Q4 2022 GDP growth slowdown will likely precede recession

26 Jan. 2023 | Comments (0)

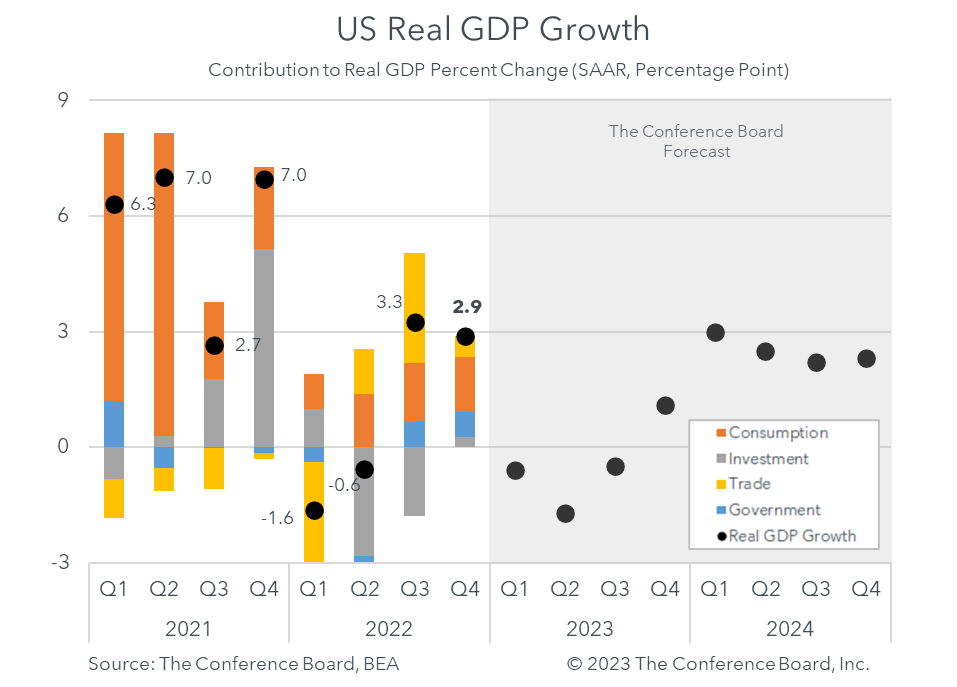

US Real Gross Domestic Product rose by 2.9 percent (annualized) during the fourth quarter of 2022, exceeding the consensus forecast of 2.6 percent* and The Conference Board’s forecast. While many components expanded for the quarter, they also showed softening. We continue to expect the US economy to slip into recession in early 2023.

GDP data in Q4 2022 showed a number of important trends that we expect to continue to play out in 2023. Consumer spending held up for the full quarter, but it appears to have fallen off dramatically in December. We’ll learn more about this in tomorrow’s Personal Income & Outlays report. The GDP data also showed that residential and non-residential investment are buckling under the weight of high interest rates. We don’t expect rates to fall for a year, so this trend will continue through much of 2023. Private inventories expanded more than expected in Q4 2022, boosting overall GDP considerably. This is unlikely to last. On the trade front, both exports and imports dropped for the quarter, but imports dropped more. This helped to boost overall GDP growth. These anomalies in inventories and trade mask deeper softness in the economy. Indeed, when stripping them out, GDP growth shrinks to just 0.8 percent.**

The individual components of GDP were mixed.

Personal Consumption Expenditures (PCE) expanded by 2.1 percent for the quarter, vs. 2.3 percent in Q3. Demand for goods grew by 1.1 percent, while demand for services grew by 2.6 percent, reflecting an ongoing shift in consumer spending patterns. Given what we know about PCE in October and November, however, these GDP data imply that December PCE growth was quite weak.

On the investment side, nonresidential fixed investment grew by just 0.7 percent, vs. 6.2 percent in Q3, due largely to weaker investment in equipment for the quarter (-3.7 percent). Residential investment grew by -26.7 percent, vs. -27.1 percent in Q3. This was the seventh consecutive quarter of negative growth and was associated with rising interest rates and elevated home prices. Private inventories expanded by $130 billion*** - an unexpectedly large amount. This increase from $39 billion in Q3 resulted in a boost to US GDP growth of 1.5 percentage points.

Government spending was a positive contributor to overall economic growth for the quarter, rising 3.7 percent for a second consecutive quarter. These recent expansions follow five consecutive quarters of negative growth.

Net exports contributed 0.6 percentage points to overall GDP. This was a weaker contribution than those seen in previous quarters and was fueled by a contraction of -1.3 percent in exports and an even larger contraction of -4.6 in imports.

Again, the topline GDP data mask a softening trend in the US economy that we expect to worsen in early 2023. We maintain that a mild recession is likely to begin in Q1 2023.

* Survey conducted by Bloomberg.

** Final sales to domestic purchasers is GDP less trade and changes in private inventories.

*** chained 2012 US$

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy