Inflation continued to moderate in October

14 Nov. 2023 | Comments (0)

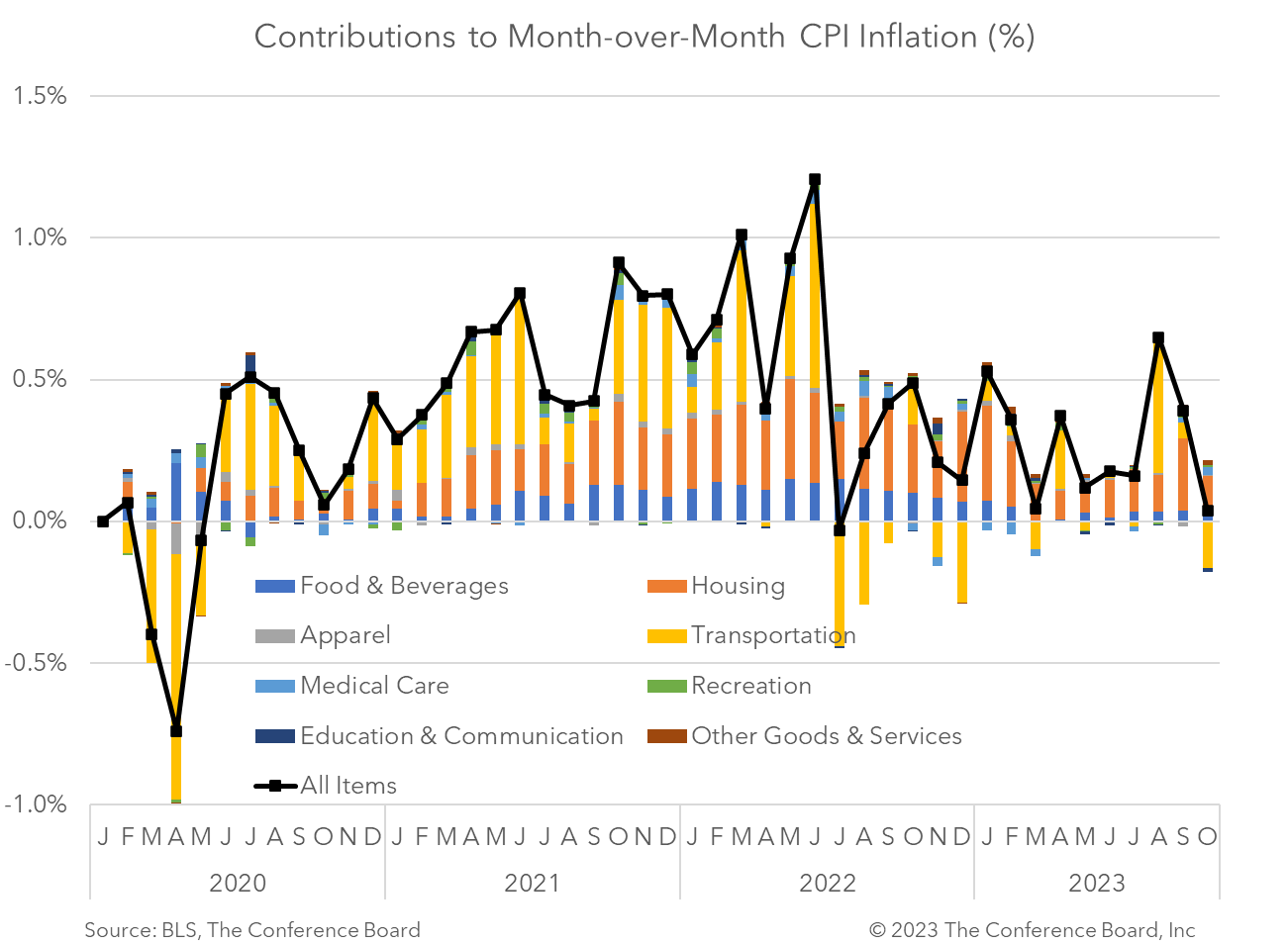

The October Consumer Price Index (CPI) showed that inflation rose 3.2% from a year earlier, vs. 3.7% in September and the peak of 9.1% in mid-2022. Meanwhile, core CPI, which excludes volatile food and energy prices, rose 4.0% in October from a year earlier slowing from 4.1% year-over-year in September.

The Fed will be pleased to see this moderation in price increases, but as Federal Reserve Chair Powell said earlier this month progress on inflation will be “lumpy” and “bumpy.” At present our forecast calls for one final 25 basis point rate increase in December. While these data make that outcome less probable, additional inflation and job reports will be released in the interim. Thus, we are maintaining our forecast until additional data for November are available.

While we continue to see progress on the inflation front and anticipate a return to the Fed’s 2% target by the end of 2024 there are numerous risks to this outlook. The outbreak of war in the Middle East could result in higher energy prices as could an intensification of strife in Eastern Europe. A resurgence in inflation associated with these or other events would likely impact monetary policy.

Data Details

Headline CPI rose by 0.0% month-on-month and 3.2% y/y, vs. September’s 0.4% m/m and 3.7% y/y. Shelter prices continued to rise in October, but a decline in gasoline prices kept the headline index from growing for the month. Energy commodity prices fell 4.9% m/m while new vehicle prices dipped 0.1% m/m and used car prices dropped 0.8% m/m. Meanwhile, food prices rose 0.3% m/m – the largest increase since February 2023.

Core CPI rose 0.2% m/m and 4.0% y/y, vs. September’s 0.3% m/m and 4.1% y/y. While shelter prices rose 0.3% m/m, this is down significantly from the rates recorded earlier this year.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy