Fed “skips” rate hike in June, but says more hikes coming

14 Jun. 2023 | Comments (0)

The Fed declined to raise interest rates today, as expected, but signaled that it will continue to tighten in the future. Chair Powell noted at the onset of his press conference that nearly all FOMC participants believe that additional tightening will be likely this year. Indeed, the SEP indicates that two more 25 basis point hikes are on the horizon. He characterized the rate hike “skip” at this meeting as a natural progression in the deceleration of the tightening cycle as opposed to an indication that the tightening cycle is over. We see things a bit differently. Our assessment of the economic outlook is more pessimistic than the Fed’s and we now only anticipate one more 25 basis point hike this year.

Chair Powell said that progress continues to be made on inflation, but that it remains far too high. He acknowledged the progress seen in topline inflation readings, but warned that the Fed is not seeing the kind pf progress it wants in core inflation (which excludes volatile food and energy prices). The drivers of disinflation have varied, he said, noting that it is being seen in goods, will be seen in housing soon, but that there are only the “earliest signs” of core services disinflation. Powell attributed the lack of progress in this component to tightness in the labor market and rapidly rising wages among many services workers.

On the aftermath of the banking crisis, Powell said that conditions in the banking sector have continued to improve since March. Indeed, the statement issued at today’s meeting said that “the US banking system is sound and resilient.” However, Powell did say that the full extent of the banking turmoil consequences are unknown and that the FOMC will continue to monitor the banking sector closely as it contemplates additional rate hikes.

The Conference Board posits that businesses should expect interest rates to remain high for the duration of 2023. Furthermore, the Fed’s work to tighten monetary policy coupled with the reverberations from the banking crisis will likely continue to make credit availability scarcer. Thus, loans may become even more challenging to secure for businesses and consumers moving ahead.

As the full impact of these developments continue to weigh on the economy, The Conference Board forecasts that a recession will occur this year. Additional factors that may weigh on the economy include the termination of the student loan repayment reprieve at the end of September, and the spending cuts associated with the debt ceiling agreement. These developments may weigh on consumption and government spending respectively toward the end of the year.

What were the Fed’s actions?

After hiking rates over the last ten consecutive meetings, the FOMC elected to hold the federal funds rate window at 5.00 – 5.25 percent in June. Doing so, they argue, will allow the monetary tightening that has already been implemented more time to weigh on the economy. Rates remain deep in ‘restrictive’ territory (anything above 3 percent). The Fed also said that there will be no change to its ongoing plan to reduce the size of its balance sheet, which was first unveiled in May 2022. Today’s actions were unanimously approved by the members of the Federal Open Market Committee.

What are the Fed’s expectations for the future?

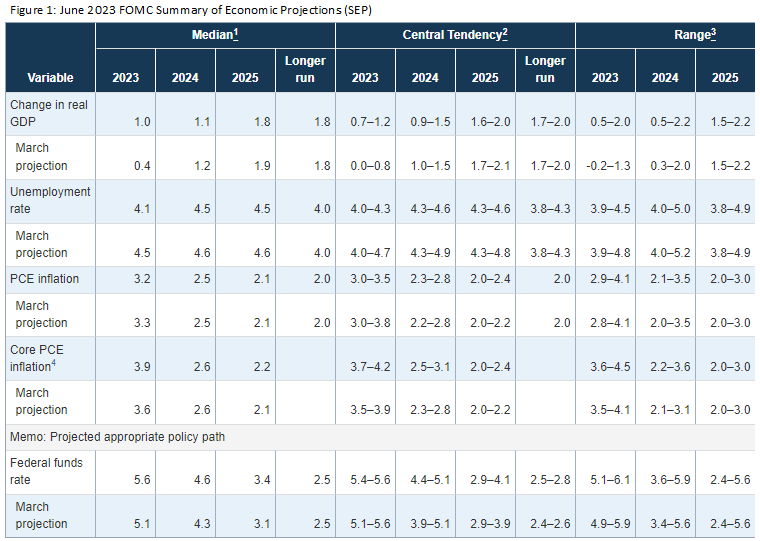

The Federal Reserve’s June Summary of Economic Projections (Figure 1) anticipates better economic growth than the March SEP. The FOMC projects 4q/4q 2023 GDP growth of 1.0 percent (vs. March SEP of 0.4 percent), 4q/4q 2024 GDP growth of 1.1 percent (vs. March SEP of 1.2 percent), and 4q/4q 2024 GDP growth of 1.8 percent (vs. March SEP of 1.9 percent). The large upgrade to 2023 overshadows the modest downgrades for 2024 and 2025. We are less optimistic and forecast GDP growth of -0.4 for 4q/4q 2023, but 1.4 for 4q/4q 2024. The FOMC forecast for inflation was largely unchanged, with 4q/4q 2023 PCE inflation of 3.2 percent, 4q/4q 2024 of 2.5 percent, and 4q/4q 2025 of 2.1 percent. We forecast 3.1 and 2.0 for 4q/4q 2023 and 4q/4q 2024, respectively.

Importantly, the SEP projects that the Fed Funds rate will rise to 5.6 percent by the end of 2023, and then fall to 4.6 percent in 2024 and 3.4 percent in 2025. This implies two additional 25 basis point rate hikes by the end of the year. We believe this is too hawkish. We expect economic growth to come in much softer than the Fed and for the labor market to slow more materially than what is implied by the SEP. This supports just a single additional 25 basis point hike and then an extended pause, possibly into mid-2024.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy