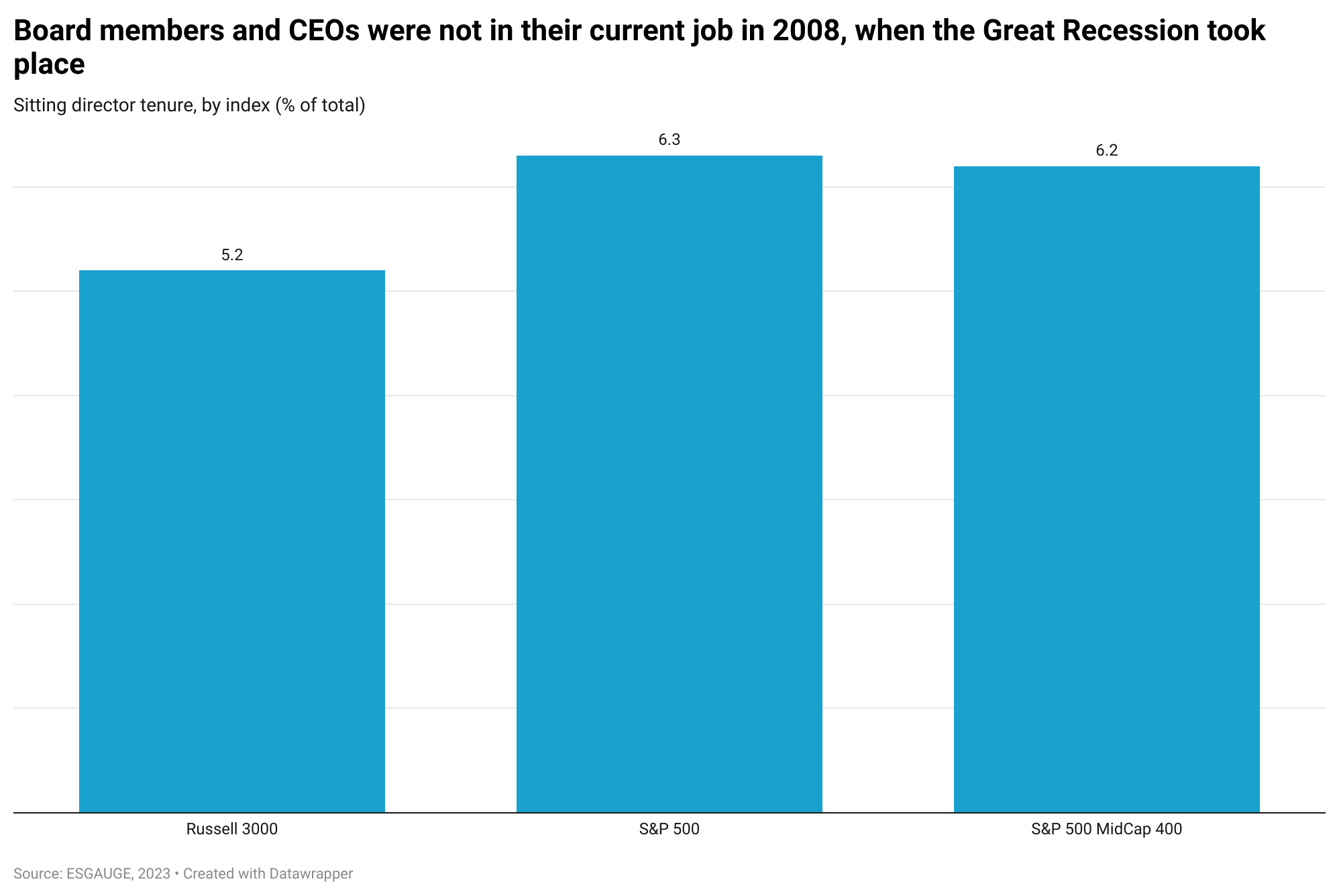

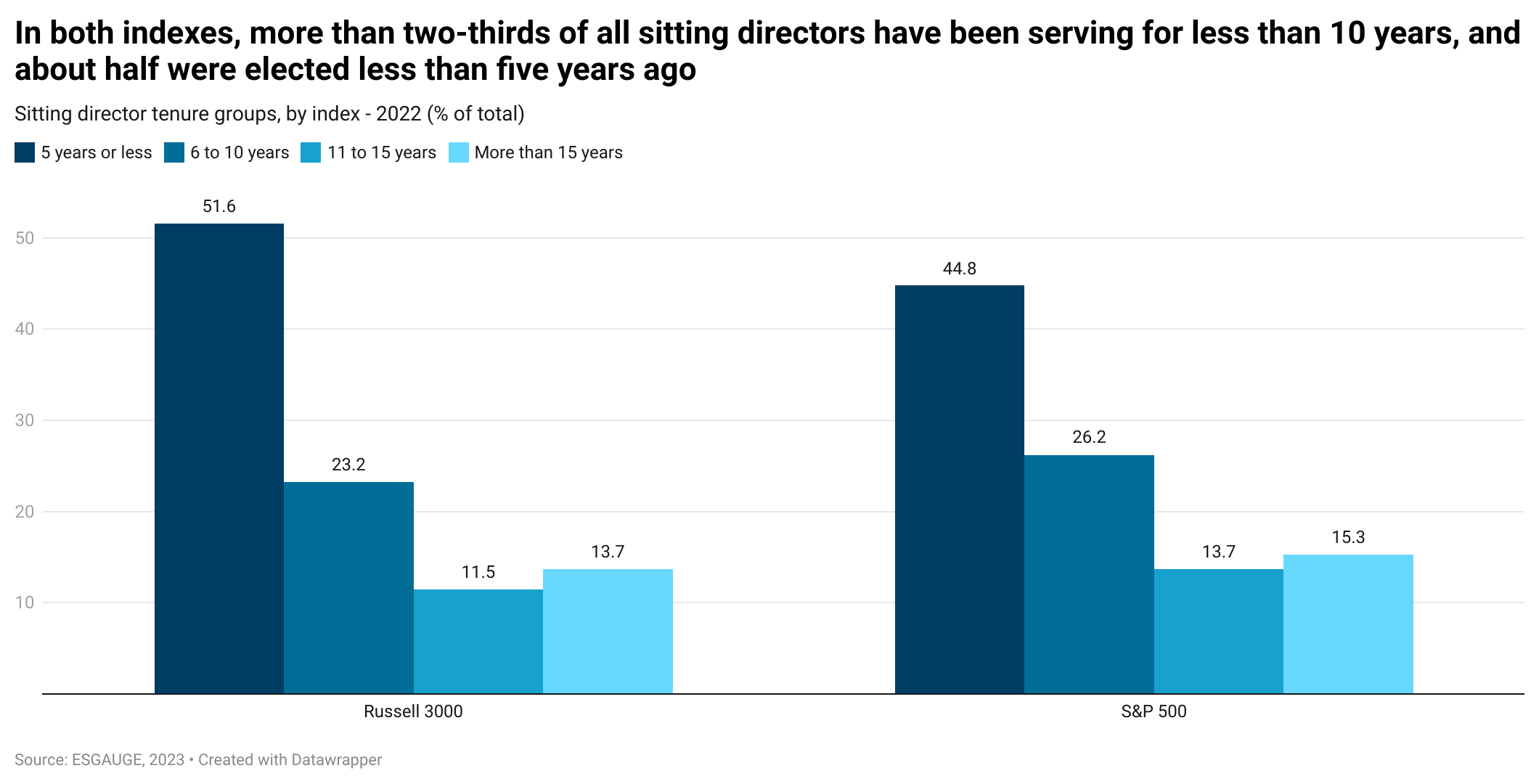

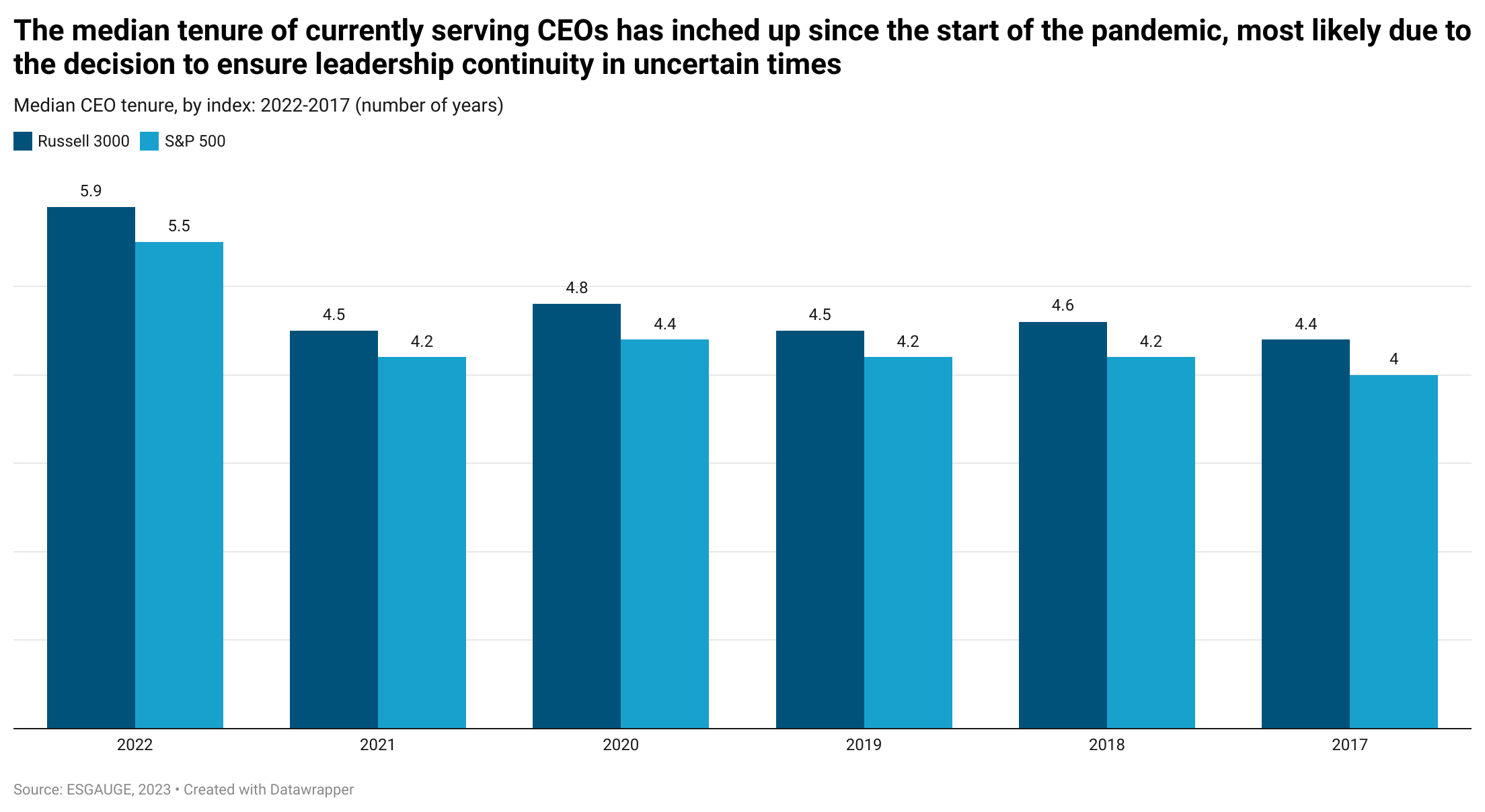

Recessions present unique challenges that require a different set of oversight skills and crisis management strategies than those used during periods of economic growth. Most US CEOs and board members who are bracing for the downturn The Conference Board projects for this year were not in their current role during the Great Recession of 2008. Yet, that period of turbulence can still teach important lessons.

The Conference Board first outlined lessons from the Great Recession when it released The Role of the Board in Turbulent Times: Leading the Public Company to Full Recovery in 2009.[1] It then updated them more recently, over the course of the COVID-19 crisis.[2] We believe these takeaways will continue to provide valuable insights in the months ahead:

Why the Current Economic Situation Has More In Common with the Financial Crisis of 2008 than the COVID-19 Recession of 2020Business leaders’ crisis skills were recently tested by the March–April 2020 downturn, when the pandemic wreaked havoc worldwide and brought to a sudden halt the consumption of many goods and services. Just like most other turbulent times, the onset of COVID-19 taught business leaders the importance of agility and adaptability. However, that recession was in many ways extraordinary. Its causes were unique: rather than the result of deteriorated economic conditions, it was induced by government lockdowns and travel restrictions meant to contain the spread of the virus and protect public health and safety. Unlike in other recessionary periods, the COVID-19 crisis prompted an unprecedented level of government interventions around the globe, not only by limiting the ability of many people to move freely but also by enacting measures of fiscal support that, at least to those extents, were hardly used before. Finally, that recession—the shortest on record in the United States—stood out for its severity and speed. Instead of a slow erosion of confidence, the downturn was sudden and hard, with economic output beginning to recover almost just as quickly. On many levels, the current economic situation has more in common with the Great Recession. It is developing over a much longer period of time, driven by a whole range of factors rather than a single calamity. In the 2007–2008 financial crisis, those factors were a housing market bubble, fueled by low interest rates; excessive risk-taking by financial institutions in the subprime mortgage business; and a sharp contraction in credit availability. This time around, the economic slowdown is accompanied by inflation, geopolitical instability, supply shortages, heightened competition to attract and retain talent, and accelerated digital and sustainability transformations of the economy. These are just some of the complex issues board members and CEOs will be facing as they steer their companies through the expected downturn. |

For other current statistics on board composition and CEO succession practices, please visit our Live Dashboards on ESG Advantage, Powered by ESGAUGE. In particular, for live data on director tenure, see the Corporate Board Practices Live Dashboard, a project conducted by The Conference Board and ESG data analytics firm ESGAUGE in collaboration with Debevoise & Plimpton, KPMG, Russell Reynolds Associates, and the John L. Weinberg Center for Corporate Governance at the University of Delaware. For live data on CEO tenure, see the CEO Succession Practices Live Dashboard, a project conducted by The Conference Board and ESGAUGE in collaboration with Heidrick & Struggles.

[1] Matteo Tonello et al., The Role of the Board in Turbulent Times: Leading the Public Company to Full Recovery, The Conference Board, September 2009.

[2] Matteo Tonello and Paul Washington, 7 Key Areas for Board Attention During the COVID-19 Crisis, The Conference Board, March 2020.

[3] See Lindsay Beltzer and Paul Washington, Crisis Management in the Era of ‘No Normal’, The Conference Board, September 2021.

[4] Also see Thomas Singer, Five Ways a Sustainability Strategy Provides Clarity in a Time of Crisis, The Conference Board, April 2020.