will absorb 40 branches of Signature Bank. The FDIC estimates that the cost of Signature Bank’s failure cost approximately $2.5 billion.

The largest liquidity swaps were during the European Sovereign Debt and Banking Crisis and during the pandemic.

<

Sources: Federal Reserve Board and the Conference Board.

Other Key Events

Several other key events have occurred since the outbreak of the bank crisis, with implications for monetary policy and the financial system.

- ECB Hikes Interest Rates – The European Central Bank hiked interest rates by 50 basis points in line with its determination to ensure the timely return of inflation to the 2% medium-term target. Although the banking crises were occurring in the US and Switzerland, sovereign debt of economies within the Euro Area were under pressure. Nonetheless, the ECB sent a strong message that fighting inflation remained the greatest challenge to the Euro Area economy. Moreover, the move contributed to a degree of confidence that its actions would not exacerbate the financial market turmoil in the wake of the banking crisis, as it can do two things at once: tighten credit to address inflation while maintaining a sufficient degree of liquidity.

- Insights for What’s Ahead: Potentially, the ECB’s actions are a template for the Fed as it heads into its March 22 meeting. We continue to anticipate a 25-basis point hike Wednesday, and for the Summary of Economic Projections to signal several more hikes to go followed by a pause into early 2024.

ECB hiked interest rates last week even amid the banking crisis

<

Sources: Bank for International Settlements, regional central banks, and The Conference Board.

- US Banks Borrowed Billions from Fed Facilities – To shore-up the financial system in the wake of two US and European bank failures and stress, roughly $145 billion was withdrawn from the Federal Reserve in loans to US banking institutions during the week ending March 15, 2023. The loans from three sources (primary credit to depository institutions, Bank Term Funding Program, and other credit extensions) the Fed is making to banks to facilitate liquidity exceed those issued during the financial crisis of 2007-08 ($112 billion) and the pandemic ($50 billion) from this subset of credit facilities. However, the lending so far is still far below the total amount of loans the Fed issued in 2007-08 at $438 billion.

Banks began drawing on the Fed for liquidity in first week of availability

<

Sources: Federal Reserve Board and The Conference Board.

Fed loans to banks exceeding Great Financial Crisis and Pandemic levels

<

Sources: Federal Reserve Board and The Conference Board

Updated: Friday, March 17, 10:05am EDT

US Banking Crisis—One Week Later

One week ago, Silicon Valley Bank (SVB) experienced a massive run on its deposits, resulting in its failure and a consequent roiling of financial markets. A second bank—Signature Bank—failed, and others came under pressure. To arrest the crisis, the White House, US Treasury, Federal Deposit Insurance Corporation, and Federal Reserve (Fed) took quick actions to reassure Americans that the US banking system is safe. According to the US administration, the emergency actions do not necessarily constitute a "bailout" given the shifting of the rescue risks to the private sector, and as stock and bond holders of the failed banks will not be protected.

Primary actions included:

- SVB and Signature Bank were given the designation of systemically important financial institutions (SIFIs) by the US Administration, to allow for emergency actions on their behalf. Usually only the very largest banks are given this designation. This systemic risk exception was made just for these two banks.

- SVB and Signature Bank depositors were given full access to their funds starting Monday, March 13. These actions protected uninsured deposits (i.e., deposits in excess of $250,000), some of which were from corporate accounts. Indeed, many SVB clients were venture-funded tech firms, and Signature largely served private companies and crypto asset firms.

- The Federal reserve established a new liquidity facility, called the Bank Term Funding Program (BTFP). Banks, savings associations, credit unions and other depository institutions holding safe (i.e., high quality) assets, can swap these assets for cash. The swap is essentially a loan that lasts for up to a year. The collateral used includes anything for purchase by the Federal Reserve Banks in open market operations, such as US Treasuries, agency securities, or agency mortgage-backed securities. Also, while the value of these assets held by banks for swap have fallen, the Fed will accept them for 100 cents on the dollar. This facility is designed to shift the risk of the rescues to the banking (i.e. private) sector and not tax payers. However, if those banks have losses, there is the potential that the government will have to absorb the losses on these loans if not repaid in full.

- The Treasury will also help backstop the Fed’s BTFP with $25 billion from its Exchange Stabilization Fund.

Since the government rescues, markets have been in upheaval

First Republic Bank came under pressure and received funding offers from the Fed and JP Morgan Chase, which provided 70 billion of unused liquidity on top of any funds it can borrow from the Bank Term Funding Program. First Republic Bank received $30 billion in a joint rescue by 11 large bank banks

While the UK arm of SVB was acquired by HSBC for 1 dollar, regulators have struggled to find a buyer for the parent SVB. SVB’s creditors formed a group to potentially profit from the sale of the institution’s nonbank assets if a bankruptcy filing is placed. This might help bondholders to recover at least a portion of their losses since the failure.

In Europe, contagion fears were stoked by financial stability troubles at Credit Suisse Group AG. Swiss regulators offered to provide liquidity to the SIFI after its shares tumbled and its bond rating collapsed to distressed levels. Although European markets recovered after the announcement, the selloff in Credit Suisse shares prompted vigorous buying in European treasuries as fears of contagion to other European banks mounted. The selloff in Credit Suisse shares ended once it announced that it will borrow $54 billion in funding from the Swiss National Bank.

Financial markets have generally sold off as fears of contagion to healthy banks and to mid-sized banks that may have replicated SVB’s profile in the US and abroad. Banking stocks tumbled, dragging down major stock indices (Dow and S&P several hundred points) and US treasury and German Bund yields collapsed. Falling yields means the price has risen because of a surge in demand as investors seek “safe-haven” assets. Liquidity declined for these bonds as well as derivatives of these securities used by investors to lock in prices and hedge risks. Spreads against these assets also widened, which is a sign of stress.

Fed policy actions next week remains up in the air

Economic data released amid the turmoil continued to suggest that inflation remains a problem, but the banking crisis casts doubt over the Fed’s monetary policy plans. Retail sales dipped in February, after a surge in January (see Retail Sales reaction), but were still significantly higher compared to a year-ago. Also, while CPI inflation eased somewhat in February, both overall and less food and energy, the gauges at 6.0 percent and 5.5 percent, respectively, remained extremely elevated (see CPI reaction). These readings both suggest that the Fed still has work to do regarding tamping down inflation.

We, along with many other forecasters, project the Fed will hike interest rates by 25 basis points at its March 22 meeting. However, if global financial conditions continue to tighten on bank contagion woes, then the Fed might consider a pause. Still, a pause would likely be accompanied by a strong message that the battle to tame inflation is not over and that once financial markets calm, the central bank will resume tightening. We think three more hikes are likely ahead (see The Conference Board US Forecast Update).

Bond market volatility reached new pandemic-era heights over the past week

<

Sources: Bank of America Merrill Lynch and The Conference Board

Banking stocks have collapsed, weighing down broader indexes

Sources: Standard & Poor’s and The Conference Board

**********

Updated: Sunday, March 13, 9:30pm EDT

The Silicon Valley Bank (SVB) Collapse & Implications for Business

On March 10, Silicon Valley Bank (SVB) was shuttered by US regulators after an insolvency scare prompted a run by depositors. At the time of publication, regulators are actively facilitating timely sales of SVB’s assets to other financial institutions with stronger balance sheets and liquidity. Federal regulators have said that all depositors of Silicon Valley Bank, as well as also-closed Signature Bank, will be able to access all of their money. Additionally, the Federal Reserve said it would make additional funding available to banks to ensure they have “the ability to meet the needs of all depositors” through a new “Bank Term Funding Program.” This facility will offer loans of up to one year to banks that pledge US Treasury securities, mortgage-backed securities, and other collateral.1

While the Federal Deposit Insurance Corporation (FDIC) may be able to contain the fallout from these two failures, will this lead to a US or even global financial crisis? The failures are far short of the 2008 crisis that hit the core of the banking system. However, we posit that contagion risks remain material, and that further action to restore confidence by regulators to safeguard the financial system and companies to protect themselves from financial harm may be warranted to avoid a broader crisis.

Insights for What’s Ahead

- Regulators must continue to bolster confidence in the US banking system. Regulators must communicate to the public three points:

- There is constant monitoring of the financial system and the health of financial firms;

- Regulators will take action when necessary, as exemplified by the steps being taken to contain the two bank failures; and

- Regulators must continue to provide any extra liquidity that is needed in the market.

- Regulators must also continue to provide adequate support to the financial system. We suggest that regulators take specific actions to underpin the financial system including:

- Transparency – Describing the new policy decisions put in place, including the new facility, and the seemingly unlimited protection of depositors by the FDIC.

- Risk assessment – Evaluating the implications of these decisions for the banking system as a whole and the risks these decisions may have on the governance of financial institutions.

- Duration – How long these emergency policies will remain in place to avoid creating other systemic risks.

- Venture capital (VC) backed companies should take measures to protect clients. Actions include:

- Speaking with investors and reassuring them of the transparency and robustness of your capital structure and banking relationships.

- Exercising due diligence on your counterparty risk exposure.

- Diversifying deposits across institutions.

- Asking investors to provide emergency liquidity backstops.

- Communicating with suppliers to ensure their liquidity as well as consistency of supply.

- Looking to raise equity in the near future.

- Banking institutions must take immediate steps to ensure liquidity but also plan for future crises.

- Immediately

- Take whatever action is needed to ensure liquidity and customer confidence, including reiterating what Treasury and the Fed have done to support financial markets.

- Communicate transparently with all clients about liquidity sufficiency.

- Review Asset-Liability Committee (ALCO) strategy with a focus on both tenor matching (i.e., having the assets and deposits with the same time profile (e.g., 10-year assets paired with 10-year deposits)) and liquidity pool depth (i.e., diversifying sources of funding including commercial paper, repos, triparty agreements, etc.).

- Review counterparty risks for rehypothecation (i.e., when assets your institution lends are lent again to third parties, which makes your bank an unsecured creditor to that third party).

- Carry a deeper buffer of cash liquidity than historic business practice might suggest.

- Future steps

- Lower leverage ratios.

- Reduce investments in risky assets.

- Ensure operating familiarity with the Fed’s discount window. Consider using it during times of low volatility to guarantee that processes work and that your institution has established a good relationship with the Fed window.

- Nonbank firms must take steps to protect their assets and clients from harm. Important actions include:

- Reviewing the flexibility of operating accounts with your banking institution.

- Raising liquidity in an abundance of caution.

- Checking the liquidity status of all vendors and suppliers.

- Draw down revolvers (a short-term credit facility from a bank) if needed, to backstop working capital needs.

- Reassure all stakeholders (customers, employees, and owners) by verifying and reporting on the depth of your company’s liquidity and banking sources.

- What to expect next? While capital tests may be useful to judge robustness of banks in some scenarios, we posit that the issue surrounding SVB’s failure concerned liquidity. Hence, the focus should be on ensuring there is sufficient liquidity in the US (and by extension, the global) financial system.

- More shoes may drop. The US banking system is indeed generally healthy and well capitalized, but even with emergency decisions just announced, financial institutions should evaluate their ALCO models. Other institutions may have replicated SVB’s asset-liability model. Consequently, additional institutions may come under liquidity stress and choose to 1) be absorbed by a larger institution; 2) partner with other more liquid institutions to create a more robust entity or consortium; or 3) dissolve.

- Possible contagion to Europe. There are clear concerns about international contagion given SVB’s operations in the UK. Firms abroad may have similar ALCO models to SVB’s.

- Potential Stablecoin spillover. There could be spillover between stablecoin markets as some of their assets may be intertwined in SVB’s assets.

- Fed pause possible. In addition to key economic data reports, this week’s activity in the banking sector and financial markets will be critical for determining if the Fed pauses its interest rate hiking cycle. While inflation remains the most important threat to the real economy, and this week’s CPI and retail sales reports may further underscore this fact, this financial crisis might prompt the Fed to not raise interest rates at the March 22 meeting. Instead, the Fed might state that it is pausing its campaign in order to wait for financial market volatility to die down and then resume tightening as appropriate once it feels confident that there will be no dislocations caused by its actions. Even with a pause, we believe several more interest rate hikes are in store before the Fed completes the cycle. However, if financial markets calm over the next few days, the Fed may proceed with an increase this month.

What Happened to SVB?

During the week of March 3, SVB experienced a massive bank run – where depositors withdrew deposits at a scale that overwhelmed the bank. SVB lacked sufficient cash to meet depositor demands, and on Friday, March 10, the FDIC seized the bank. Individuals and corporations are insured by the FDIC up to $250,000 per bank for all assets held at an individual bank.

SVB was the US’ 16th largest bank, mainly serving corporations and high-net-worth individuals linked to the tech sector. However, at the core, the FDIC’s guarantees are intended to protect retail (consumer) investors. Hence, there are grave concerns about whether depositors – many of which are businesses – will be made whole enough to continue operating and pay workers.

While US banks generally are well capitalized and possess high-quality assets, SVB’s woes centered primarily around liquidity, which were exacerbated by downshifts in deposits and net interest margins at the bank linked to weakness in the tech sector more broadly and rising interest rates. Three factors likely led to the illiquidity of the institution, with the first being the most critical:

- Tenor mismatch: SVB may have accepted short-term deposits from clients but matched them by purchasing very long-term fixed-rate assets. Ideally, deposit tenor should match asset tenor. The fault in this strategy is that a) when interest rates rise, the value of long-term deposits fall; b) long-term assets can take time to sell; c) selling those assets create a cash shortfall such that an institution has less depositor money to return to the client; and d) when assets are sold en masse in a “fire sale” the bank may not receive the best pricing for those assets. We posit that SVB’s capital and capital management may have been sound, but its cash and ALCO management was not. Capital provides reporting information, but cash provides liquidity.

- Decline in deposit base: Following the pandemic-era boon, the tech industry is now experiencing a swoon as consumer demand is shifting away from tech equipment and services with the return to the office. Interest rates have also risen precipitously as the Fed is tightening monetary policy to curb inflation, making debt more expensive for highly leveraged firms in the tech sector. Meanwhile, input costs, including labor, are on the rise. Consequently, tech firms have been forced to burn through more cash, as evident in reduced free cash flow and shrinking margins. IPOs are infrequent and VCs are unable to raise capital through subsequent funding rounds. If VCs deploy less cash, then companies are unable to keep more cash in bank accounts. Together, these dynamics potentially reduced SVB’s deposit base. Additionally, if SVB possessed a revolving credit facility (i.e., a bank line or credit card for clients), then companies likely drew on those bank lines to stay liquid.

- Shrinking net interest margin: Given the type of clients SVB hosted, shrinking net interest margin may also have weakened the bank. Net interest margin is the earnings banks make from paying less in interest on deposits than the interest charged on loans. SVB’s clients were corporations and high net worth individuals, both of which tend to be more sophisticated investors. Moreover, these clients are believed to have possessed billions of dollars in holdings at SVB, and thereby the leverage to ask for greater returns on their deposits as interest rates rose.

What Are the Contagion Risks?

Small bank failures are common and rarely lead to contagion, but the size of SVB and the interconnectedness of the global financial market suggest that the risk of contagion is material. Those risks include the following:

- Indiscriminate runs on other banks.

- Banks with similar lending and liquidity profiles as SVB may come under severe stress.

- The Fed and Treasury’s actions notwithstanding, there could still be future runs on more traditional banks by institutional (i.e., firms) and retail (consumers) customers. These other banks may not be low on liquidity or have mismatches in the time horizons of their assets vs. liabilities, but still come under pressure.

- Extensive reviews will be triggered.

- Regulators should review the implications of their emergency actions to address the current crisis.

- Banks should conduct extensive reviews of the banking relationships with their financial institution clients, including operating accounts, trading counterparty activity, and other transactions such, as letters of credit.2

- Banks should conduct extensive reviews of their corporate and retail clients for the same product sets.

- Seizing up of individual asset markets could occur Large institutional depositors may choose to hold back their available funds from the short-term lending market (e.g., commercial paper) while they wait for greater market clarity. This seizing up occurred during prior financial crises of 1991, 2000 and 2008.

- Foreign contagion is at risk. There could be spread of the US crisis to the UK given SVB’s operations in that economy’s banking system. This could lead to suspicion of other foreign firms with similar operating models.

- A further cascade of failures in the opaque crypto market is possible. The stablecoin market may become unstable given statements by some of the larger entities operating in this space that their assets are tethered to US currency and Treasury assets held at SVB. This reinforces concerns that, without safety nets for stablecoins, losses could emerge even where there are verifiable deposits.

- Broader contagion to financial markets and to the real economy. The thus far orderly slowdown in the US economy and layoffs limited to the most impacted sectors could rapidly become disorderly and flareup into another financial crisis and deep recession. Bank runs by ordinary consumers could cause a panic leading to a nosedive in consumer spending and massive job losses as firms react to the cratering of demand. Hence, the importance of regulators and financial institutions to continue to reassure Americans that the financial system is sound.

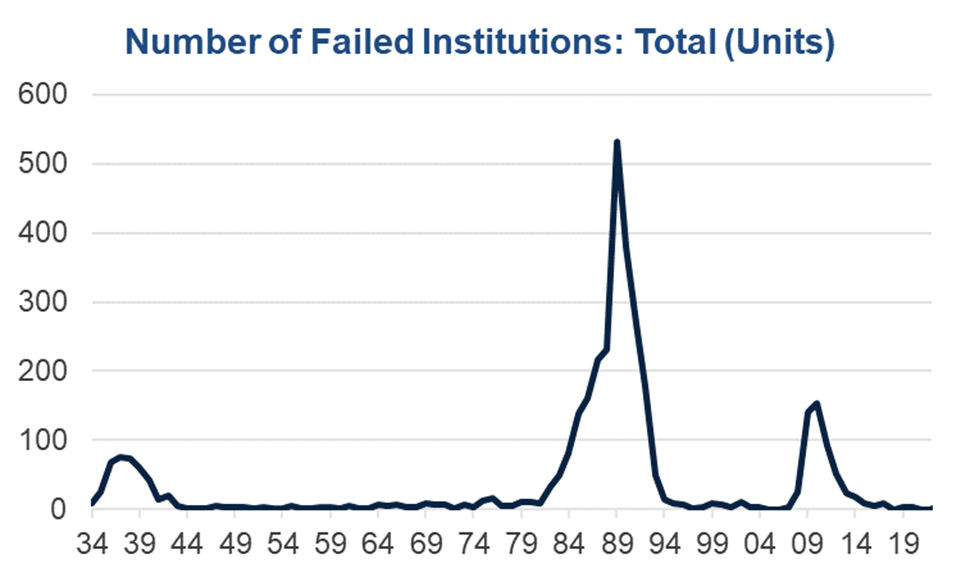

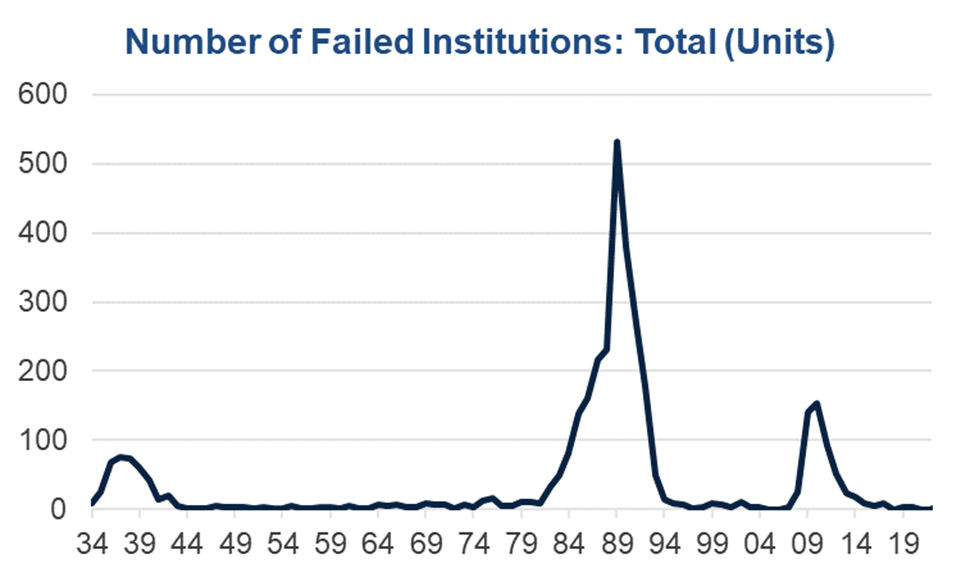

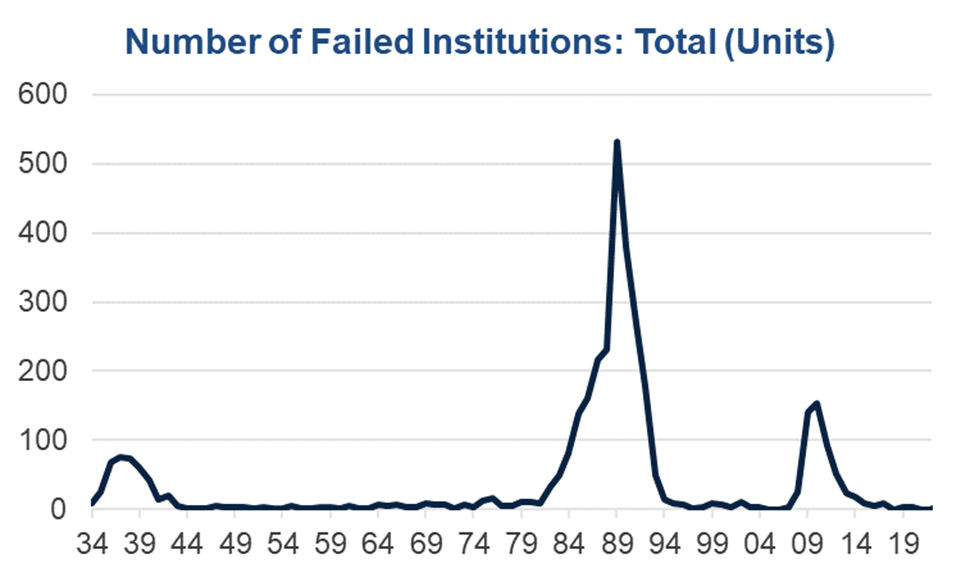

US Bank failures are common, but contagion is not

Sources: Federal Deposit Insurance Corporation and The Conference Board.

Additional Ripple Effects

In addition to some degree of contagion, SVB’s demise probably will cause other ripple effects through banking and financial markets:

- A hole in a major funding market. The dissolution of SVB may gut an important source of funding for tech firms. SVB might have provided bespoke capital options and complex lending packages that tech customers often require. Indeed, the complexity of the lending products might enhance the difficulty of selling off SBV’s assets. Tactically, without customized capital it probably will be difficult for capital intensive startups to launch and remain solvent.

- Flight to safety. SVB’s failure may result in its customers, and others like them to, seek traditional banks that are more liquid, better capitalized, and less complex, but less willing to offer customized capital. The largest US and global banks have the greatest opportunity to benefit in this tenuous environment.

- Fire sales of assets. The current crisis creates a buying opportunities for Private Equity and VC funds. Those with capital can potentially create an entirely new ecosystem for liquidity provision.

- Distressed sales. A few banks or even firms may sell themselves, look for partners with deep pockets, or even close in reaction to the scrutiny the SVB episode will bring.

- Unknown externalities. The FDIC’s systemic risk exemption for the two banks in crisis will have important, as of yet, unknown knock-on effects on the banking structure and governance.

What Are the US Government’s Next Steps?

The SVB event is an “old-school” run on a bank, but by an unusual set of depositors – particularly large corporations and wealthy individuals instead of SMEs and consumers. Per policy, the FDIC closed SVB and seized its assets. Once the initial dust settles, a critical question will remain: what will be the order of priority for those with claims on SVB’s assets? The following order is possible:

- Depositors will be made whole in excess of the prior $250,000 cap.

- Shareholders and certain unsecured debt holders will not be protected (i.e., equity holders could lose the entire value of their holdings; bond holders may suffer either a partial or total loss).

- For traders and counterparties, qualified financial contracts (QFCs) may be honored whether in the money or out of the money.3

- Letters of credit will be honored.

Concluding Thoughts

Regulator-mandated stress testing is paramount, but internal controls are critical. In this instance, capital and high-quality assets do not appear to be at the root of the events leading to SVB’s failure, but a dearth of liquidity. Opacity regarding internal operations and a lack of consideration of the more extraordinary needs of SVB’s clients might have also contributed to the blind sighting of regulators and SVB’s ultimate demise.

Hence, corporations must remain on constant alert for cracks in their own systems, especially in a high interest rate environment (see Three Steps to Managing Risk in a High-Interest Rate Environment). In addition to constant monitoring for risks (see Deploying Proactivity, Monitoring, and Vigilance (Seven Pitfalls of Business Risk Management, Part 1 of 4)), maintaining adequate cash reserves (see Cash Is King in an Illiquid and Capital-Opaque World (Seven Pitfalls of Business Risk Management, Part 2 of 4)), and championing due diligence to defend against external threats (see From Outsourcing Risk Management to DIY Threat Monitoring and Robustness (Seven Pitfalls of Business Risk Management, Part 3 of 4)), executives must also choose the right board members to advise the corporation through the worst of storms (see Your Board Can Be Your Best Risk Management Defense (Seven Pitfalls of Business Risk Management, Part 4 of 4)).

1 Federal Reserve Rolls Out Emergency Measures to Prevent Banking Crisis, Wall Street Journal

2 A letter of credit is a document sent from a bank or financial institution that guarantees that a seller will receive a buyer's payment on time and for the full amount – Source: Invetopedia.com.

3 Calls are in the money when the security's price is above the strike price, and out of the money when the security's price is below the strike price. Put options are in the money when the security's price is below the strike price, and out of the money when the security's price is above the strike price. – Source: TheBalance.com

Updated August 30, 2023

After a six-month lull, concerns about the US banking sector are resurfacing. A series of rating agency downgrades of banks heavily exposed to commercial real estate (CRE)—office space in particular—is renewing concerns. Meanwhile, mounting credit card debt and increasing charge-offs may also weigh on small- and medium-sized banks. Lending standards are tightening, and regulators are considering expanded restrictions for at-risk institutions. Uncover the latest troubles in the US banking sector and discover best practices for executives to navigate through uncertain times.

Click here for must see charts: 2023 Banking Crisis: US By the Numbers, 6-Month Update

Updated May 15, 2023

Must See Charts Updated: The worst of the banking crisis appears to be over, but stress in financial markets remains as uncertainty over additional shoes to drop looms large. Policymakers and regulators have assessed the causes of the crisis and are considering steps to prevent a similar crisis from occurring again. This update provides the latest on key metrics to watch amid the crisis and consideration of new risks to banks that might be just around the corner. Click here for must see charts: 2023 Banking Crisis: US By the Numbers

Insights for What’s Ahead

- Banks are still borrowing from the Fed to remain liquid, and this has stabilized at an elevated level. Money being withdrawn from the FDIC has fallen from a daily average of nearly $70 billion to just $12 billion. Outflows of deposits from small banks to large banks or various financial assets persist but at a slower rate.

- Policymakers are considering a variety of changes following internal reviews by the Fed and FDIC in early May. The FDIC recommended separating business deposits from its $250,000 insured limit, which would require congressional action. The FDIC also released a proposal for special assessment fees to recoup losses from the sales of SVB and Signature that would exempt the smallest banks. Losses on the sale of First Republic will be recovered separately through regular fees. Regulators at the Federal Reserve are examining whether stricter requirements should be reimposed on mid-sized banks with assets between $100 billion and $250 billion, particularly related to stress testing.

- So far, credit spreads remain narrow, and liquidity appears to be adequate. Still, the Fed anticipates some tightening in financial conditions (akin to a 25-basis point interest rate hike) due to the banking crisis. Businesses, small and large, may be more affected than consumers, who have already pulled back on big-ticket items requiring financing.

- Markets are still awaiting more shoes to drop. These might include difficulty for corporations to obtain cash from either banks or capital markets. Additionally, commercial real estate loan defaults may place added stress on small banks at a delicate time, and the looming debt ceiling may place upward pressure on borrowing costs and depress the value of US Treasury assets held by banks.

- Against this backdrop, The Conference Board continues to anticipate one more Fed interest rate hike as the banking crisis appears generally under control, but inflation remains uncomfortably high. Tight monetary policy is likely to induce a short and shallow recession, potentially starting in 2Q 2023, that results in some weakening in the labor market.

- Click here for must see charts: 2023 Banking Crisis: US By the Numbers.

Updated May 2, 2023

CED Policy Update: Banking Crisis Updates; Fed and FDIC Publish Reviews of Supervision

Insights for What’s Ahead

Amid the sale of First Republic Bank to JPMorgan, the Federal Reserve and the FDIC released reports reviewing the role of supervision in recent bank failures and policy considerations moving forward.

- The Federal Reserve’s report on SVB and FDIC’s report on SBNY each found lapses in regulatory oversight but also revealed repeated inaction by both management teams to address identified issues. Each agency plans to review its escalation and enforcement processes.

- The Federal Reserve’s review of SVB detailed plans to review capital and liquidity requirements for mid-sized banks (over $100 billion in assets) while revisiting how the agency assesses risk of uninsured deposits and its handling of growing banks transitioning between size classes. Nearly all the potential changes outlined can be made through standard rulemaking under existing authorities.

- The FDIC’s review of SBNY cited resource and staffing challenges as key contributors to supervisory issues at SBNY while also stating it will review its guidance related to uninsured deposits and to liquidity management.

- The FDIC’s separate review of deposit insurance recommends a targeted increase in insurance limits on business payment accounts, along with other provisions to support stability.

Read the full policy update here: Banking Crisis Updates; Fed and FDIC Publish Reviews of Supervision

Updated April 6, 2023

Must See Charts: The worst of the banking crisis appears to be over, but some stress in financial markets remains. Additionally, policymakers and regulators are still sifting through the rubble to consider what steps must be taken to prevent a similar crisis from occurring again. This latest update provides quick insights on the current state of play, how financial markets are reacting to events to date, and what to expect next. Click here for must see charts: 2023 Banking Crisis: US By the Numbers.

Insights for What’s Ahead

- Banks are still borrowing from the Fed to remain liquid, although it appears to be stabilizing. Money being withdrawn from the FDIC has fallen from a daily average of nearly $70 billion to just $5 billion. Outflows of deposits from small banks to large banks or various financial assets seem to have paused.

- Policymakers are considering a variety of proposed changes for medium-sized banks, deposit insurance, and regulatory scrutiny. Reaching consensus on action in a divided Congress will be difficult unless the crisis were to deepen. But congressional investigations of the failures are the first order of business. Regulators are examining whether stricter regulations should be reimposed on banks having assets between $100 billion and $250 billion. There is bipartisan interest in considering proposals to protect small and medium sized banks, including increasing the amount of insurance for deposits. Regulators are undergoing reviews to search for failures in oversight.

- So far, credit spreads remain narrow, and liquidity appears to be adequate. Still, the Fed anticipates some tightening in financial conditions (akin to a 25-basis point interest rate hike) due to the banking crisis. Businesses, small and large, may be more affected than consumers, who have already pulled back on big-ticket items requiring financing.

- Other shoes to drop might include difficulty for corporations to obtain cash from either banks or capital markets. Additionally, CRE loan defaults may place added stress on banks at a delicate time.

- Against this backdrop, The Conference Board continues to anticipate two more Fed interest rate hikes as the banking crisis appears under control, but inflation remains uncomfortably high. The Fed’s tighter monetary policy is likely to induce a short and shallow recession, potentially starting in 2Q 2023, that results in some weakening in a fairly robust labor market.

- Click here for must see charts 2023 Banking Crisis: US By the Numbers.

CED Policy Brief: Banking Crisis Update & Policymakers' Reaction

Updated March 29, 2023

This week, lawmakers are holding the first hearings over the handling of Silicon Valley Bank and Signature Bank. The hearings mark the first forum for Congress to press relevant regulators beyond Treasury Secretary Yellen and Fed Chair Powell to uncover details on the actions of the banks’ management. CED’s new Policy Brief breaks down how policymakers are reacting to the banking crisis.

The policy response will have an important impact on how banks manage risk as more and more banks are considered too systemic to fail, the extent of federal regulation and engagement in the US banking system, and the future of small and medium-sized banks.

In the coming weeks, there are several key areas to watch:

- Accountability: Lawmakers will scrutinize the banks’ risk management practices and public disclosures, while legislation has been introduced that would allow clawbacks of compensation for executives at failed banks.

- Regulator Reviews: Federal Reserve supervision is under review, with proposals for an independent investigator general as well as restrictions that would prohibit bank executives from serving on regional Fed boards. It would also bar Fed employees from investing in institutions under its jurisdiction.

- More Regulation or More Rigorous Regulatory Oversight: The big debate among policy makers is whether more regulation is needed over medium and small banks, or whether the Federal Reserve needed to adjust its stress tests to address the impact of higher interest rates on the health of the banks and whether it missed clear warnings of problems at SVB.

- Deposit Insurance Debate: Expanding FDIC deposit insurance either temporarily or permanently is the subject of ongoing discussion. Some lawmakers are opposed to universal insurance and expanding the role of the federal government in the banking system; while others are expressing concerns around smaller banks and business deposit accounts, which may benefit from an adjustment. How this debate plays out will have a major impact on the US banking system and whether it becomes much more consolidated. It will also have a major impact on how banking management, depositors and the market generally discipline risk.

Tuesday’s Senate Banking Committee Hearing

On Tuesday, the Senate Banking Committee hosted the primary regulators with oversight of the collapses of Silicon Valley Bank (SVB) and Signature Bank, featuring testimony from the Federal Reserve Vice Chair for Supervision Michael Barr, FDIC Chair Martin Gruenberg, and Under Secretary of the Treasury Nellie Liang. The executives of SVB and Signature, Gregory Becker and Joseph DePaolo, were absent from the hearing despite Committee Chair Sherrod Brown (D-OH) and Ranking Member Tim Scott (R-SC) issuing a joint letter requesting testimony from the CEOs. With a separate hearing Wednesday before the House Financial Services Committee, the two sessions are the first in what is likely to be a monthslong probe by lawmakers to understand the bank failures.

Vice Chair Barr called SVB’s failure a “textbook case of mismanagement” and assured the Committee that a full internal review of Federal Reserve supervision would be published by May 1. Chair Sherrod Brown (D-OH) struck a similar tone, remarking “the scene of the crime does not start with the regulators before us. Instead, we must look inside the bank, at the bank CEOs and at the Trump-era banking regulators, who made it their mission to give Wall Street everything it wanted.” However, the committee largely split along party lines. “Clear as a bell were the warning signs,” said Ranking Member Scott (R-SC), “by all accounts, our regulators appear to have been asleep at the wheel.”

It had been reported that Fed supervisors initially sent warnings to SVB management as early as the fall of 2021 regarding inadequate management of interest rate and liquidity risks. Barr offered new details on those interactions, some of which pre-date his role as Vice Chair that began in July 2022. Supervisors’ concerns grew in 2022 as those initial “matters requiring attention” (MRA) requests were not satisfactorily addressed by SVB and as rising interest rates were expected to begin pinching banks.

However, when asked by Sen. Mike Rounds (R-SD) the expected response time to an MRA or the more immediate MRIA, Barr only offered that it depended on the complexity of the request and repeated follow-ups were made. Sen. Jon Tester (D-MT) later followed up asking why the Fed didn’t act on the failure of management to address the flagged issues, “It looks to me like the regulators knew the problem, but nobody dropped the hammer.” While Republican committee members focused on the Fed’s supervisory role, Democrats focused on the 2018 rollback of Dodd-Frank rules that may have lowered the guardrails on midsize banks allowing for fragilities. Barr was also critical of those rollbacks from Congress and the implementation of the statute completed by prior regulators in 2019. When pressed by Sen. Elizabeth Warren (D-MA) over whether the three officials agreed that the government needs to strengthen rules for banks to prevent future collapses, all three agreed. "I anticipate the need to strengthen capital and liquidity standards for firms over $100 billion," said Barr.

Concerns were also raised that the money for the deposit insurance fund, which by law comes from a special assessment on other banks, would have the smaller community banks bearing the burden of these failures. FDIC Chairman Gruenberg responded that a recommended formula, which the FDIC has some discretion over, would be announced in early May.

Policymakers Focus on Accountability, Await Further Investigations

President Biden had called on Congress to empower the FDIC to clawback executive compensation from banks requiring government assistance. Lawmakers of both parties are receptive to that idea. “As far as clawbacks, there are provisions under law that apply to other sectors of the world of finance that perhaps should be applied here. We're going to take a look at that,” said Rep. Patrick McHenry (R-NC). Dodd-Frank provided the FDIC with clawback authority however the rule would need to be expanded to include banks the size of SVB and Signature. Legislation has been introduced by Sen. Richard Blumenthal (D-CO) in the Senate and Adam Schiff (D-CA) in the House to recover compensation through bonuses and stock sales through a tax paid into the FDIC’s deposit insurance fund.

US regulators have also announced their own reviews. The Fed’s internal report will be released by May 1 reviewing its supervision of the banks. The FDIC has launched an investigation into the conduct of management of the two banks. The DOJ and SEC have also announced separate investigations into the collapses that will review actions of senior executives for instances of possible fraud and failure to disclose material risks.