Q3 2021 GDP Growth Slows on Delta Impact

28 Oct. 2021 | Comments (0)

Comment on US GDP report for Q3 2021

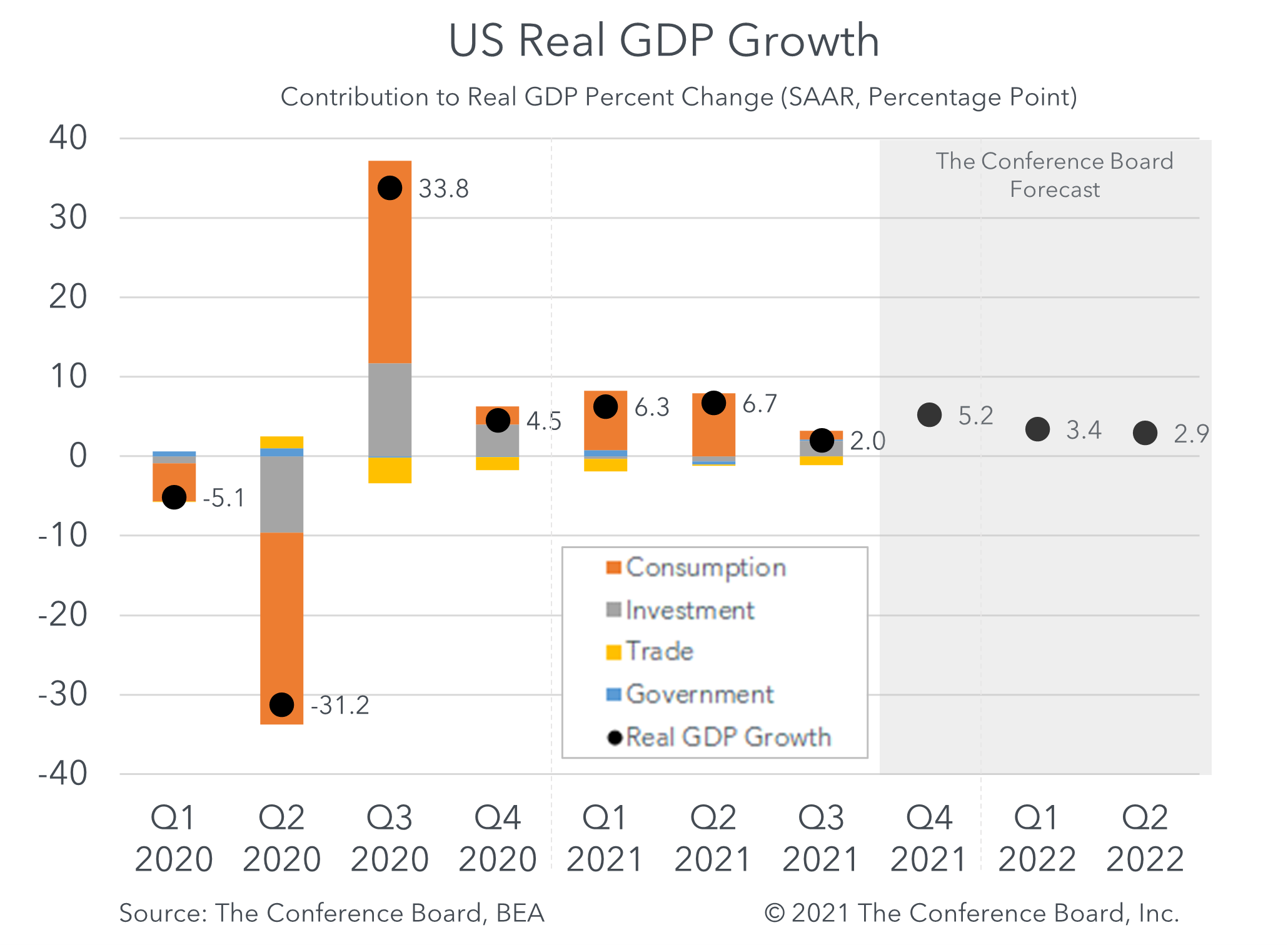

US Real Gross Domestic Product grew by 2.0 percent (annualized) during the third quarter of 2021, far below the consensus forecast of 3.6 percent* and The Conference Board’s forecast of 3.5 percent. This quarterly annualized growth rate was down from the 6.7 percent rate seen in Q2 2021 due to the impact of the Delta variant on the US economy. As this most recent wave of COVID-19 continues to ebb, we expect economic growth to reaccelerate in Q4 2021.

While overall GDP growth fell far short of our expectations due to the larger than expected impact of the Delta variant, the scale of the economic damage was not as severe as that seen during previous waves of the pandemic. The modest improvement in economic activity recorded in Q3 2021 was driven by growth in consumer spending, and nonresidential fixed investment, but several other GDP components offset growth. Personal consumption expenditures rose by 1.6 percent (annualized) – with spending on services contributing 3.4 percent to total GDP growth but a drop in spending on goods contributing -2.3 percent. Residential investment, which helped drive the economic recovery in previous quarters, contracted for a second quarter and subtracted 0.4 percent from overall GDP. Changes in private inventories, a notoriously volatile component of GDP, fell by USD 78 billion** from the previous quarter. While imports were close to our forecast, export growth was much weaker than expected due to continued constraints on global demand amid the pandemic. Finally, a contraction in federal nondefense spending held overall government consumption and expenditures growth down in the quarter.

Looking ahead, US economic growth is likely to reaccelerate as the burden of the Delta variant ebbs. The slowdown in infection rates coupled with continued progress on vaccinations -- and the likely introduction of vaccines for more children soon -- should help moderate any COVID-19 resurgence in Q4 2021. However, given the seasonal nature of the pandemic seen last winter another disruptive wave is possible in Q1 2022. Additionally, while the severity of month-over-month inflation rates has moderated somewhat, concerns about persistent rising prices remain high. Rising wages, bottlenecks in many supply chains, shortages of key parts, and elevated demand for key goods and services are behind the high inflation trend and it is difficult to forecast when these challenges will be resolved. High inflation will continue to hinder GDP in the future. Given these trends, the Federal Reserve is expected to begin tapering asset purchases starting in November and may introduce rate hikes before the end of 2022. Finally, it looks increasingly likely that another large wave of government spending may be on the horizon via a $1 trillion infrastructure package, but timing remains uncertain.

* October Blue Chip Economic Indicators® Survey

** chained 2012 USD

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy