Fed Holds Policy Line But Leaves Taper Door Open

29 Jul. 2021 | Comments (0)

The Fed held interest rates and large-scale asset purchase amounts steady at the July 28th FOMC meeting. However, policymakers left the door open for changing its tack on when tapering, and ultimately rate hikes, might begin given noted improvement in the US economy.

The Fed highlighted that amid progress on vaccinations and strong policy (likely fiscal and monetary) support, US GDP growth and labor markets continued to strengthen. Moreover, that even while in-person services have yet to fully recover there were signs of improvement. Chair Powell, in speeches, has expressed discomfort with current levels of inflation. Indeed, the core PCE deflator inflation rate is well above 3 percent year-on-year. Nonetheless, policymakers showed little alarm in the July Statement, believing most of the upward pressures on prices are largely transitory. The Fed also noted accommodative financial conditions, reflecting easy monetary policy.

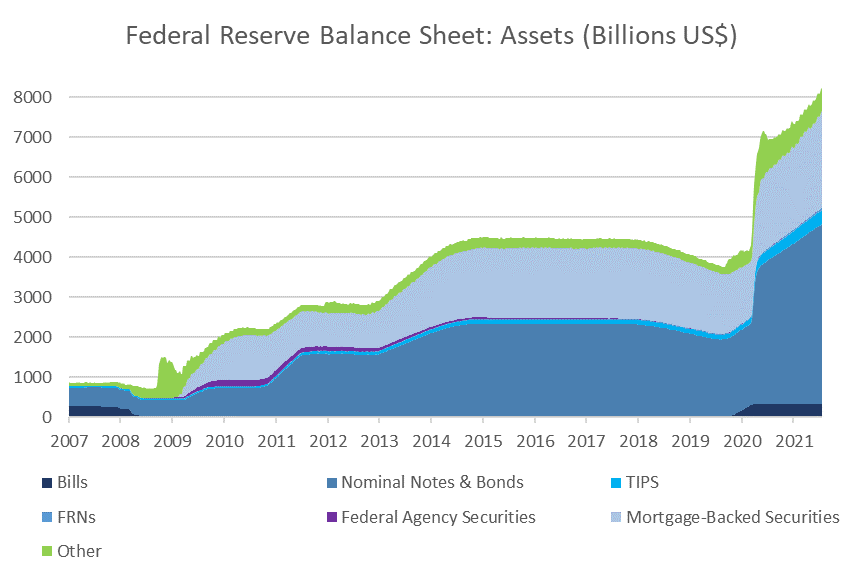

However, the good economic news was not sufficient to change the Committee’s stance on monetary policy. Uncertainty remained given continued risks to the economy from the evolution of the coronavirus. We note that variants are cropping up and infection rates are rising in pockets of the US and the world, risking renewed interruptions to economic activity and soured consumer, business, and financial market confidence. Also, the Fed did not appear to see substantial further progress regarding the achievement of its dual mandate: maximum employment and inflation to moderately exceed 2 percent for some time. Hence, the FOMC continued to schedule purchases of $80 billion in Treasury securities and $40 billion of agency mortgage-backed securities per month, adding onto the Fed’s $8.2 trillion balance sheet.

Still, the FOMC stated that progress has been made towards dual mandate goals and reiterated that it would continue to monitor incoming information for the economic outlook, and assess progress in coming meetings. Additionally, that the Fed stood ready to adjust the stance of monetary policy if risks emerge that could impede attainment of the FOMC’s goals. Key “information” will include readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments. These statements provide assurance that the Fed will not upset the economic recovery by removing accommodation too quickly, but is certainly willing to pivot if downside risks to the recovery, say run-away inflation, intensify.

In the post-statement press conference, Chair Powell stated that the Fed would act – “use tools” – if inflation remained to high. We project that both overall and core consumer price inflation will continue to rise through yearend (core PCE deflator at 3.6 percent year-on-year in 4Q 2021; total 4.1 percent), but begin to cool over the course of 2022 averaging just above the Fed’s 2-percent inflation target for the year (core 2.3 percent, total 2.5 percent). Still the risk is that inflation remains more persistent forcing the Fed to begin raising rates sooner than what is implied in the ‘dots plot’ (2Q 2023). Indeed, the Bloomberg consensus of economists anticipates the Fed may begin hikes in 1Q 2023, a shift up one quarter relative to the June FOMC meeting.

The Fed’s Balance Sheet Has Increased to $8.24 trillion as of late July

Source: Federal Reserve Board and The Conference Board.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global E…

0 Comment Comment Policy