Lower than expected economic growth remained high, but highlights uncertainty

29 Jul. 2021 | Comments (0)

Comment on US GDP report for Q2 2021 – Erik Lundh, Principal Economist, The Conference Board

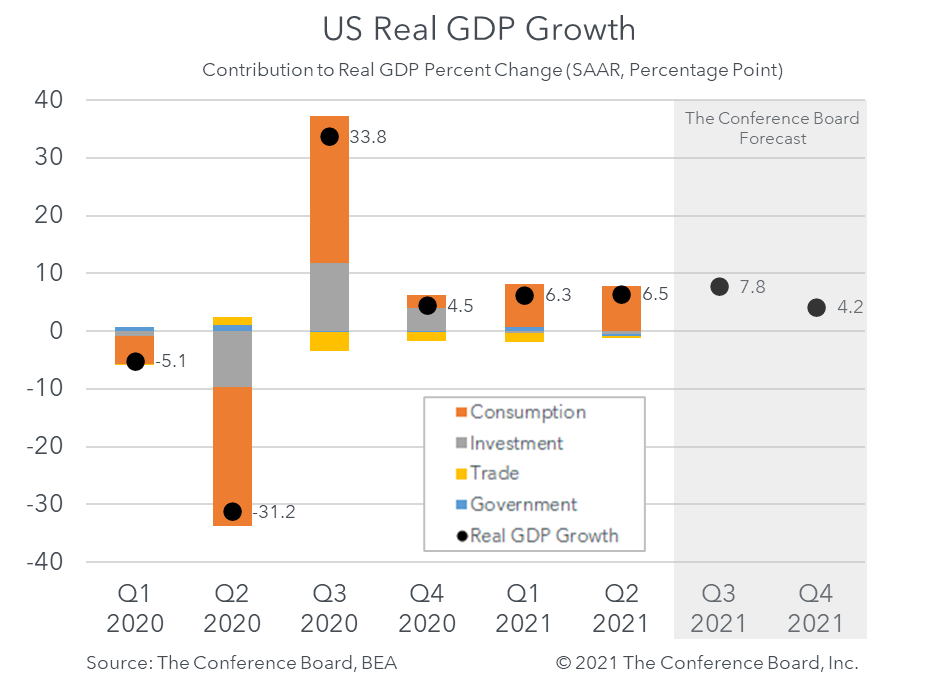

US Real Gross Domestic Product grew by 6.5 percent (annualized) during the second quarter of 2021, below the consensus forecast of 9.1 percent* and The Conference Board’s forecast of 9.0 percent. This quarterly annualized growth rate was up slightly from the 6.3 percent rate seen in Q1 2021, when the economic recovery began to reaccelerate following a difficult winter.

While overall growth fell short of expectations, these data also show that real GDP has finally returned to pre-pandemic levels (as we projected). The modest improvement in economic activity recorded in Q2 2021 was driven by robust consumer spending, but several other GDP components muted growth. Personal consumption expenditures rose by 11.8 percent (annualized) – with spending on services contributing 5.1 percent to total GDP growth and spending on goods contributing 2.7 percent. Residential investment, which helped drive the economic recovery in previous quarters, contracted in Q2 2021 and subtracted 0.5 percent from overall GDP. Changes in private inventories, a notoriously volatile component of GDP, fell by USD 77.6 billion** from the previous quarter. While imports were close to our forecast, export growth was weaker than expected due to continued constraints on global demand amid the pandemic. Finally, unexpectedly weak federal nondefense spending pulled overall government consumption and expenditures down for the quarter.

Looking ahead - the US economic recovery remains on solid footing, but future uncertainty persists. While a large share of the US population has been vaccinated, new cases of COVID-19 have recently been on the rise due to the new Delta variant. We expect this new wave to be smaller than those seen previously but are concerned that consumer confidence could be dampened. Additionally, elevated inflation rates over the last several months have many concerned that rising prices could grow out of control. The Federal Reserve, however, views these inflationary pressures as temporary and has said it is unlikely to tighten monetary policy anytime soon (see our recent analysis here). Finally, it looks increasingly likely that another large wave of government spending may be on the horizon via an infrastructure package, but the size, composition and timing remain uncertain. In the event that a multi-trillion dollar package is approved, it is likely that economic growth would be bolstered by improved in 2022 and beyond.

* July Blue Chip Economic Indicators® Survey

** chained 2012 USD

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy