June PCE inflation data may push Fed to continue large hikes

29 Jul. 2022 | Comments (0)

June Personal Income & Outlays data, released this morning, showed an economy that is continuing to grapple with inflation. According to the Bureau of Economic Analysis (BEA), US income growth fell in real terms in June, but real consumer spending expanded slightly. Meanwhile, the inflation story appeared to have worsened in June as increases in the core PCE price index hastened for the month. Combined, these readings will likely push the Fed to continue raising interest rates in large increments over the coming months and increase the probability and potential severity of a recession this year.

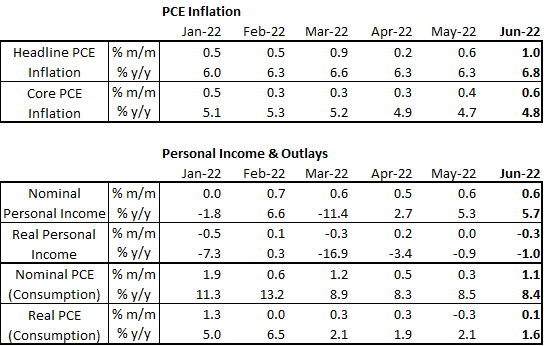

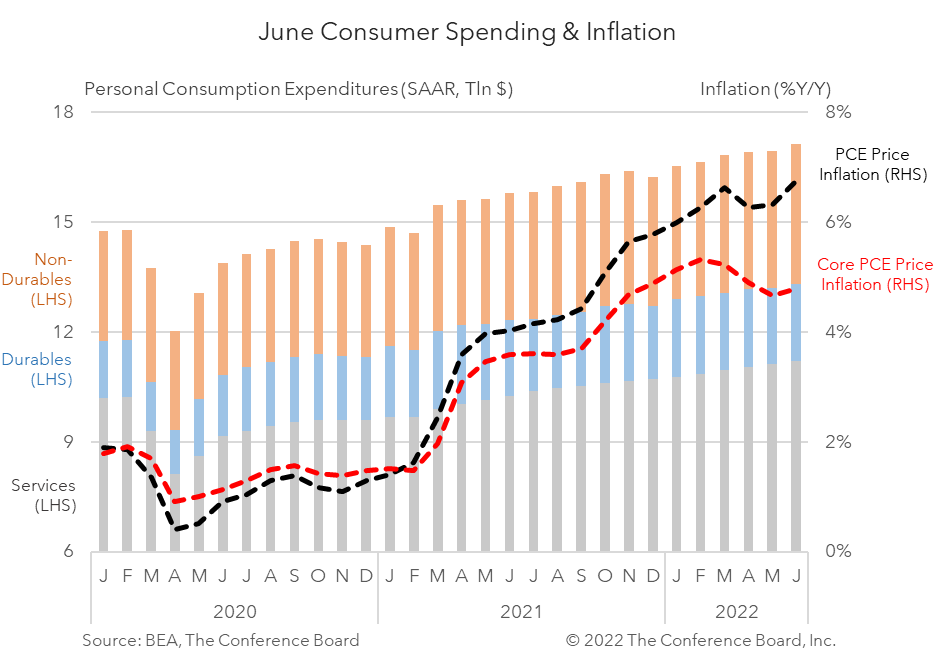

Headline PCE price inflation rose to 6.8 percent year-over-year (y/y) in June (a fresh 4-decade high) and core PCE price inflation rose to 4.8 percent y/y. On a month-over-month basis both inflation metrics worsened as well. While an acceleration in the June headline inflation number was expected given trends in energy and food prices last month, the acceleration seen in the core inflation reading (which strips out energy and food prices) is concerning. This trend suggests that inflation is spreading more broadly throughout the economy and increases the likelihood that the Fed will continue to make large interest rate hikes over the coming months.

Overall personal income growth rose 0.6 percent m/m (in nominal terms), vs. 0.6 percent m/m in May. However, the increase was more than offset by increases in prices. In inflation-adjusted terms, personal income fell by -0.3 percent m/m in June. Indeed, three of the last six months have seen negative real income growth. Thus, while Americans have recently seen their incomes rise in nominal terms, they are seeing their purchasing power eroded even more quickly.

Personal consumption expenditures rose by 1.1 percent m/m (in nominal terms) in June following a 0.3 percent m/m increase in May. Spending on services rose by 0.8 percent m/m while spending on goods bounced back to 1.6 percent m/m after contracting the prior month. After accounting for inflation, however, consumer spending rose by just 0.1 percent m/m in June with spending on goods up 0.1 percent m/m and spending of services up 0.1 percent m/m. We expect personal consumption expenditures to slow further over the coming months as tighter monetary policy drives interest rates higher.

Personal income and consumer spending will face continued challenges in the months ahead. Headline inflation may be peaking as energy prices continue to decline, but the pickup in core inflation recorded in these June data suggest that price increases are spreading throughout the economy. Such a situation is likely to weigh on consumer spending and may incite the Federal Reserve to continue to hike interest rates in large increments over the coming months. This kind of environment increases the probability and potential severity of a recession later this year.

CHART & TABLE:

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy